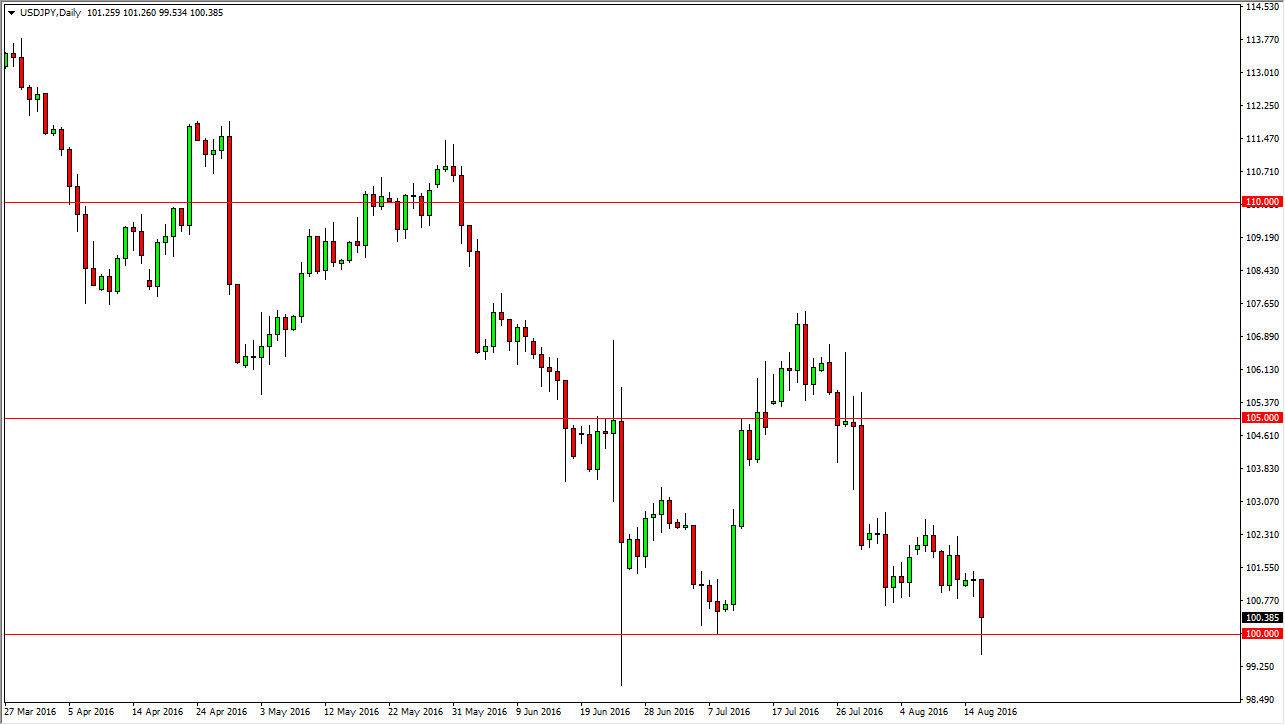

USD/JPY

The US dollar fell rather significantly during the course of the day on Tuesday, slicing through the 100 level against the Japanese yen. However, we did get a bit of support, and quite frankly I think this number is too large for traders to ignore. A bounce from here makes quite a bit of sense, because quite frankly even though there are concerns about whether or not the United States can raise interest rates anytime soon, the reality is that the Bank of Japan will get involved in this keeps up. It will more than likely cause quite a bit of psychological support just below and therefore I think short-term buyers could very well jump into this market and take advantage of the significance. I’m not looking for a major move higher, but a bounce isn’t completely out of the question.

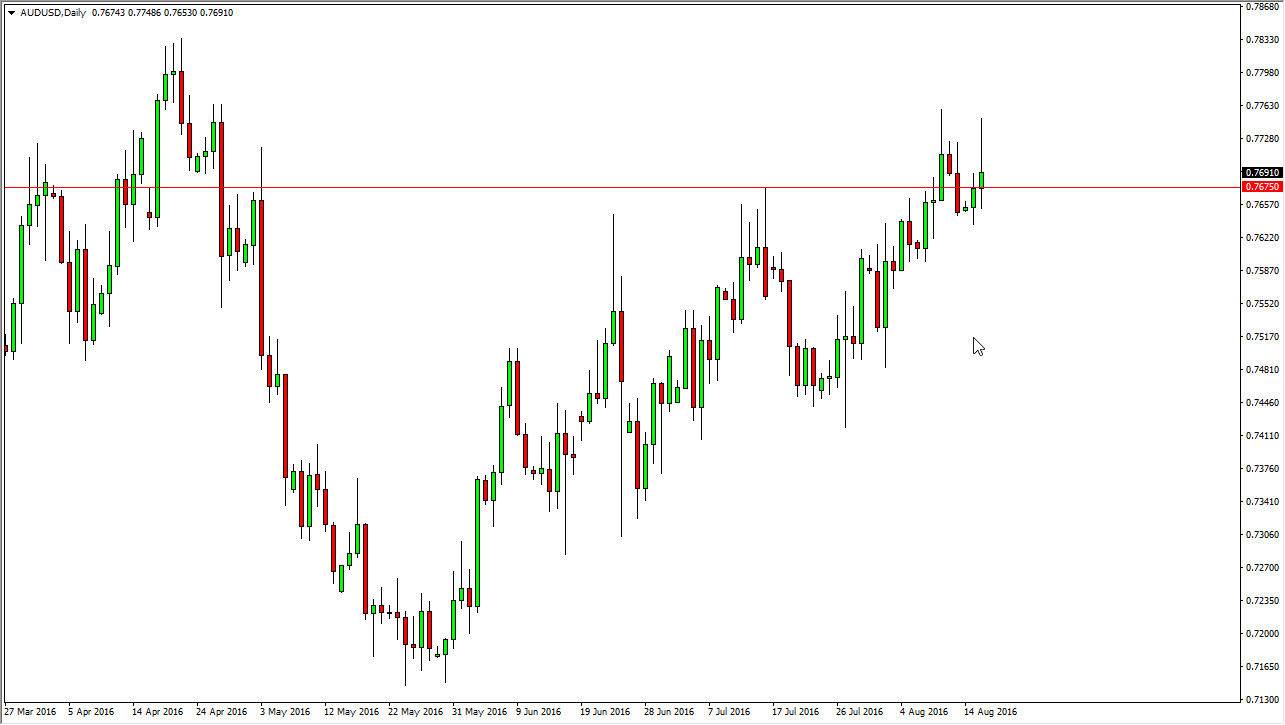

AUD/USD

The Australian dollar did initially try to rally during the course of the day on Tuesday but found enough resistance near the 0.7750 level to turn things around and form a shooting star that is sitting just upon the previous resistance. With this, I think that the market is starting to show that it needs to build up a little bit of momentum, but more importantly we get Australian employment numbers today. That of course can cause quite a bit of volatility in this pair so needless to say it’s probably best to wait until was numbers come out.

I believe that pullbacks at this point time will only offer value at lower levels, but it could be rather volatile down there. On the other hand, if we can break above the top of the shooting star for the day on Tuesday, I believe that would be a very bullish sign that you could not ignore. It is going to be choppy in either direction so you have to be aware of that. Pay attention to the gold markets as well, if they get a bit of steam it could very well put a bit of momentum into the Aussie dollar to the upside.