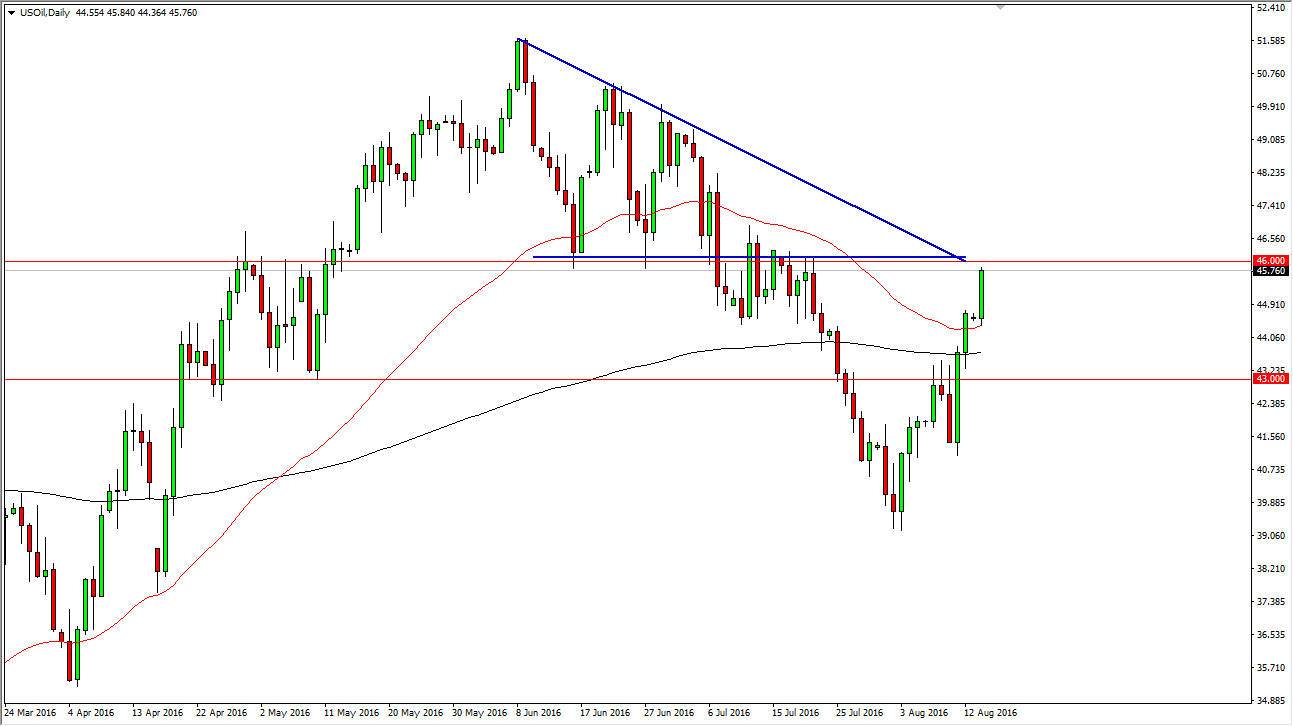

WTI Crude Oil

The WTI Crude Oil market rose during the course of the day on Monday again, as we are starting to grind our way towards the $46 level. I believe that if we can break above the $46 level, the market could then very well go much higher. However, I also recognize that there is a long of resistance just above that could very well turn this market back around. An exhaustive candle would be a nice opportunity to start selling again, as we did have a significant breakdown, but at this point in time it appears that the buyers could very well be trying to step into this market and could be getting a bit over exuberant due to the fact that it is possible that we have less production next year, and therefore we could have supply disruptions going forward. On the other hand, I would be the first person to ask where the demand is going to come from?

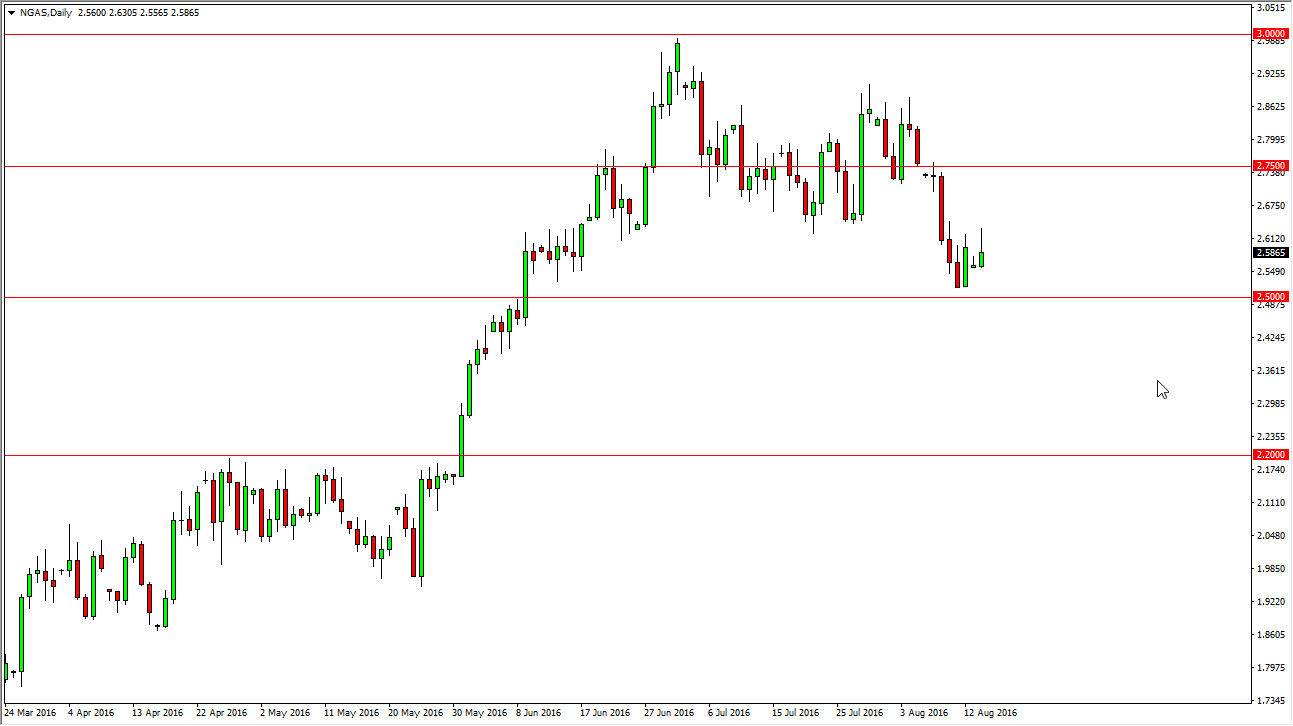

Natural Gas

The natural gas markets initially tried to rally during the course of the day on Monday, but turned right back around to form a bit of a shooting star. It appears that the $2.60 level above has caused quite a bit of resistance, and as a result we ended up forming this candle. I believe that the market is trying to break down, as the $2.50 level below offers quite a bit of support, but if we break down below there we would more than likely reach down to the $2.20 level after that. At this point in time, I believe that anytime we rally, there will more than likely be a selling opportunity based upon exhaustion. With this, it’s only a matter of time before sellers returned so therefore I look at any rally at this point in time as a potential selling opportunity.