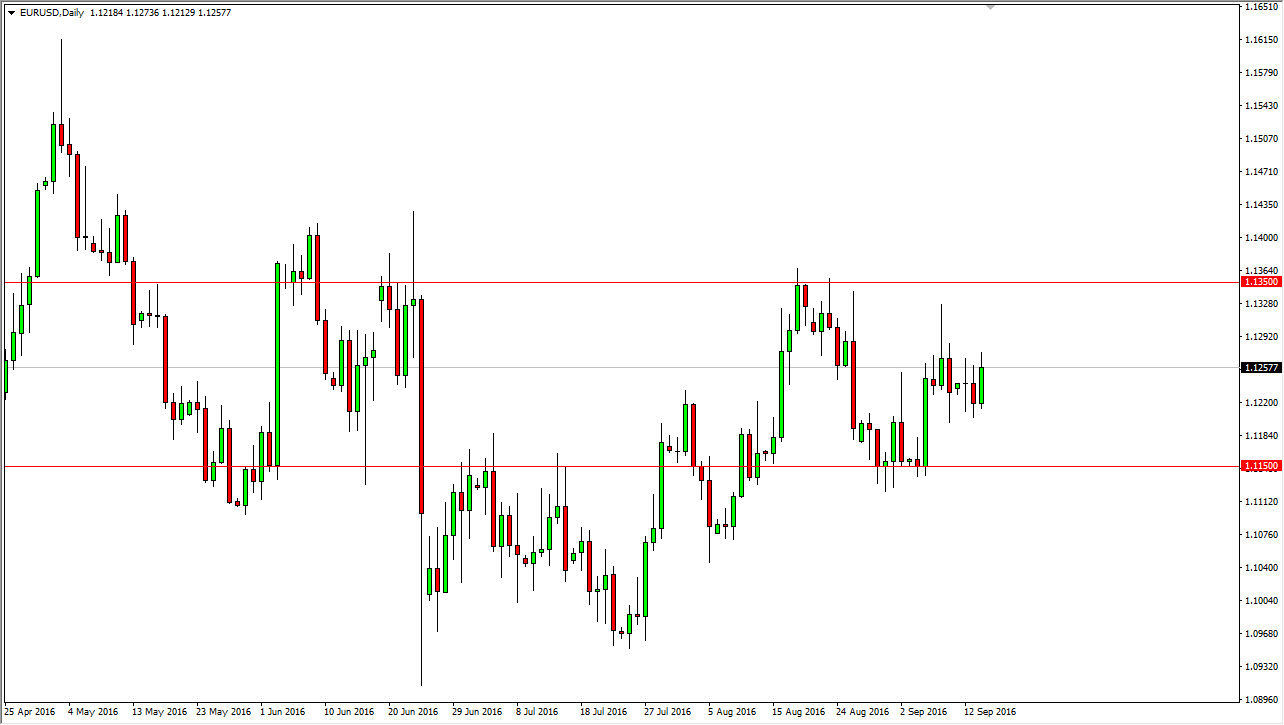

EUR/USD

The EUR/USD pair continues to bang around in the 1.1250 region, which is essentially the middle of the larger overall consolidation area. Because of this, I still don’t have any real interest in trading this market, and therefore will be sitting on the sidelines. However, I would point out that the 1.1150 level below is massively supportive, while the 1.1350 level above is massively resistive. If we can break out of this area, that would be a very nice opportunity to take a trade. In between this area though, I simply think that is going to be far too choppy to waste any real money on a trade. With this, I am on the sidelines at the moment.

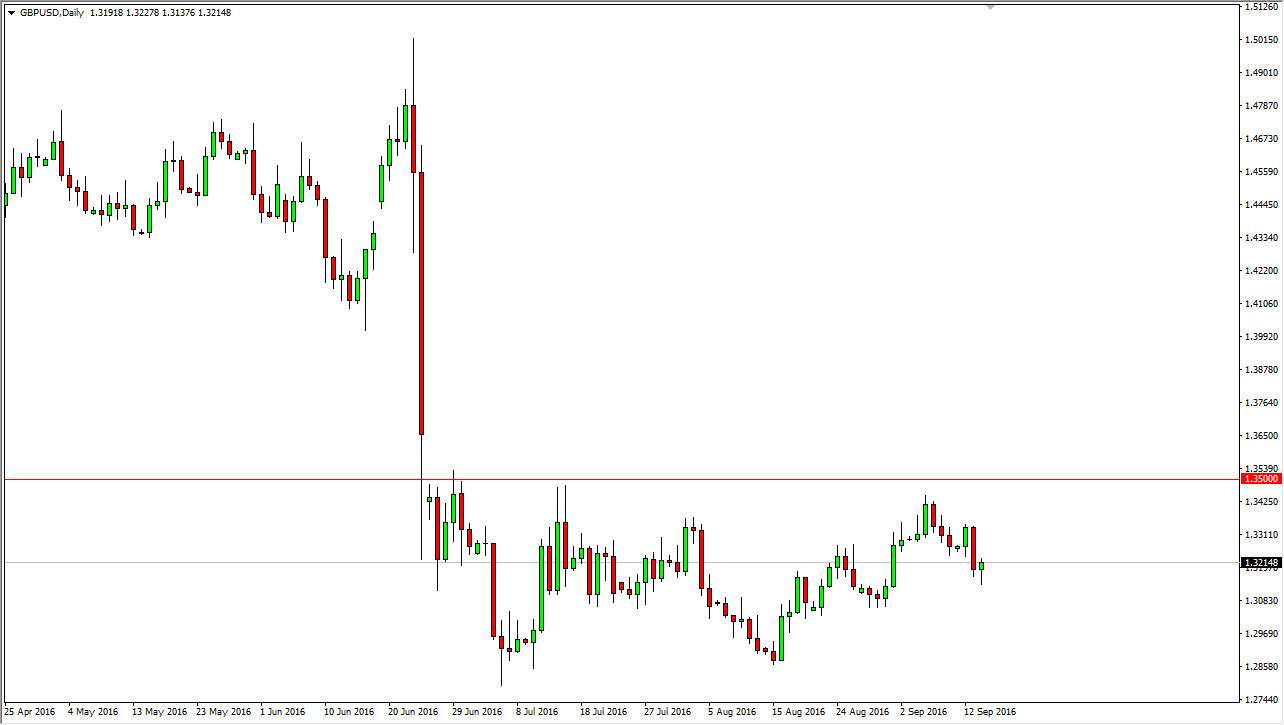

GBP/USD

The British pound initially fell during the course of the session on Wednesday, but turned around to form a bit of a hammer. The hammer of course is a bullish sign so if we can break above the top of a technically it’s a buy signal. However, I do recognize that there is a lot of resistance in this pair, especially once you get to the 1.34 handle. I think that it extends all the way to the 1.35 level, and as a result it’s likely that we will see an exhaustive candle that we can take advantage of. I also recognize that there is a massive amount of resistance above the 1.35 handle, and as a result of that gap that formed after the post-Brexit vote, I believe that is going to be very difficult to break out to the upside anytime soon. I think a lot of things would have to change, but at this point in time I feel that the market is simply taking its time to figure out what it wants to do next. After all, it isn’t as if the United Kingdom has suddenly melted down, so we haven’t seen much in the way of follow-through. In the meantime, I believe that a short-term exhaustive candle might offer a short-term selling opportunity.