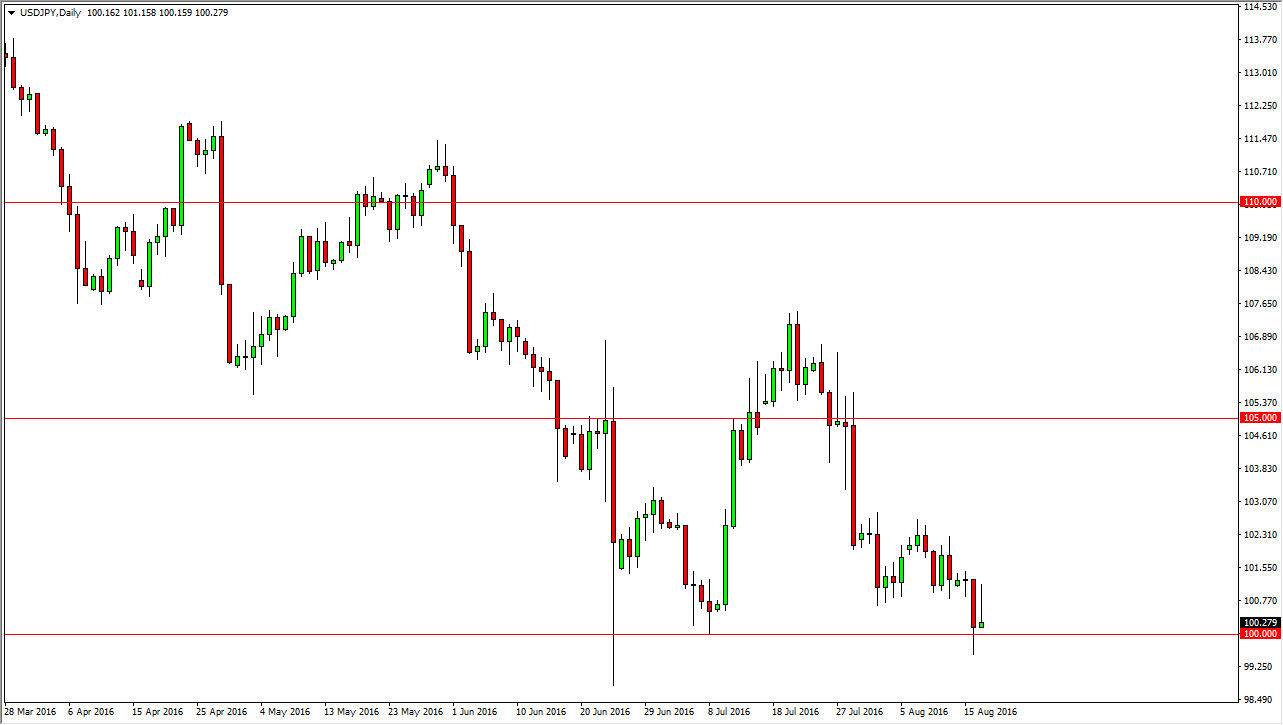

USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Tuesday, but turned right back around to form a shooting star. The shooting star sits right on top of the 100 handle, so having said that it’s likely that buyers and support will find its way into the marketplace in this general vicinity. I believe that the Bank of Japan should continue to cause a little bit of a barrier in this area, and any signs of support should be a short-term buying opportunity in a market that will most certainly continue to see the psychological significance of the 100 handle. If we can break above the 101.50 level, it should send the market much higher and reaching towards the 103 handle.

AUD/USD

The Australian dollar fell significantly during the day on Tuesday, but turned right back around to show signs of support. If we can break higher, I think that the market will try to grind its way towards the 0.77 level. If we can break above there, I feel that the market then eventually goes to the 0.80 level but it’s not going to be an easy move. We probably need some type of help out of the gold market, which of course has quite a bit of influence on the Australian dollar.

I believe that pullbacks at this point in time will more than likely offer buying opportunities below, and signs of support or bounces from lower levels will offer value the people will take long positions in this particular market. I have no interest in selling this market, because they feel there is so much in the way of noise below. Ultimately, the Australian dollar will continue to do fairly well overall due to the interest-rate differential, because quite frankly there’s no interest to be found anywhere at the moment.