USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at any of the key support levels which were reached.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken from 8am New York time until 5pm Tokyo time over the next 24 hours.

Short Trades

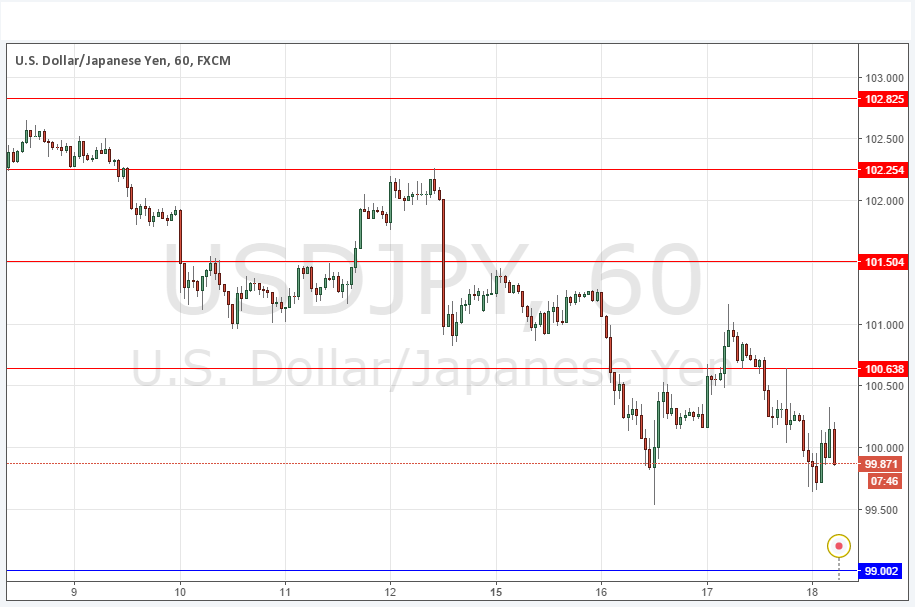

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.50 or 100.64.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 99.00.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair turned steadily bearish yesterday after looking set to rise. The turn was slow but picked up volatility around the time that New York opened, and the FOMC release was just a blip on the way down, not even taking out that day’s high price.

What is interesting right now is that we seemed to bottom out just above 99.50, but the price has just turned bearish again, as at the time of writing, and seems to be on its way down to test that bottom. If it does break and 99.50 is weighed upon, we could continue downwards to the multi-year low at around 99.00.

At best, a continued bearish move in line with the long-term strongly bearish trend. At worst, just a choppy day with the price swinging around the 100.00 area.

There is nothing due today concerning the JPY. Regarding the USD, there will be releases of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time.