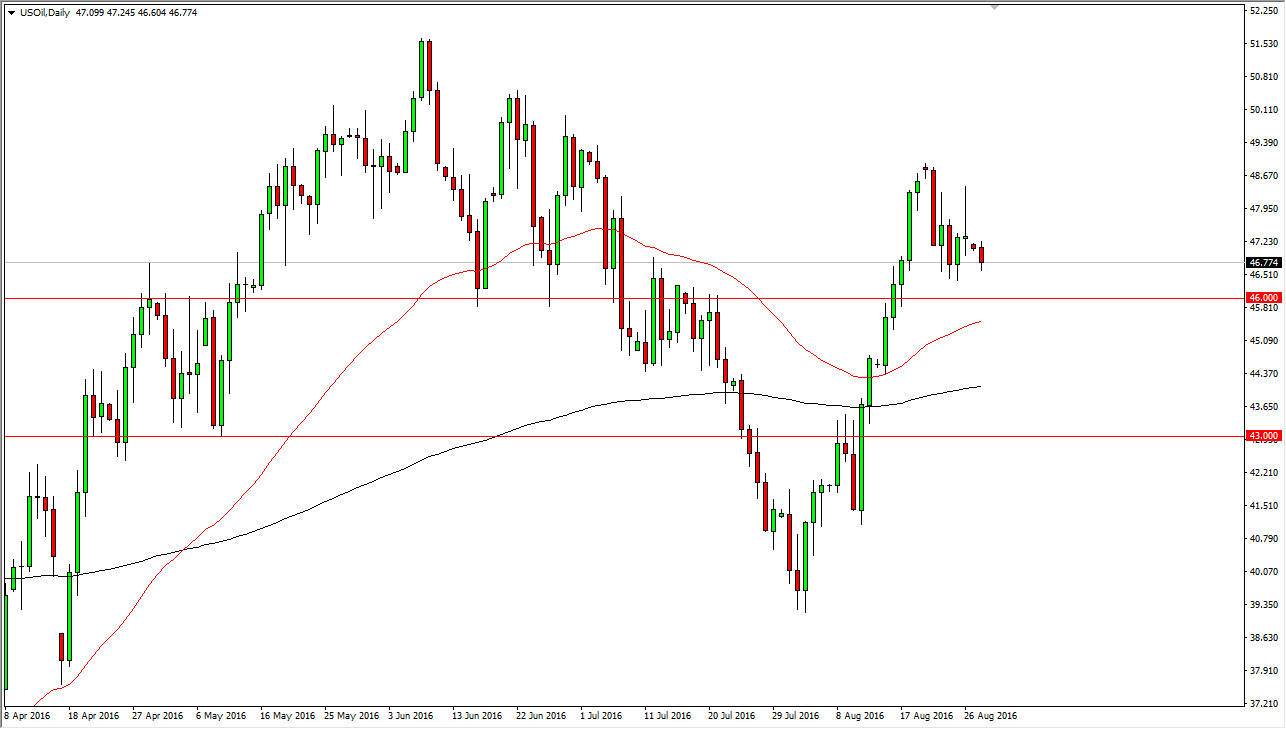

WTI Crude Oil

The WTI Crude Oil market fell slightly during the course of the session on Monday, as we continue to see quite a bit of volatility. The $46 level below causes quite a bit of support, as we have seen previously, as well as quite a bit of resistance at that level. This is a market that continues to chop around sideways due to the fact that we may have to take a bit of a breather after the recent explosion to the upside. However, I believe that we break down below the $46 level would be a short-term selling opportunity based upon the fact that we formed a shooting star on Friday. On the other hand, if we break above the top of the shooting star, we could continue to go long at that point.

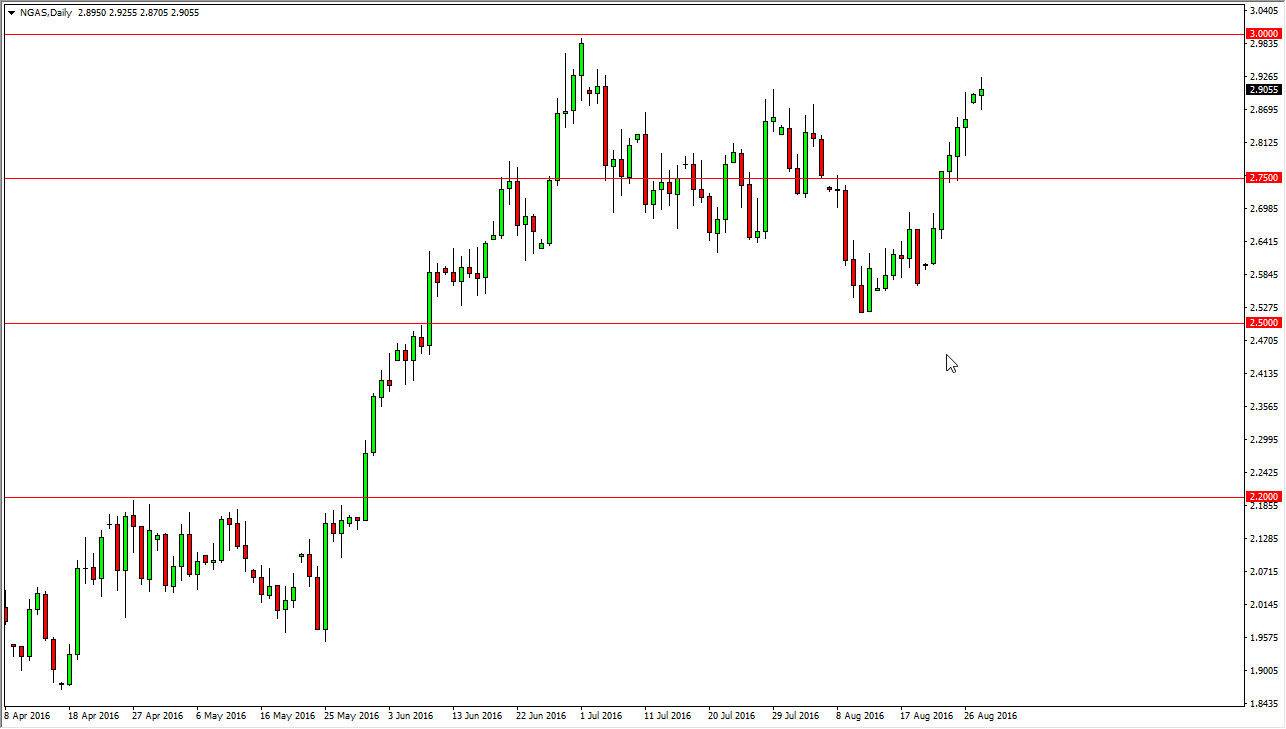

Natural Gas

The natural gas markets gapped higher at the open on Monday, slamming into the $2.90 level. This is an area that begins a significant amount of resistance, extending all the way to the $3 level. At this point, it’s likely that the market will find some type of exhaustive candle that we can start selling above there, as the market will have most certainly gotten a bit overexposed and overextended. A break above the $3 level would be massively bullish, and would more than likely change the complexity of this market going forward. However, we are getting close to the end of the summer cooling season in the northeastern part United States, so we could very well see a dip in demand.

I believe that the $2.75 level below will continue to be massively supportive, and a break down below there after a reversal would be extraordinarily bearish. However, this point in time I think the one thing you can count on is volatility and short-term trading.