GBP/USD Signals Update

Yesterday’s signals were not triggered as none of the key levels were reached.

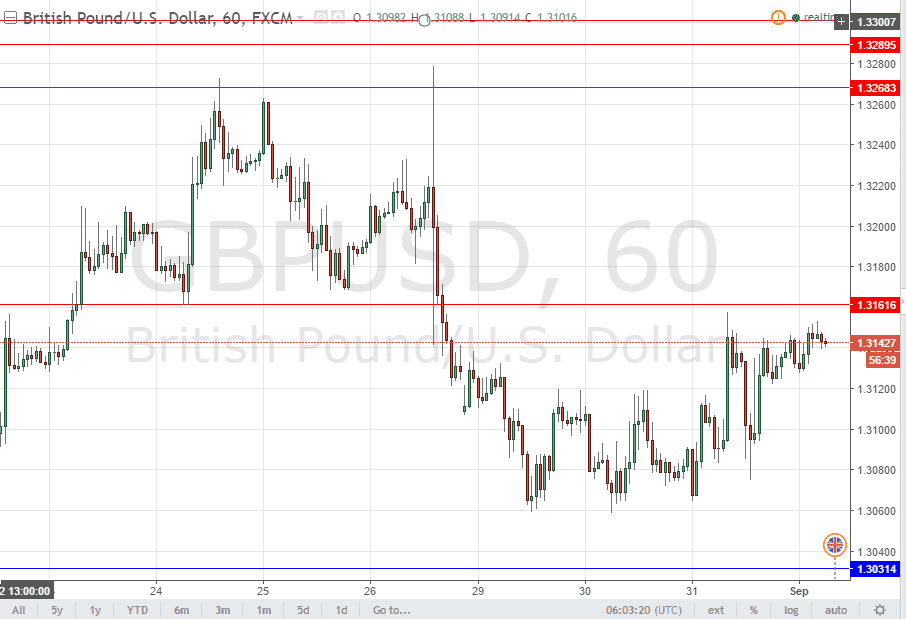

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered from 8am to 5pm London time today.

Long Trades

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3031 or 1.2996.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3162.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

It was an interesting day yesterday, which really started around the New York open with a strong, sharp drive down, the low of which broke and produced a further fall on increasing volatility to an area below 1.3100. However, the bulls then stepped in and drove the price all the way back up just a few pips short of the daily high. Overall, it was confusing and choppy action.

Although this pair is technically in a long-term downwards trend, the trend is really starting to flatten out, with the price not really making any new lows for several weeks and showing just as much impulse from the bulls as from the bears. We also see that even when the USD is strong, the price here falls by little or not at all. These are all signs of a seeming weakening in the downwards trend.

There is plenty of data due today and tomorrow, so anything might happen.

Concerning the GBP, there will be a release of Manufacturing PMI data at 9:30am London time. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm, followed by ISM Manufacturing PMI at 3pm.