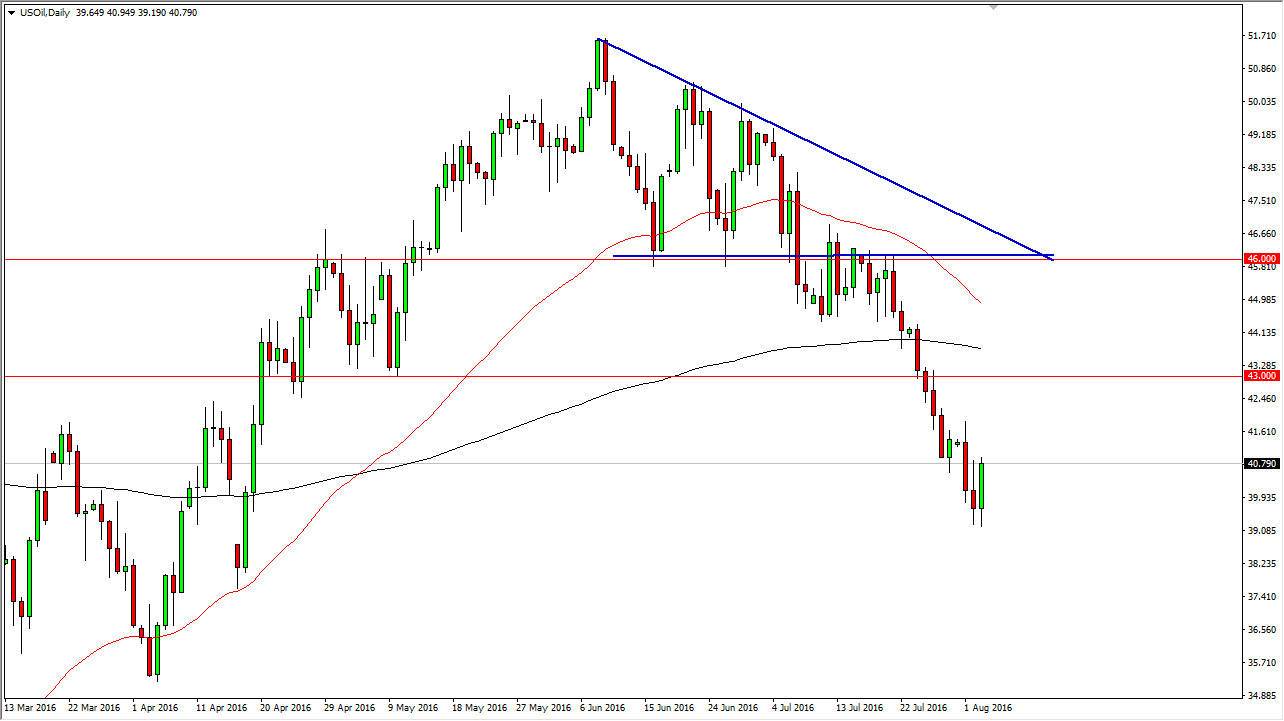

WTI Crude Oil

The WTI Crude Oil market initially fell during the course of the session on Wednesday, but bounce significantly to reach well above the $40 handle. This is a very bullish sign, so we could very well continue to go higher in the short-term. However, I see quite a bit of resistance just above current levels, especially near the $43 level, but I also recognize that 2 of the most important moving averages are about ready to cross. For example, the red 50-day exponential moving average of course is dipping lower, and it also appears like it isn’t going to be too far from the 200-day exponential moving average soon. In other words, once we get that cross it’s likely that the long-term traders will start shorting as well.

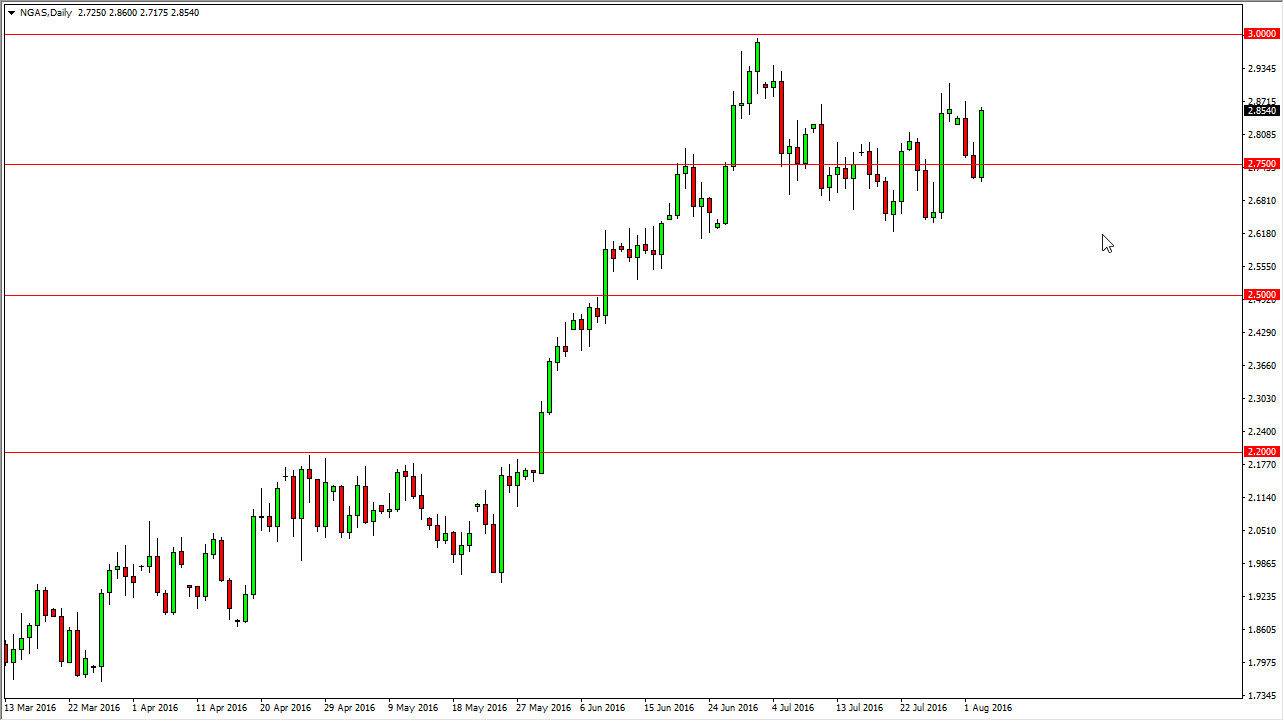

Natural Gas

The natural gas markets rose during the course of the session here on Wednesday, breaking well above the $2.75 level. In fact, we are well above the $2.80 level now as well, so I believe that it’s only a matter of time before we break out to the upside and perhaps try to reach towards the $3 level. That is an area that is massively resistive and of course will attract a lot of attention due to the fact that it is a large, round, psychologically significant number. Because of this, I am not interested in selling and I believe that sooner or later the market will continue to grind its way to the upside.

There is more than enough support below to keep this market afloat, so shorting is going to be very difficult to do in the meantime. The $3.00 level above is massively resistive though, so I don’t necessarily think we break above there anytime as well. This is a market that should continue to be attracted to that level, but whether or not we can break above it is a completely different story.