Gold prices dropped for a third session yesterday on the back of better-than-expected U.S. economic figures but recovered some of its losses after a drop in stocks outweighed the impacts of a stronger U.S. dollar. The XAU/USD pair traded as low as $1315.98 an ounce after the Commerce Department's report showed the economy expanded at a 1.4% annualized rate, up from an estimate of 1.1%. Separately, the Labor Department said the number of people filing first-time claims for unemployment insurance payments increased by 3K to 254K.

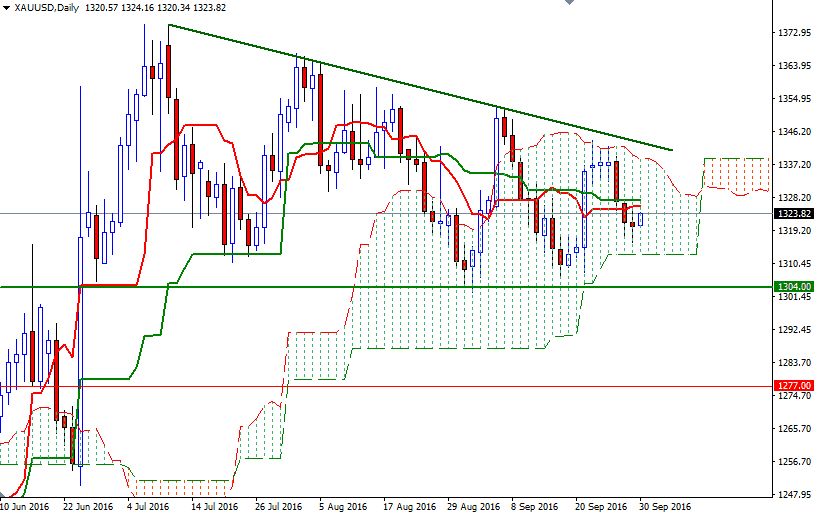

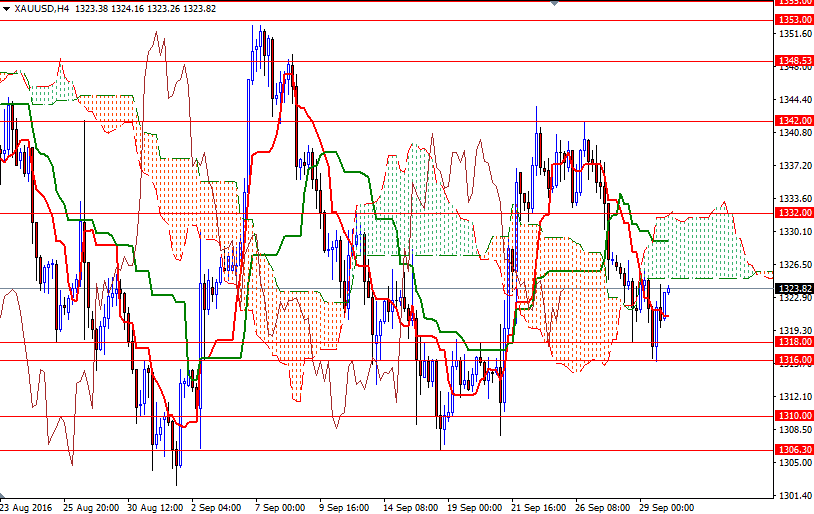

XAU/USD retreated to 1318/6 area as anticipated after it fell through the 1327.40-1324 support. Today the bulls are trying to regain the ground they lost as they found enough support in the 1318/6 area but the Ichimoku cloud on the H4 chart is right on top of the market and it occupies the area between 1324.90 and 1332 levels. In other words, until the market climbs back above the 1332, the upward potential will be limited. Negatively aligned Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) lines on both the daily and 4-hourly charts support this view. If the market successfully penetrates this barrier, then look further upside with 1339/8 and 1342 as targets.

If the 1327.40-1324 zone blocks the bulls' way, then keep an eye on the 1320-1319.70 support. Breaking below this area would suggest that we might revisit 1318 and 1316. Once below that, the market will be aiming the 1312.74-1310 zone where the bottom of the daily cloud sits. The bears have to capture this camp so that they can increase the pressure on the market and march towards 1306.30-1304.