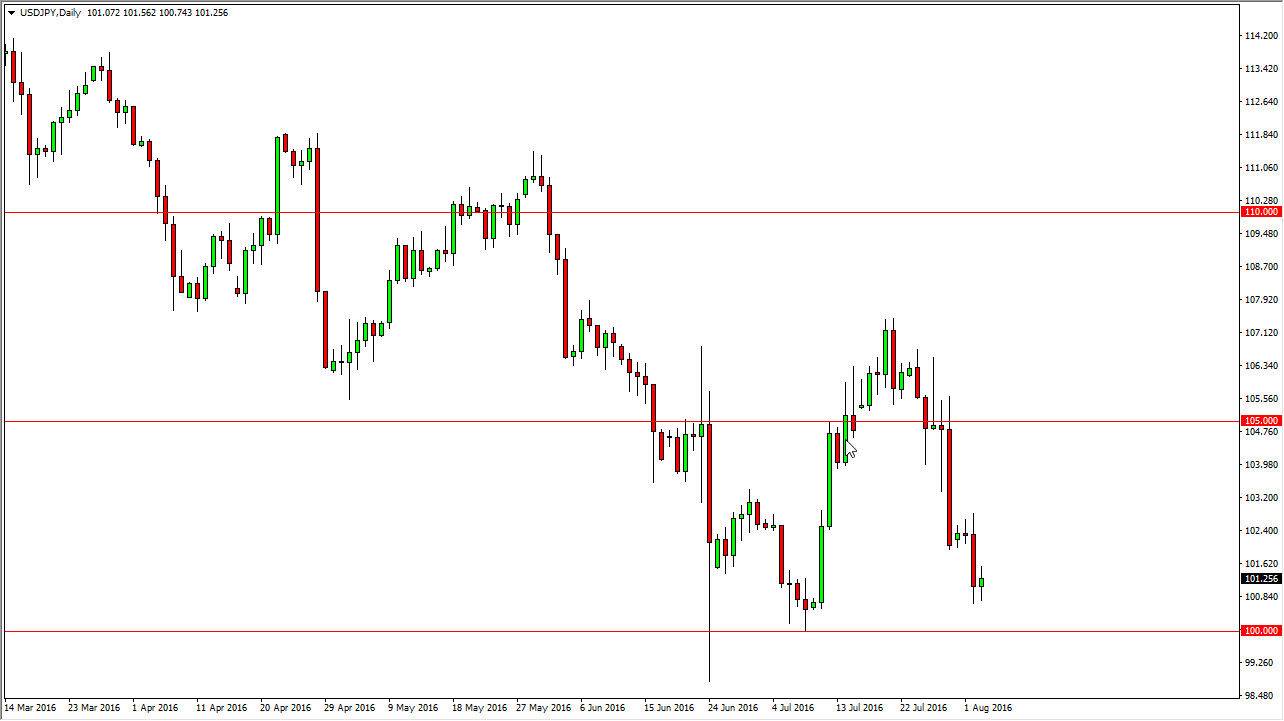

USD/JPY

The USD/JPY pair went back and forth during the course of the day on Wednesday, showing signs of support at roughly 101. This is an area that begins a fairly significant amount support all the way down to the 100 level. In fact, I believe that eventually we will bounce, and if we can break above the top of the range during the course of the session on Wednesday, we could very well grind our way back towards the 102.50 level. The 100 level below should be massively supportive, and with that being the case I believe that the market is expecting the Bank of Japan to get involved if we break below that vital area that we have bounced off of twice over the course of the last couple of months.

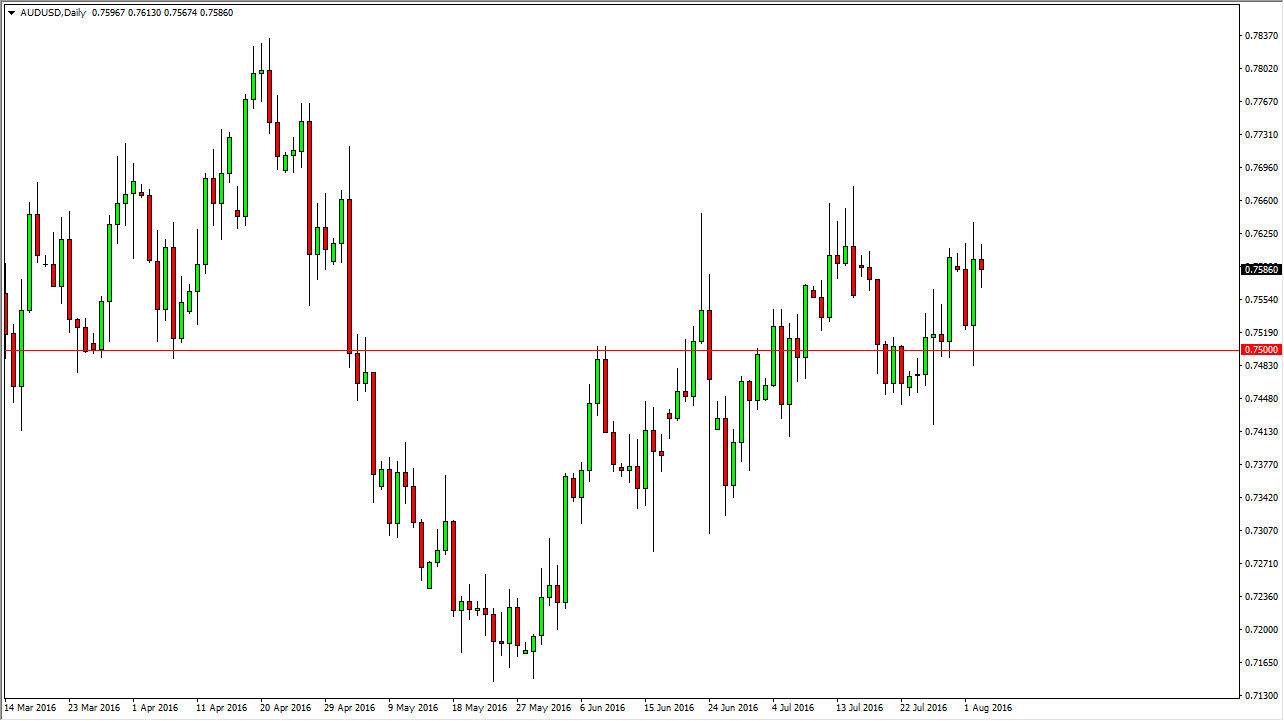

AUD/USD

The AUD/USD pair went back and forth during the course of the session on Wednesday, forming a relatively neutral candle. It looks as if we still have plenty of support just below though, so having said that it’s likely that the 0.75 level below will continue to be the “floor” in this market. Ultimately, I believe that it is only a matter time before the buyers get involved on supportive candles, and I believe that you will see some type of value underneath. The gold markets of course have quite an influence on the gold market, so having said that I think that you will have to watch the precious metals complex to see where this market goes next. I personally believe that gold goes higher, so I think it’s only a matter of time before the Aussie rises slightly itself. At this point in time, I believe that the 0.7650 level is massively resistive, and a break above there should send this market looking for the 0.7850 level which I see is the next major resistance barrier.