AUD/USD Signal Update

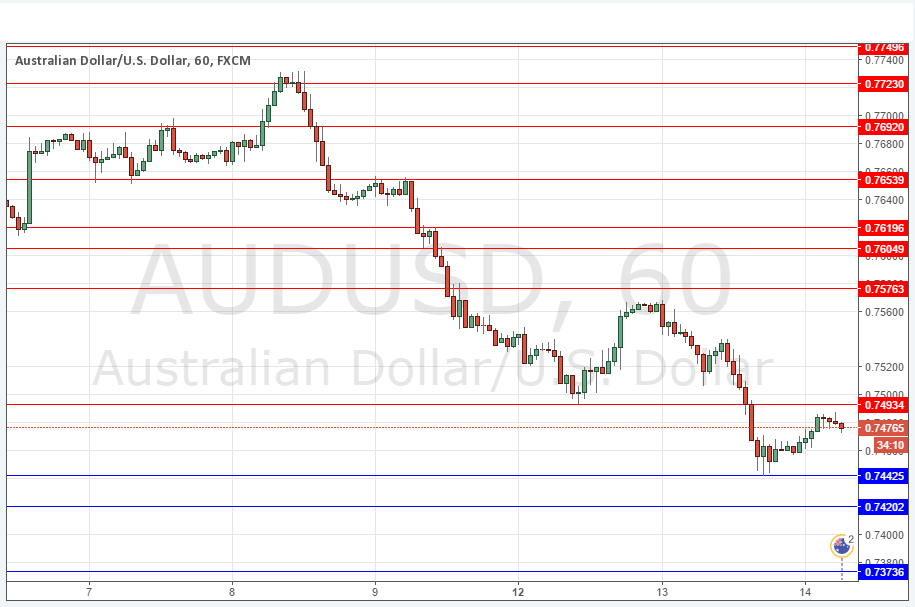

Yesterday’s signals were not triggered as there was no bullish price action at 0.7493 and insufficiently bullish price action at 0.7458.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken between 8am New York time and 5pm Tokyo time, over the next 24-hours period only.

Short Trades

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7493.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7443 or 0.7420.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

The price fell meaningfully yesterday with the rise in the USD and along with the even stronger fall in the AUD’s sister currency, the NZD.

The pair has now found support at 0.7443 and will now be likely to face resistance above close the key psychological level of 0.7500 which should have flipped from support to resistance.

Note that this area above 0.7400 has been crucial long-term support so the price is probably going to remain above this level unless the U.S. economic data tranche released later in the week.

Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time. Concerning the AUD, there will be a release of Employment Change and Unemployment Rate data at 2:30am.