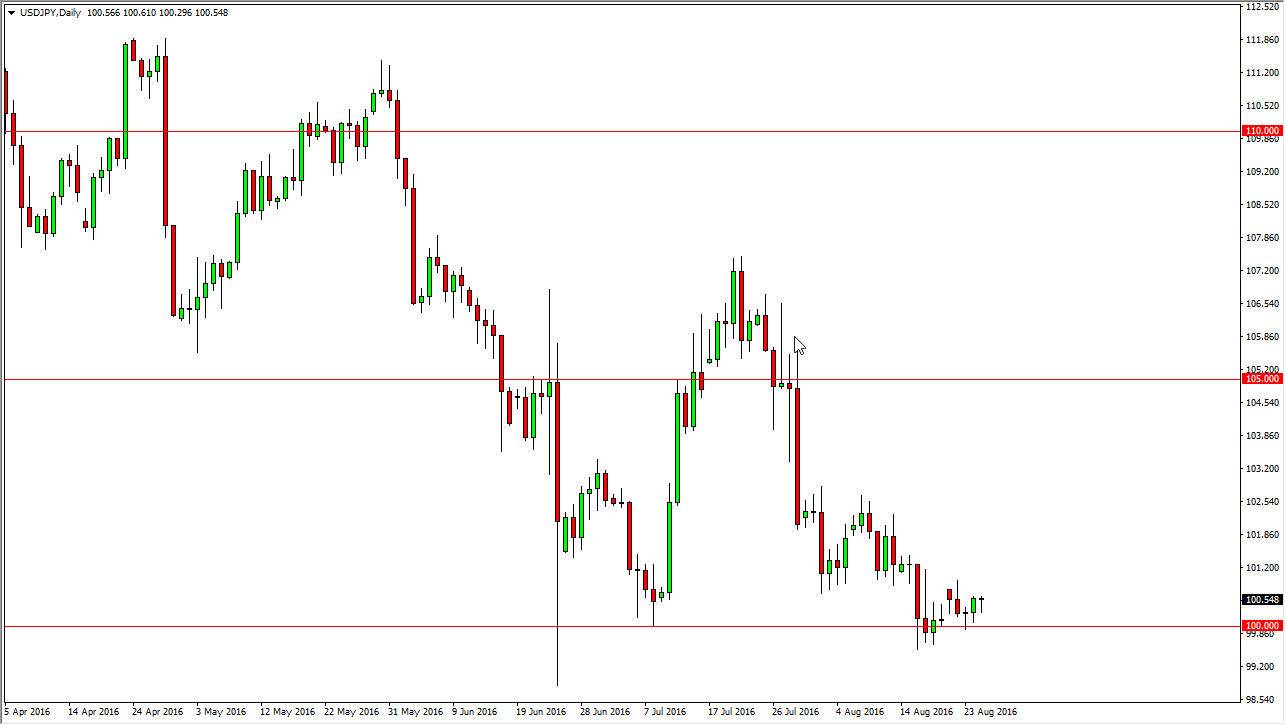

USD/JPY

This particular market continues to be fairly quiet but that doesn’t surprise me due to the fact that we are at the very end of the holiday season, and as a result almost everybody is away from their desks. However, with even more important as the 100 level as I see it being a bit of a “line in the sand” for the Bank of Japan. I think if we break down below there won’t take very much to convince them to either intervene, jawbone the currency pair higher, or do some type of quantitative easing extension program. Either way, the Japanese are not pleased about the value of the Yen at the moment.

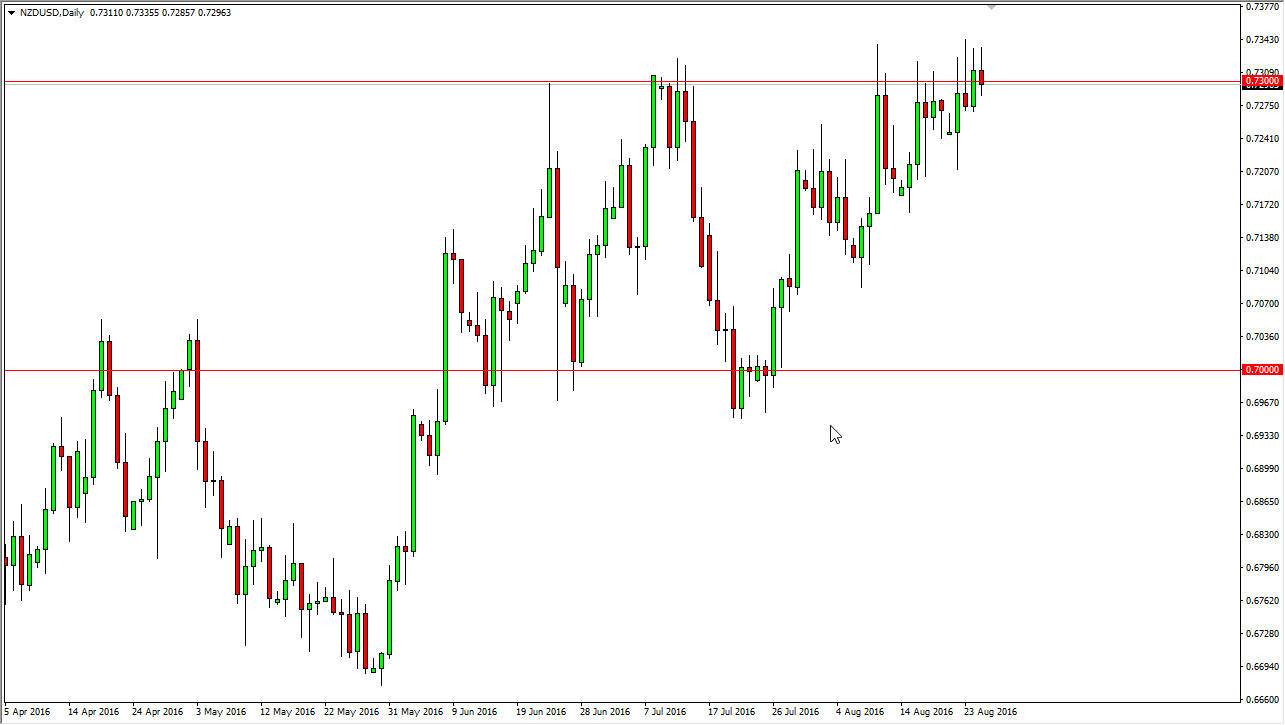

NZD/USD

The Kiwi dollar failed to break out during the day, as we continue to press the 0.73 level. We did fail though, so I think that we are going to continue to see sideways action. With this, I believe that every time we pullback it is simply another attempt to try to find momentum below in order to find enough volume to finally break out. Once we do, I think the market will probably reach towards the 0.75 level over the longer term.

This is an interest-rate poor environment that we are working with right now, so the fact that this house a positive swap is probably reason enough for people to keep jumping into the marketplace. Ultimately, in an environment where there are no returns as far as holding onto a position in the bond markets are concerned, the fact that you even get paid swap is probably good enough for most people. However, there is going to be a lot of volatility and I do not think that it’s until we break above the highs for the last couple of sessions that we can make our true move higher. Pullbacks at this point time should continue to be attractive to value hunters.