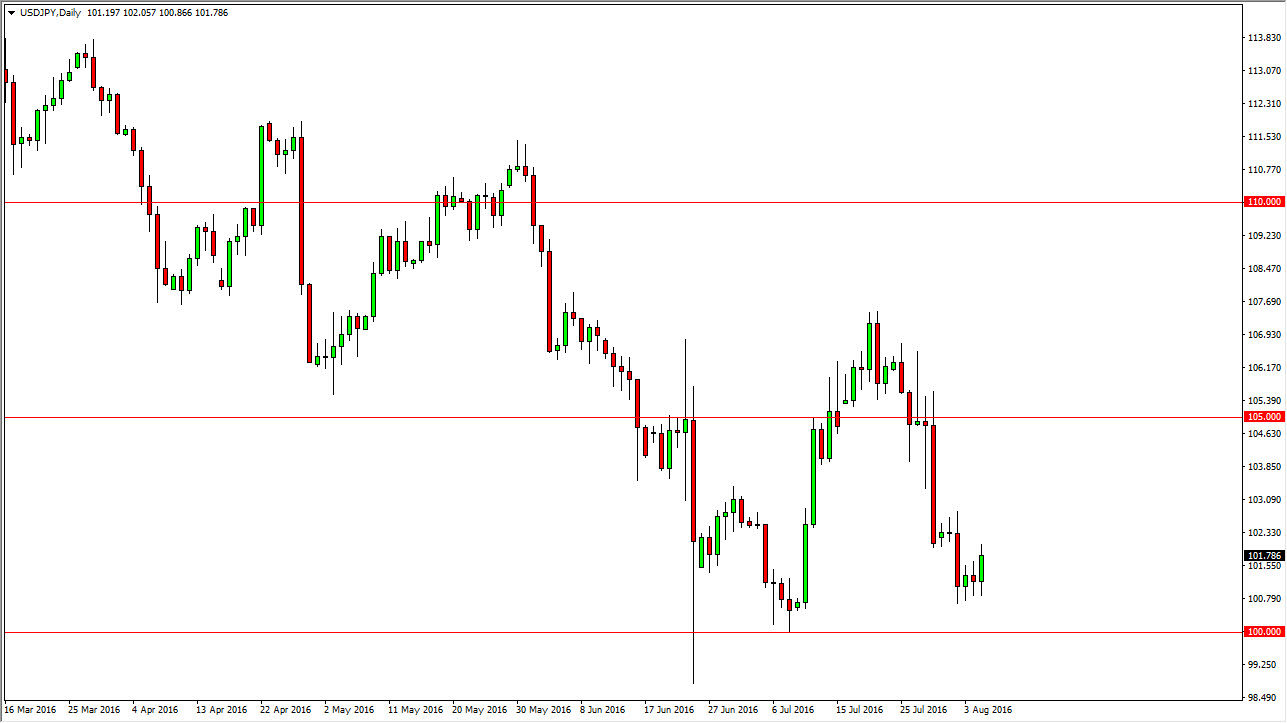

USD/JPY

The USD/JPY pair initially fell during the course of the session on Friday but turned around as the jobs number came out of America much stronger than anticipated. Quite frankly, this is a market that seems to be very sensitive that this particular announcement, and the fact that we rally it isn’t that big of a surprise. I also believe that the 100 level below is very attractive for catching the attention of the Bank of Japan, so it’s likely that we could have intervention if we break down below there. Because of this, I have been advocating for long positions over the last couple of sessions on signs of support. I now believe that the market should continue to reach towards the 105 level at this point in time. It did not have any interest in selling whatsoever because we are so close to a massive floor.

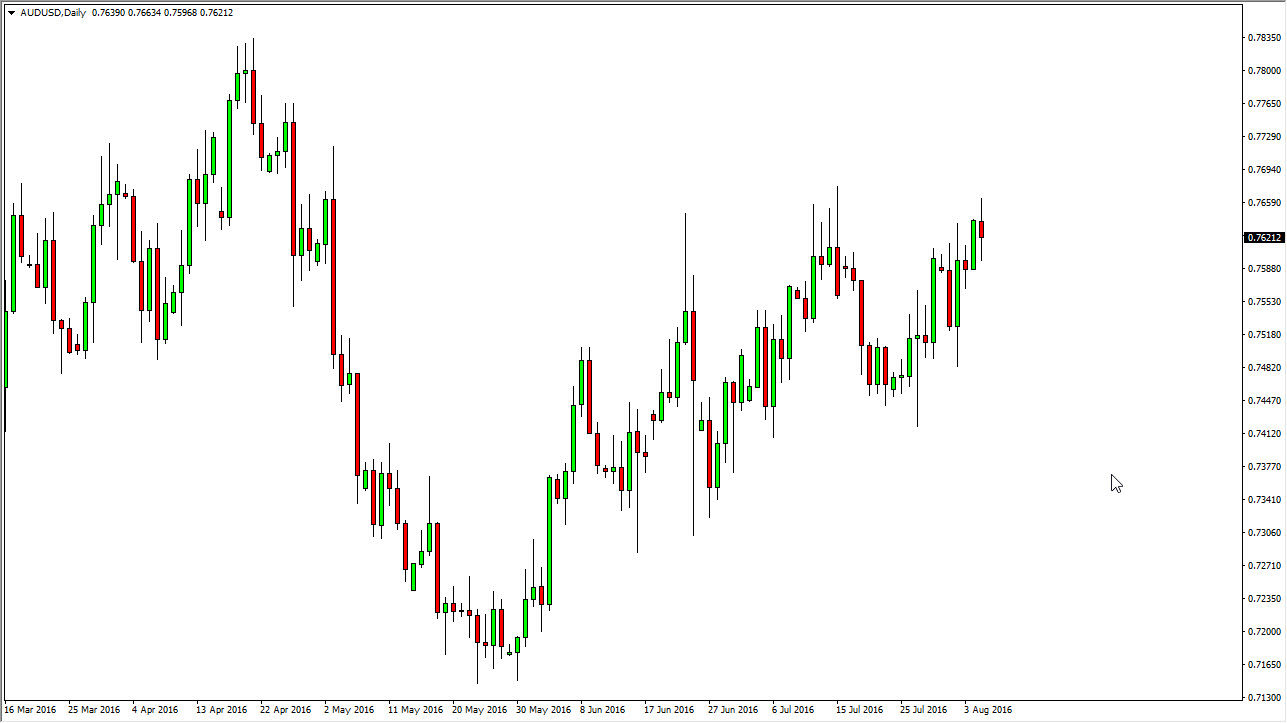

AUD/USD

The AUD/USD pair went back and forth during the course of the session on Friday, essentially forming a neutral candle. Ultimately, this is a market that looks as if it is trying to break out and above the recent resistance. The market of course is very sensitive to the gold markets, and as a result it’s likely that if the gold markets rally, the Australian dollar will continue to do the same. Ultimately, this is a market that’s very likely to follow that particular commodity.

Ultimately, I believe that the market is going to continue to go higher, but pullbacks could come time and time again in order to build up enough momentum to continue going higher. With this being the case, the market should reach towards the 0.7850 level above. That being the case, the market looks as if it will eventually not only break out to that area, and then the 0.80 level after that. The “higher lows” of course suggests that we will continue to see buying.