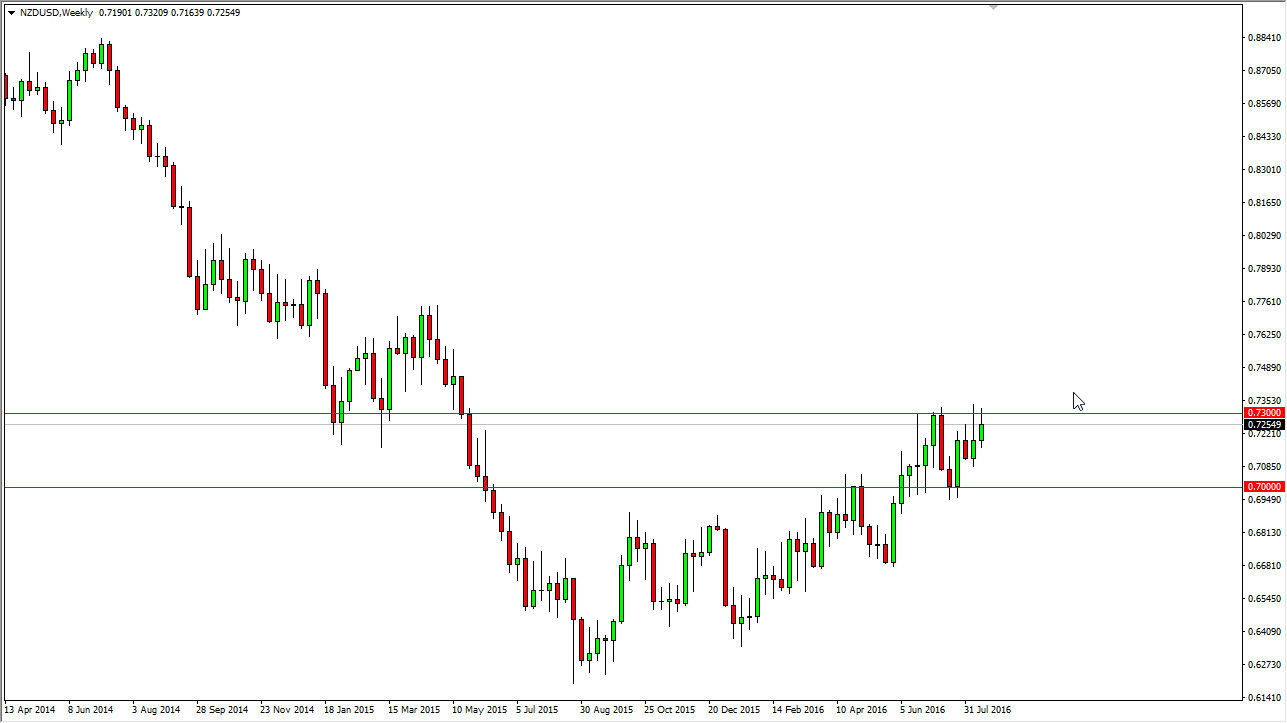

NZD/USD

The New Zealand dollar rally during most of the week, but did pullback closer to Friday. That being the case, it’s obvious that the 0.73 level has offered a significant amount of resistance. It will be difficult to get above there, but I do think we have the ability to, but maybe not this week as we are in the middle polities easing and I don’t think the volume will be there. I think short-term pullbacks will lead to short-term buying opportunities but that’s about it.

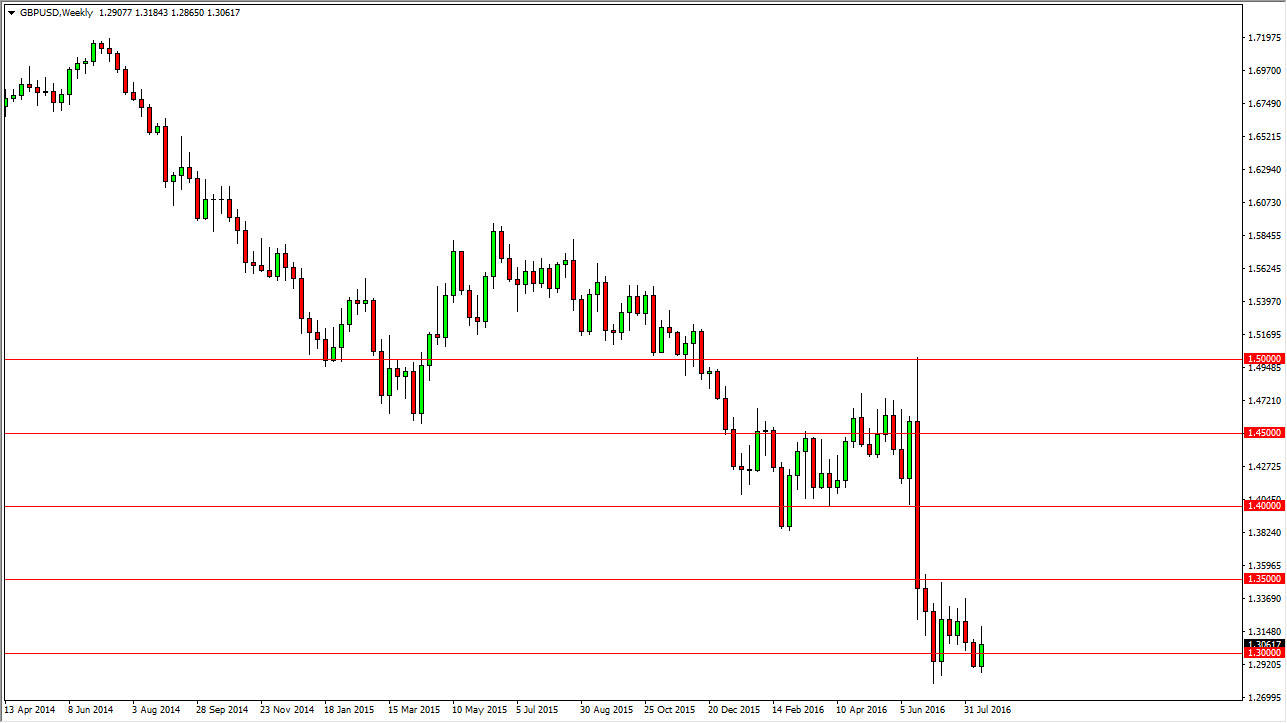

GBP/USD

The British pound tried to rally during most of the week, and it didn’t succeed somewhat but we pullback enough to form a little bit of negativity towards the end of the week. I believe that you have to look for selling opportunities on short-term charts going forward as the volume will offer bigger moves. Eventually though, I think we fall much farther.

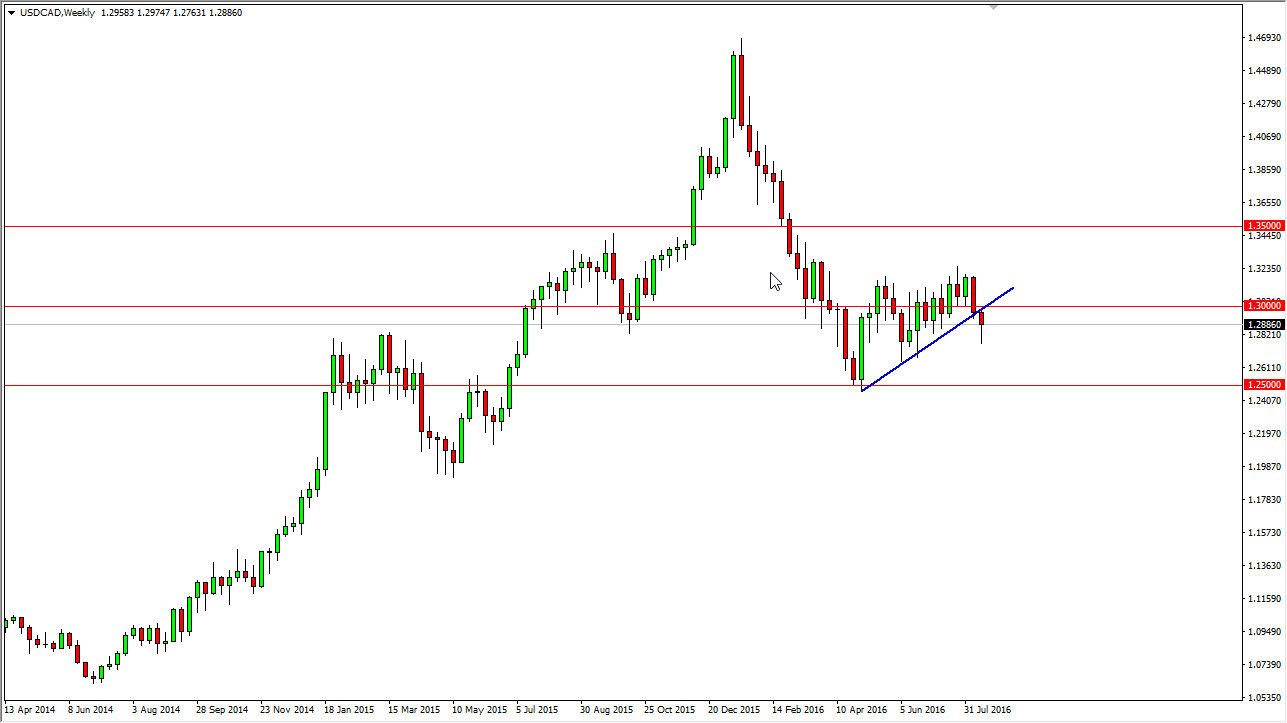

USD/CAD

This is probably the most interesting weekly chart to me right now. We did up forming a hammer during the course of the week which of course is bullish, but it’s just after a break down below a significant uptrend line. With this being the case, I think we break above the 1.30 level, the longer-term uptrend continues and we go much, much higher. However, if we break down below the bottom of the hammer, I feel that we drift down to the 1.25 level.

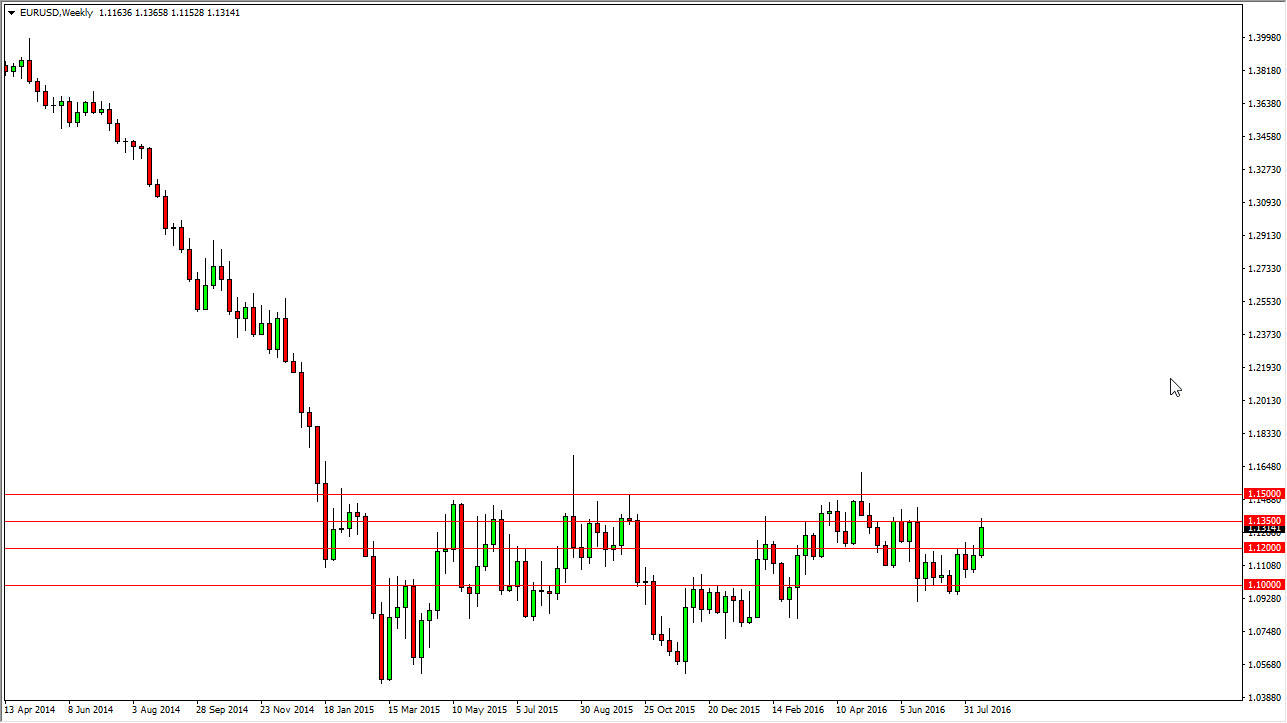

EUR/USD

The Euro had a pretty strong week over the last several sessions, but I think the 1.1350 level will offer enough resistance to the cause a bit of a pullback in this market and that might be what we need in order to build up momentum. A break above that level sends this market looking towards the 1.15 level above, and with that being the case it’s likely that we will trying to break out, but I do not expect it to happen this week.