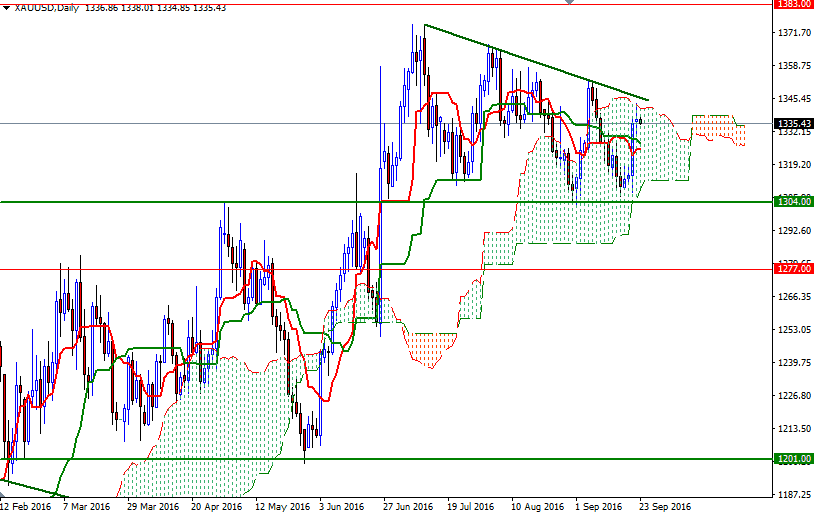

Gold prices rose to a two-week high yesterday, benefiting from a weaker dollar. The XAU/USD pair tested the resistance at around the $1342 level (which happens to be the top of the Ichimoku cloud on the daily chart) as expected after the $1332/0 support pushed prices higher but investors used this used this opportunity to take profit. As a result, prices pulled back, leaving a tall upper shadow on the daily candle. The precious metal is trading at $1335.43 an ounce, slightly lower than the opening price of $1336.86.

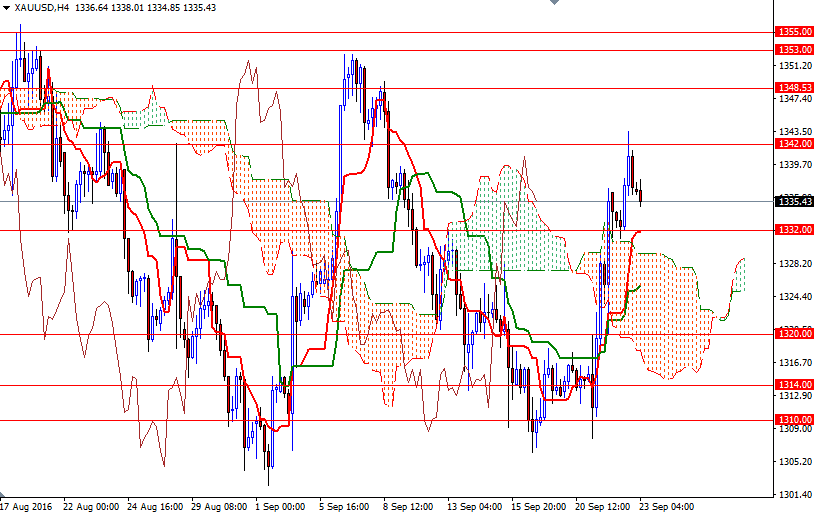

Technically, trading above the Ichimoku clouds on both the weekly and 4-hourly charts gives the bulls an advantage (as lower prices will continue to lure buyers) but yesterday’s candle argues for rejection of higher prices. As I pointed out in my previous analysis, we have a confluence of horizontal resistance and a short-term bearish trend line on top of us, so it shouldn’t be a big surprise if the market fails to break through on the first attempt.

To the upside, the initial resistance stands at 1342, followed by 1348.53. If XAU/USD breaks up above 1348.53, then the market could have a chance to tackle the 1355/3 region. On the other hand, if the bears increase the downward pressure and drag the market below 1332, then we could revisit 1329.30 (the top of the 4-hourly cloud). A break below 1329.30 would imply that 1326.40-1325.70 might be the next stop.