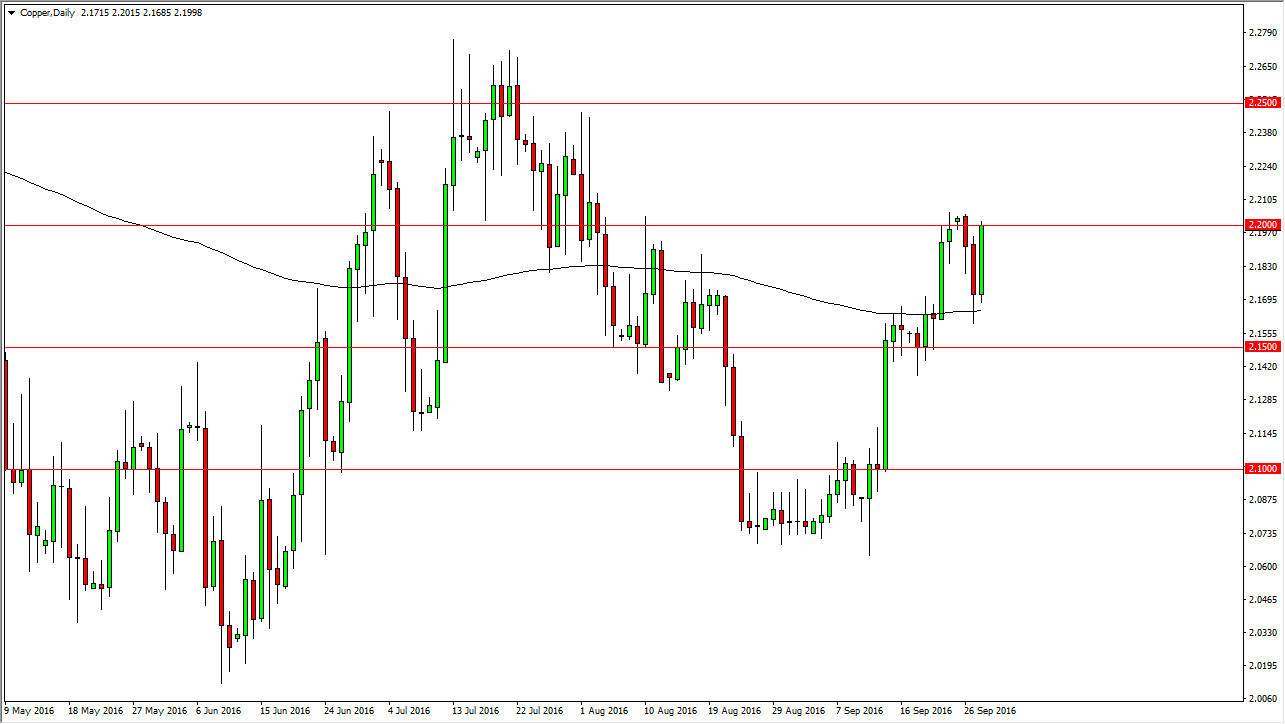

During the day on Wednesday, the copper markets rallied rather stringently as we bounced off of the 200-day exponential moving average. I have mentioned copper the other day because we are starting to show real strength again, near the $2.20 level. That’s where we find yourselves again, after having a very significant pullback. By bouncing back towards this area, it appears that we are trying to break out to the upside. If we can clear the top of the hammer from the Monday session, I believe that the copper markets will then reach towards the $2.24 handle above. Alternately, we could pull back from here, but I believe that the 200-day exponential moving averages using itself has a bit of dynamic support for the buyers.

Economic strength

The copper market shows real economic strength when they go higher, because copper is such a huge component of building and manufacturing. This is highly influenced most of the time by Asia, as construction projects will demand more and more of the metal. With this being the case, a lot of traders will watch copper just to see how the risk appetite of the overall market may perform, even if they don’t trade this particular CFD itself.

As a bit of a proxy, a lot of traders will use the Australian dollar as it sends so much copper into the Asian region, which of course is the largest consumer of the metal. Ultimately, I think that part of this might be in reaction to the possibility of more stimulus in China, which generally finds itself in the form of building projects. With this being the case, the market will more than likely find buyers every time it dips, and I believe that there’s a bit of a hard floor in the market near the $2.15 level. As long as we can stay above there I think that there are going to be plenty people out there willing to buy.