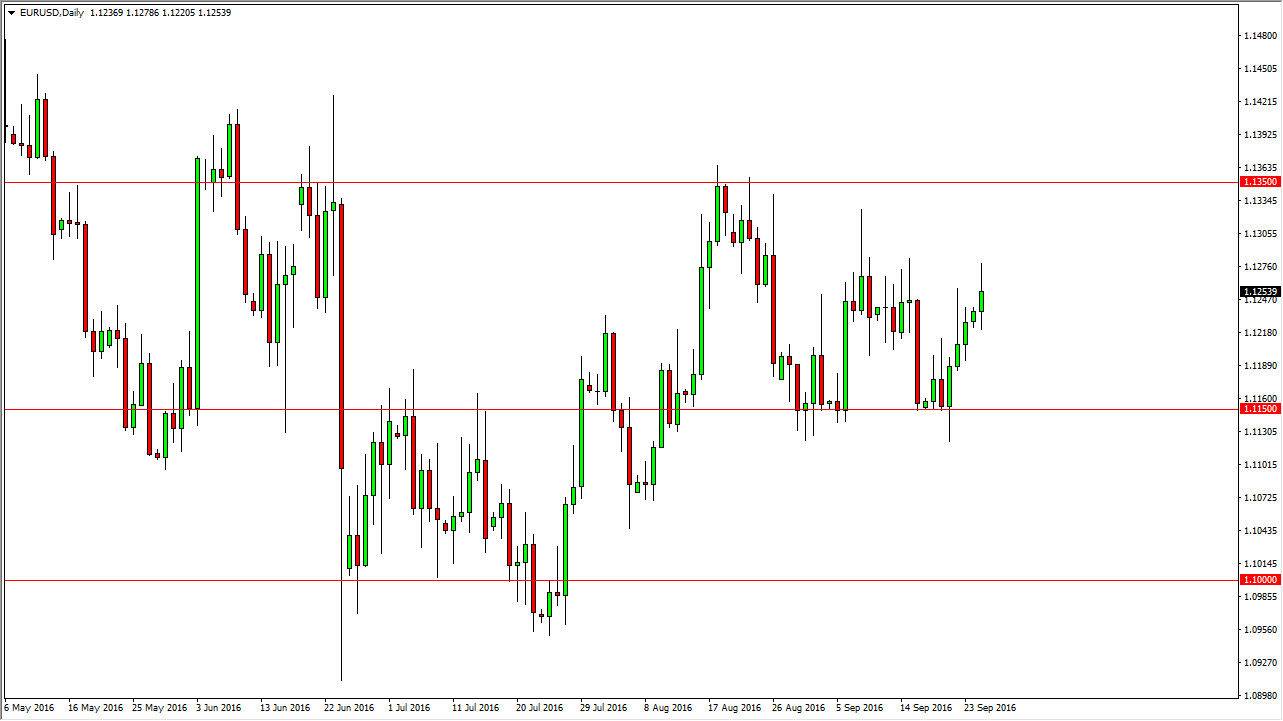

EUR/USD

The EUR/USD pair had a fairly volatile day on Monday, as we continue to see quite a bit of choppiness. At this point in time, looks like we are struggling to get above the 1.1250 level with any type of authority, so having said that it would not surprise me at all to see this market pullback again. After all, we have gradually been making lower highs over the last couple of months, and even though we are still within the consolidation area that we have been in for some time, we are starting to show a significant amount of bearish pressure above and with that being the case it’s likely that the sellers would get involved at this point in time. A breakdown will more than likely reach down to the 1.1150 level below. That is a significant amount of support, and with that being the case it’s likely that we have a short-term selling opportunity on exhaustion.

GBP/USD

The GBP/USD pair initially fell during the course of the session on Monday, but turned around to form a bit of a hammer. The hammer of course is a bullish sign, and that could lead the market to bounce from here, and with that it’s likely that an exhaustive candle will appear above, and that of course would be a selling opportunity as we continue to try to build up enough momentum to break down below the 1.2850 level. Even if we rally from here, I think that no matter what happens the sellers will eventually get involved in this market, as although we are at the very bottom of the recent consolidation area, I think that there is much more bearish pressure then bullish over the longer term.

It’s not until we break well above the 1.35 level that I would even consider buying this pair, although I do recognize that if you are a short-term trader, you may be able to pick up a short-term buying opportunity on a break above the candle for the session on Monday.