WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Monday but then turn right back around to slam into the $40 handle. With this being the case, it looks as if the sellers are going to continue to be very interested in this market. I think we could get a little bit of a bounce off of the $40 level, but given enough time I feel that bounces will offer selling opportunities on signs of exhaustion as we are most certainly in a negative trend. On top of that, it looks as if the 50-day exponential moving average could very well cross back underneath the 200-day exponential moving average. That of course is a very negative sign. Ultimately, that should bring in longer-term sellers yet again.

Natural Gas

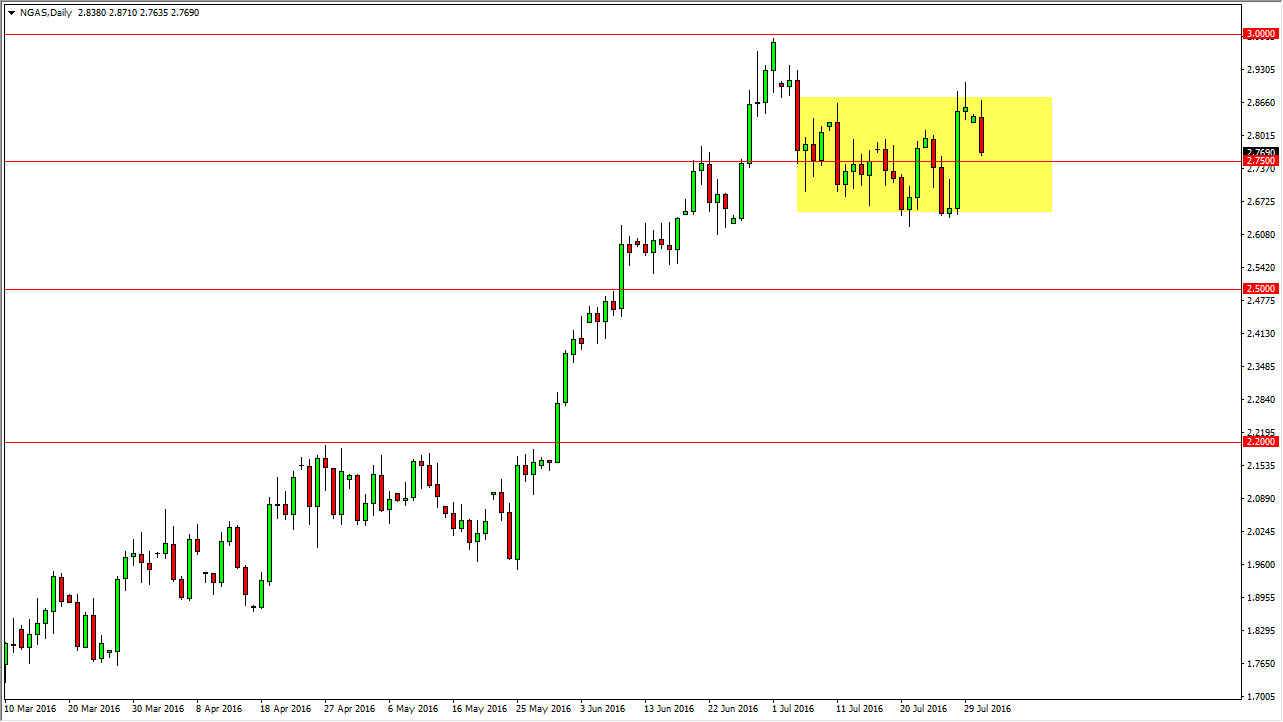

Natural gas markets initially tried to rally during the day on Monday, but turned right back around to slam into the $2.75 region. However, I recognize that we have been consolidating overall, and the market will more than likely continue to do so. The $2.65 level should of course be supportive yet again, as we continue to go back and forth. I believe that eventually we will find buyers, and it’s possible that the markets may turn things back around to form a buying opportunity. With that, I believe that the market will more than likely find enough buying pressure to try to reach the $3 level given enough time, as it is a large, round, major number. Quite often, the markets will attempt to break through those areas more than once or twice.

So having said that, I believe that short-term sellers will probably take advantage of this opportunity, but eventually buyers will pick up to the value that could be shown closer to the $2.65 level as there has been so much in the way of support in that general vicinity.