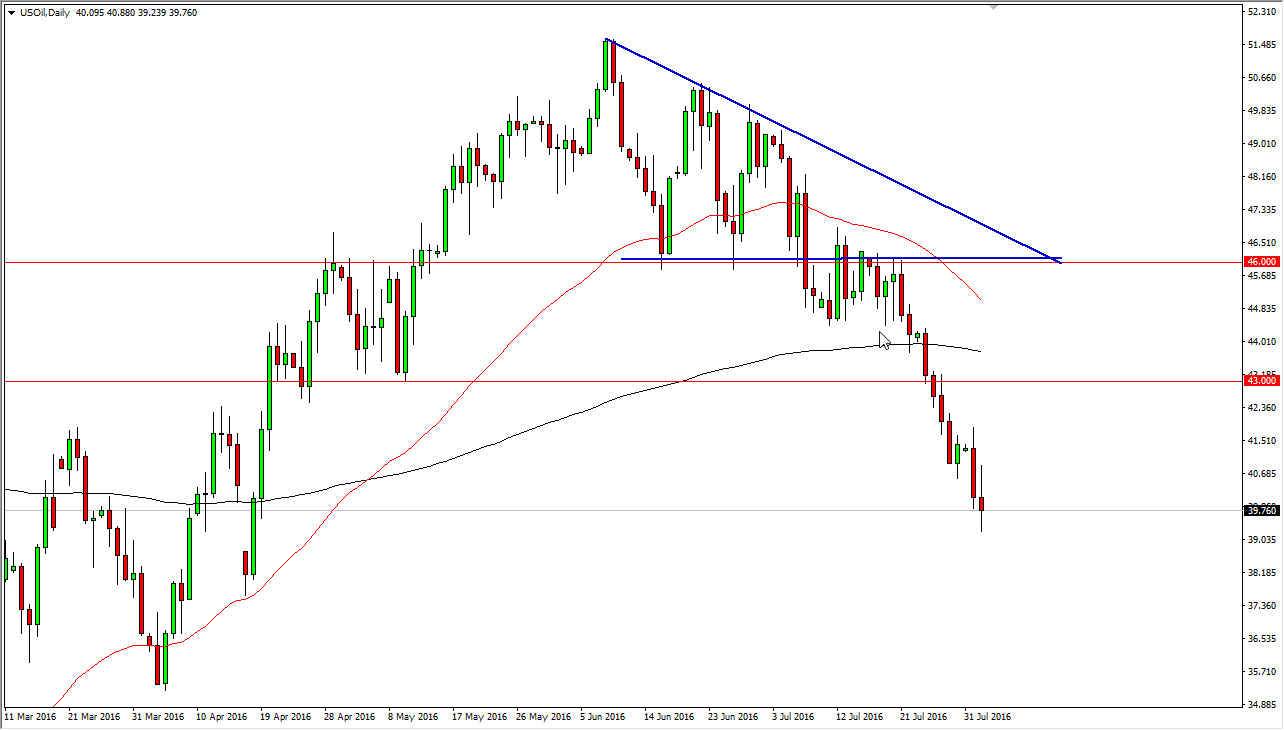

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Tuesday, but has eventually ended up forming a shooting star. The shooting star of course suggests that we are going to continue to go to the downside, as we are now below the $40 level. I also believe that the 50-day exponential moving average is about to cross over the 200-day exponential moving average, which is a longer-term sell signal. Because of this, I am selling short-term rallies as they appear and of course exhaustion as it shows itself. I believe that the market is probably going to reach down towards the $35 level and possibly even lower than that. Quite simply put, the demand just isn’t there at the moment. A lack of demand is going to be one of the biggest Achilles heels in this market.

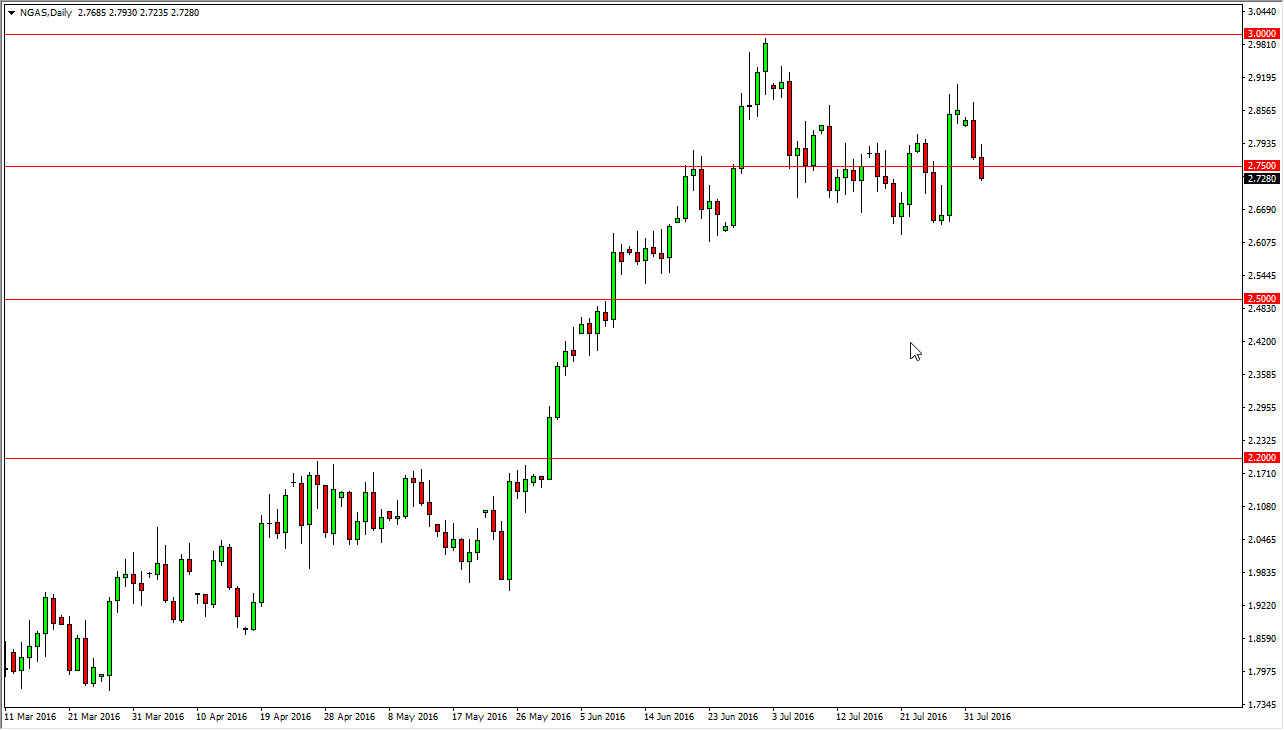

Natural Gas

Natural gas markets initially rallied during the course of the day on Tuesday, but then fell below the $2.75 level. I believe that the market is probably going to try to get back down to the $2.65 level which has been supportive recently. With that being the case, it is only a matter time before we sell off. I believe that the market will eventually bounce from that area as we continue to consolidate, but if we did break down below there I think at that point in time the next serious support barrier will be somewhere near the $2.50 level. Ultimately, the $3 level is a massive target as far as we can see, and as a result I think that we will have to have yet another attempt to break above there. Over the longer term though, I believe that the natural gas markets will continue to suffer due to the fact that there is just so much in the way of supply out there. Granted, temperatures have been very hot in the United States and that of course has driven of demand recently, but longer-term supply is massive.