By: DailyForex.com

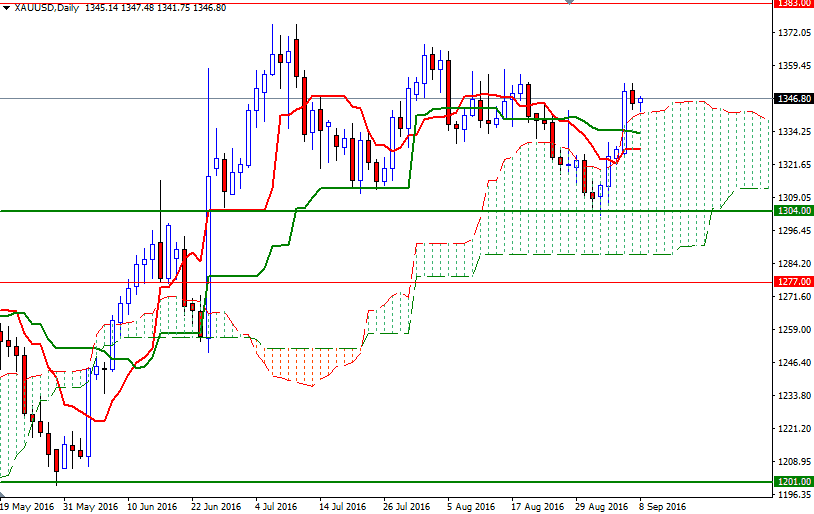

Gold fell slightly after a four-day streak of gains on Wednesday as a rebound in the greenback and the market's inability to penetrate the $1355/2 area prompted investors to book some profits. Gold's surge in recent days was mainly driven by soft U.S. data which weakened the argument for a September rate hike. The XAU/USD pair traded as low as $1341.75 in early Asian session before recovering slightly to $1346.80.

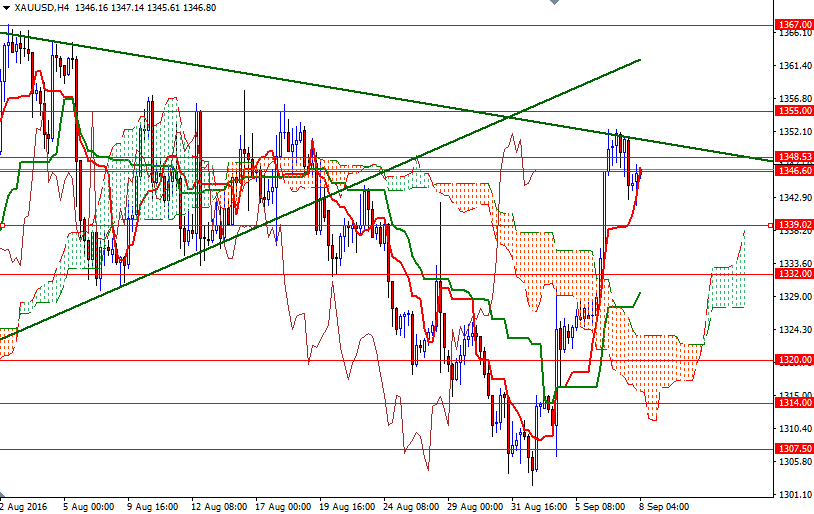

Trading above the weekly, daily and 4-hourly charts suggest that the market is likely to continue to benefit from the bullish medium-term outlook. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines on both the weekly and 4-hourly charts, along with Chikou Span/Price crosses in the same direction. However, right on top of us, there is an anticipated resistance zone that stretches from 1352 to 1355 and I think breaching this barrier is essential for a bullish continuation. A sustained break above this zone would prolong the bullish momentum and clear the path towards 1367. On its way up, resistance may be found in the 1362/0 region.

To the down side, keep an eye on the 1341.20-1339 area where the top of the daily cloud resides. The bears have to drag prices back below 1339 (the bottom of the cloud on H1 chart), if they intend to make an assault on the 1332 level. A break down below 1332 implies that the 1327 level will be the next port of call.