USD/CHF Signal Update

Last Thursday’s signals were not triggered as none of the key levels given were hit that day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

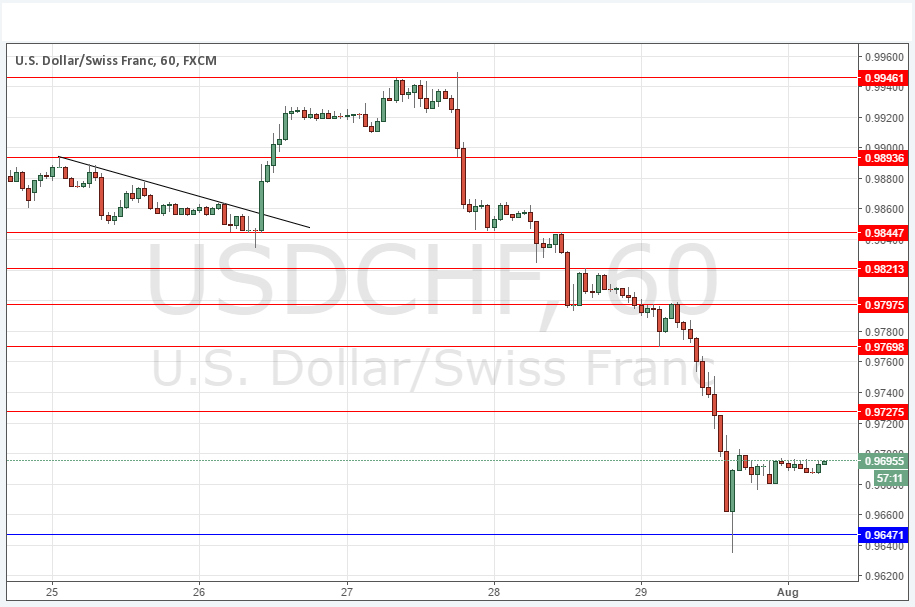

Go long after bullish price action on the H1 time frame following the next touch of 0.9647.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9728, 0.9770 or 0.9798.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The USD weakness that took hold at the end of last week really showed itself strongly in this pair, with the price falling extremely sharply. It now looks as if the price found some support around the psychologically key level of 0.9750 and while it may well not reverse, it is likely to at least take some kind of break from going down. A short trade looks like being the next higher-probability set up, but watch the candlesticks closely to see whether the impulsive move is in the buying or selling as this pair often likes to retrace sharp movements like the one that just occurred.

There is nothing due today concerning the CHF as it is a public holiday in Switzerland. Regarding the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.