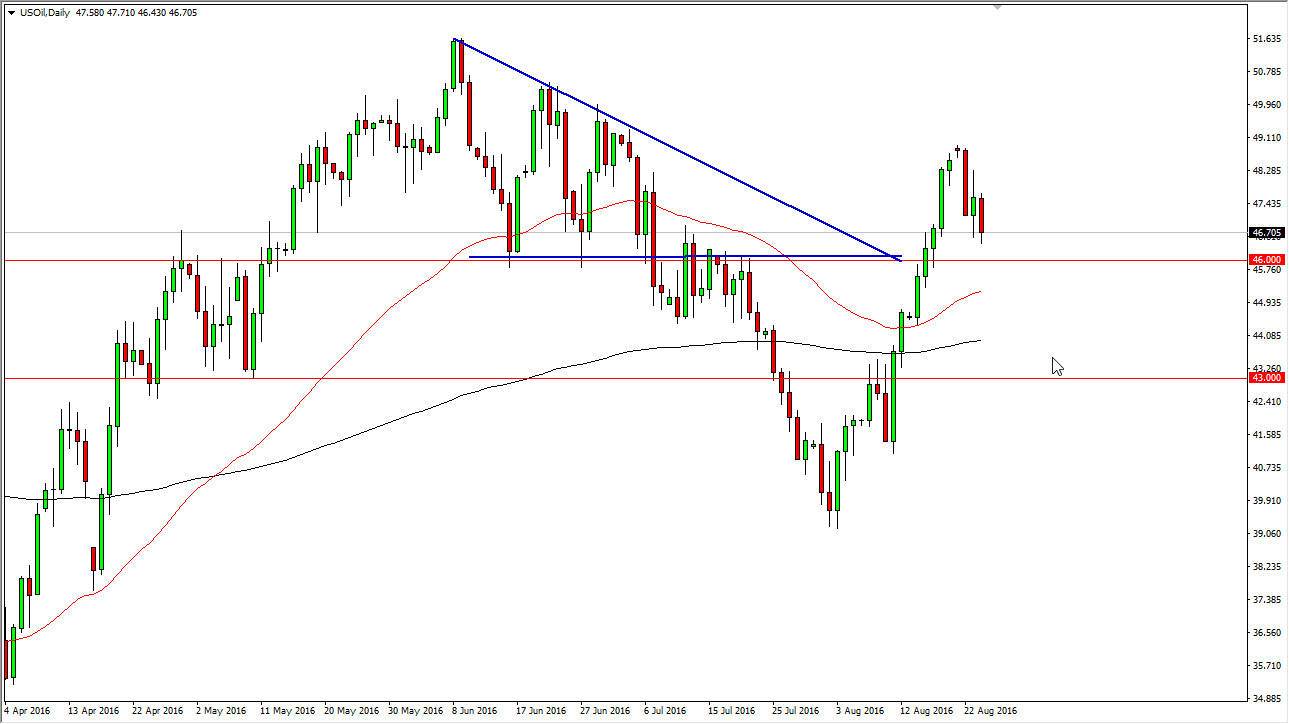

WTI Crude Oil

The WTI Crude Oil markets fell during the course of the day on Wednesday, reaching towards the $46 level. I expect to see quite a bit of support there though, so at this point in time I have no interest in selling. Because of this, I’m waiting to see whether or not we get some type of supportive candle or a bounce that we can take advantage of in a market that has shown quite a bit of support recently. With that, I’m on the sidelines and waiting to see on short-term charts signs that the buyers have returned. I don’t have any interest in selling until we break down below the $46 level, which at that point in time I would anticipate the market would then reach towards the $45 handle. Volume just isn’t there the moment, so you would be forgiven for simply standing on the sidelines.

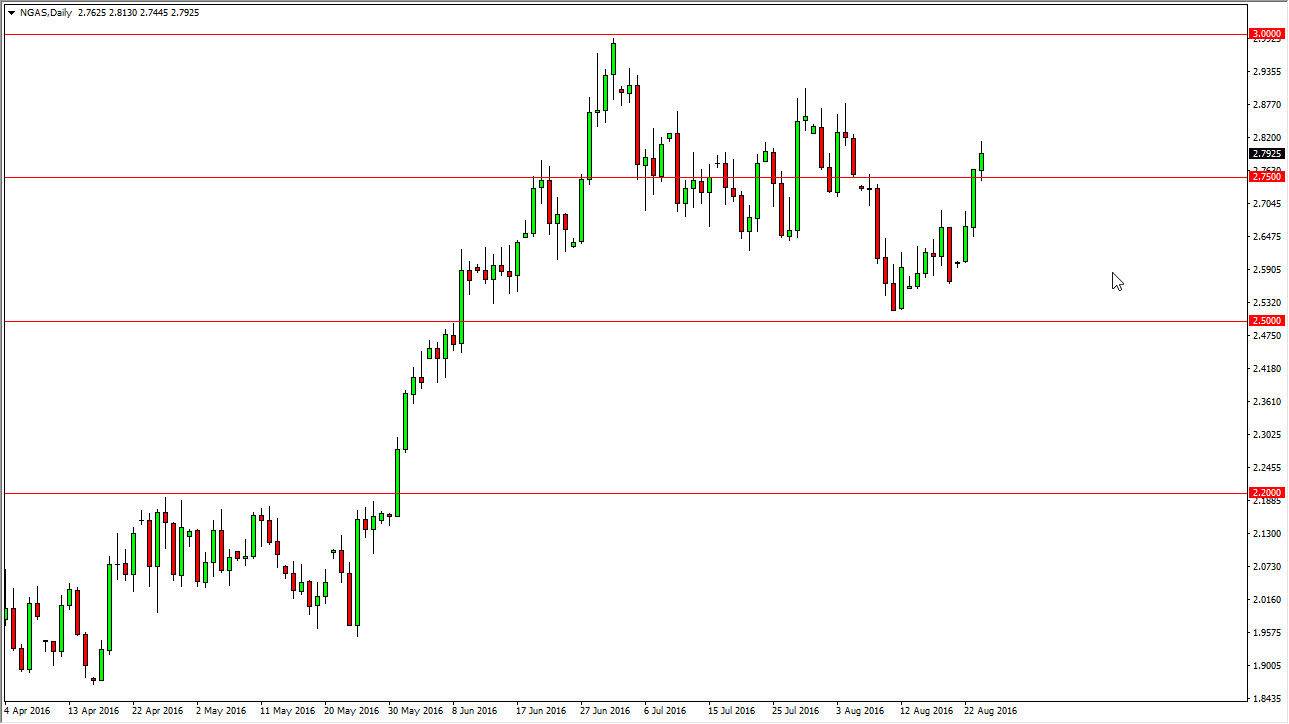

Natural Gas

Natural gas markets rally during the course of the day on Wednesday, breaking above the $2.75 level for the first time in weeks. Because of this, looks like we are going to continue to strengthen a bit, and perhaps try to reach towards the $2.90 level. Ultimately though, this is a market that I believe is a little bit overextended and we did roll over for some time previously. I believe that the sellers will return given enough time, but at this point in time, short-term traders seem to be pushing this market and the upward position. Truthfully, I do not like this market at all right now and the volume just isn’t there so therefore it can be manipulated much quicker than other futures markets, because it is in exactly a huge market to begin with.

I believe this point in time the $3.00 level is the absolute ceiling in the market, and we will not get above there anytime soon. However, we obviously don’t have enough downward pressure at this point in time to continue selling.