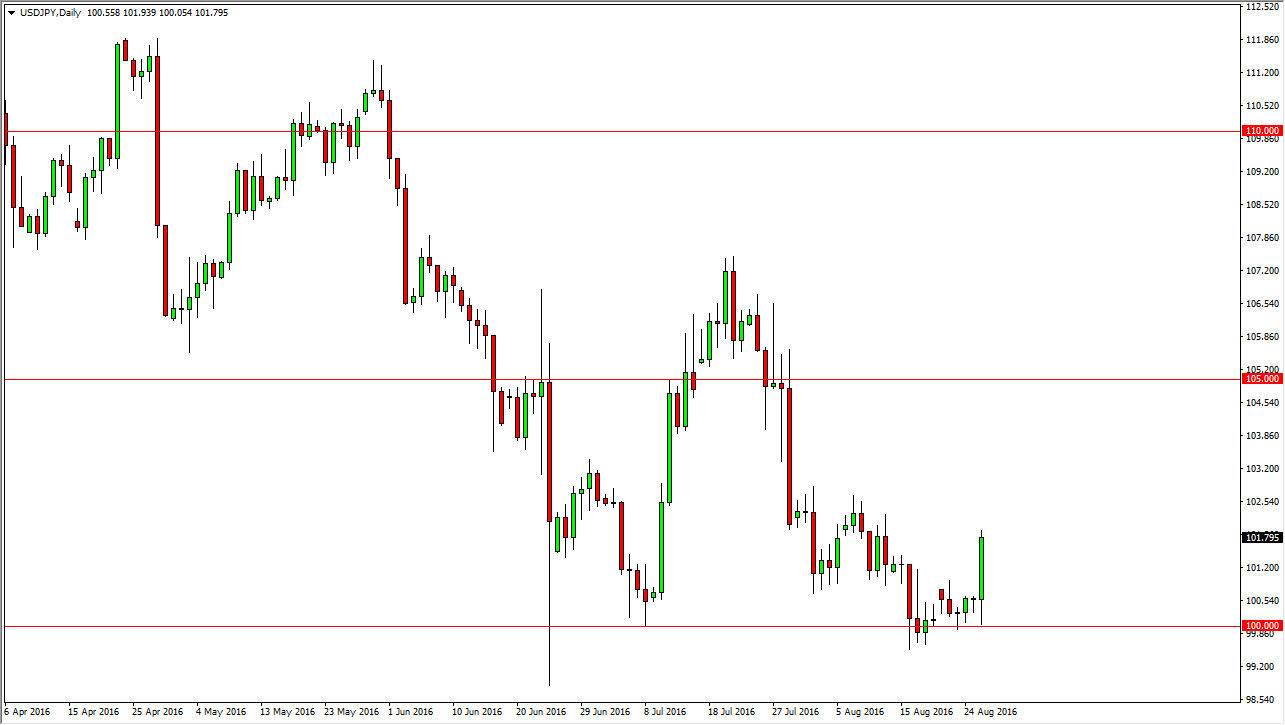

USD/JPY

The US dollar initially fell during the day on Friday but found enough support near the 100 level to turn things back around and form a massive green candle. By doing so, it shows that we may be putting in a bottom to this pair, and adding more fuel to the fire is that there are comments coming out of the Bank of Japan that suggest they may be looking at more quantitative easing fairly soon. With this, more than likely we will continue to see this market rally every time it dips, as it should pick up plenty of support. Ultimately, this market could very well reach towards the 105 level, but it is going to take quite a bit of momentum to get up there.

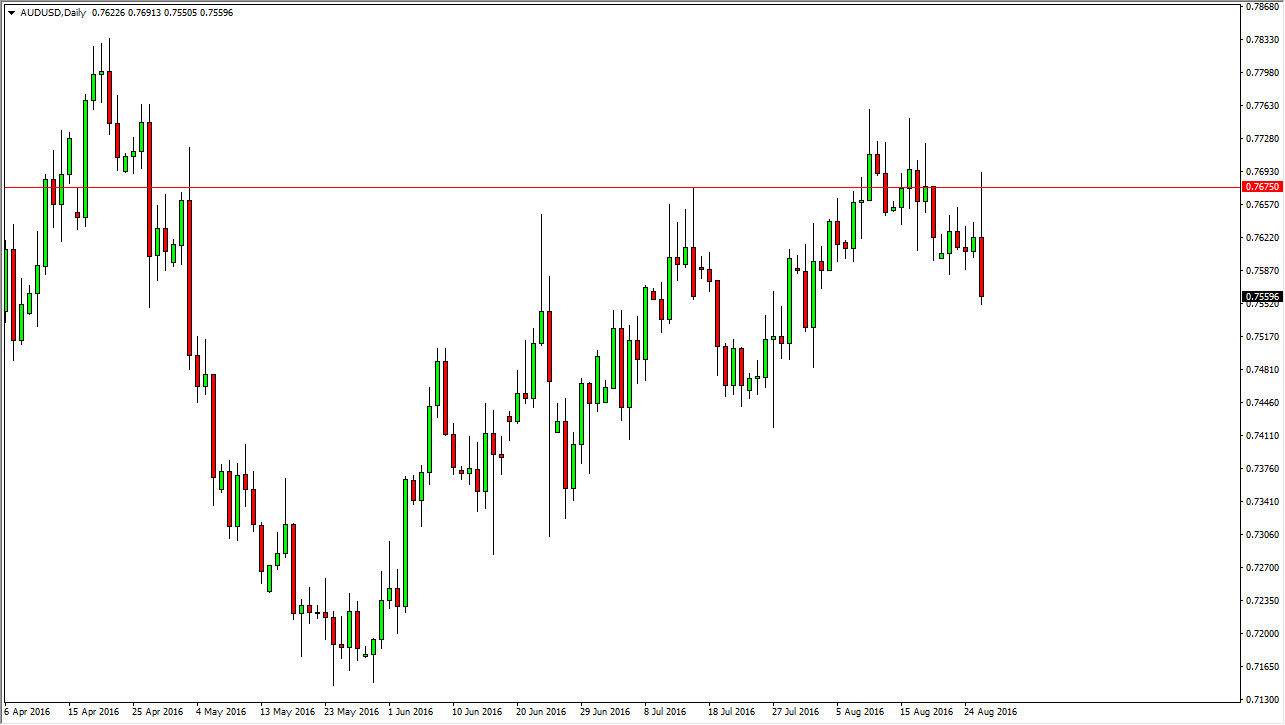

AUD/USD

The Australian dollar initially broke to the upside during the day on Friday, but turned right back around at the 0.7675 level, to show that area as being resistive still. In fact, we not only turned around that we fell apart so therefore I believe that this market is starting to pick up its momentum to the downside and that the sellers will continue to enter this market again and again. With that being the case, we could very well reach down towards the 0.74 level given enough time, and I think that short-term rallies at this point in time you have to be sold on the first signs of exhaustion.

At this point in time, I don’t really want to buy the Australian dollar, but I do recognize that if the gold markets take off, it could very well translate into a higher valued Australian dollar. With this being the case, it’s very likely that we will see volatility, but I still believe that the negativity will more or less run the market over the next several weeks.