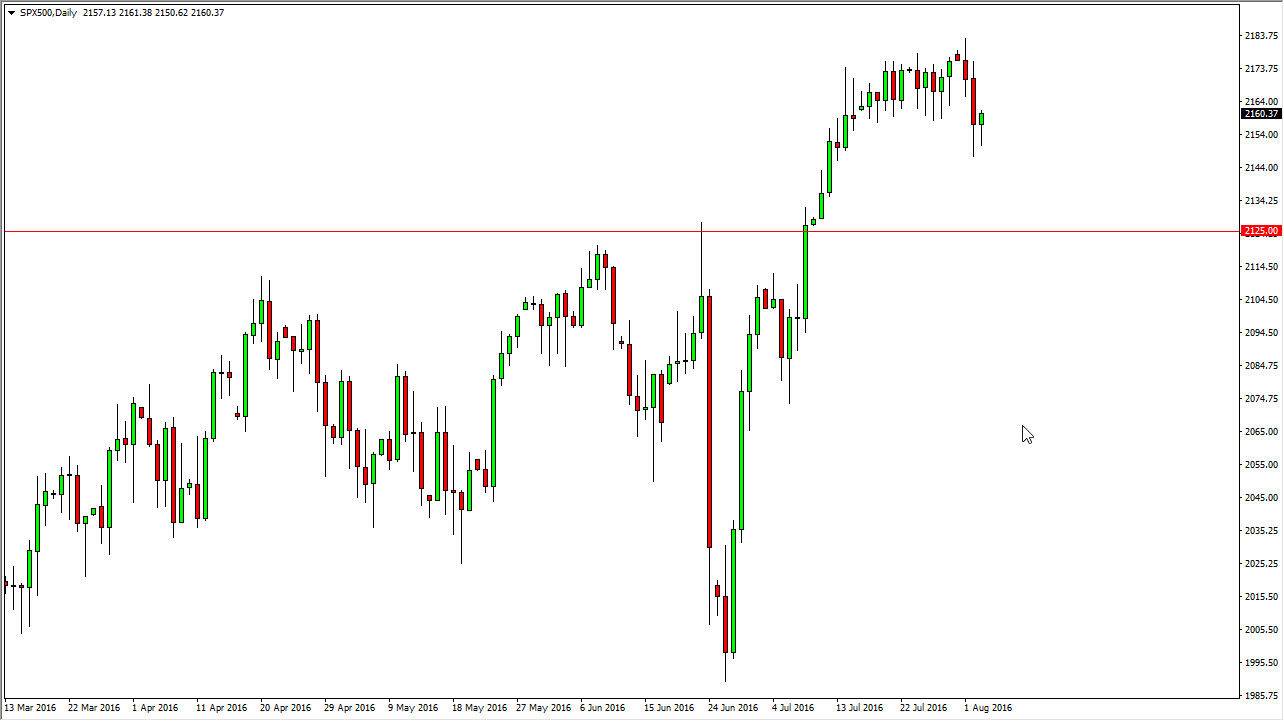

S&P 500

The S&P 500 initially fell during the course of the day on Wednesday, but turned around to form a bit of a hammer. The hammer of course is a very bullish sign, so I believe that this point in time we will continue to start buying, and reach towards the top of the consolidation area that we have been in. The 2180 level above is massively resistive, so having said that it’s likely that sooner or later the buyers will continue to get involved. I also believe that there is a massive “floor” in this market at the 2125 level, so having said that there is absolutely no interest on my end as far as selling is concerned when it comes to the S&P 500 going forward.

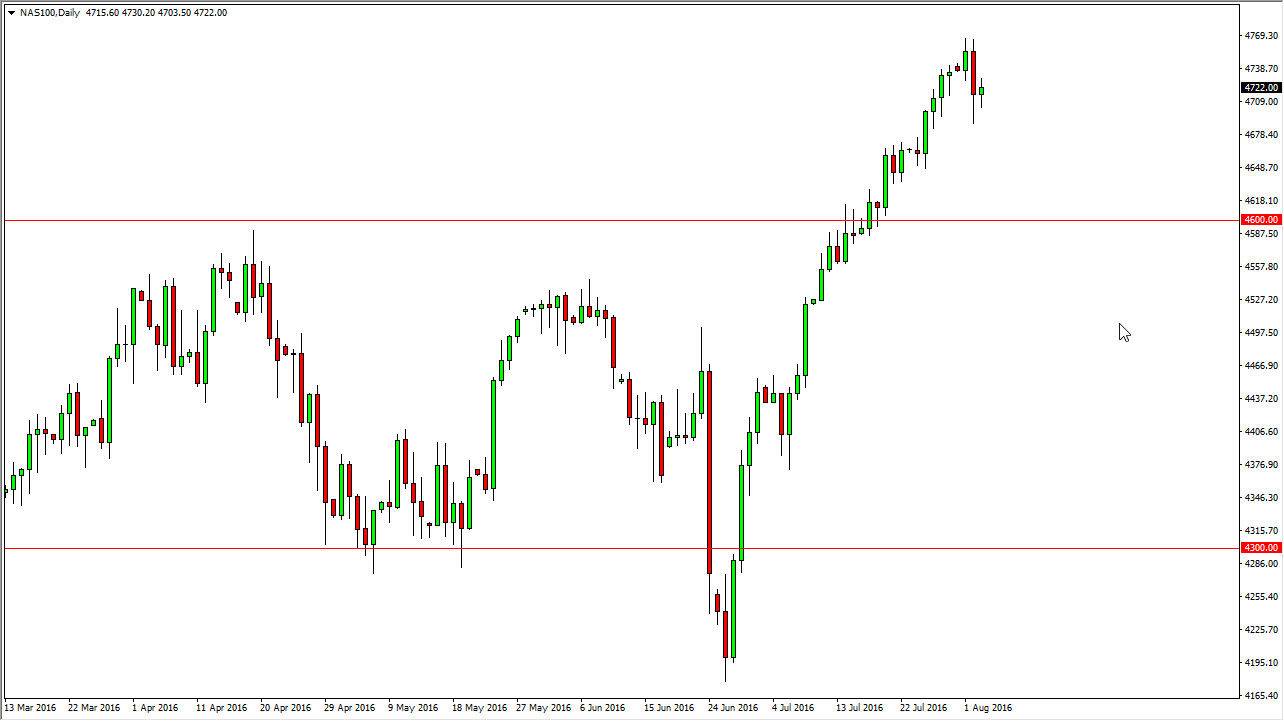

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Wednesday, but eventually settled on a slightly positive candle. I believe this suggests that there are buyers somewhere near the 4700 level, and we may grind sideways in the meantime. I do believe that eventually we go much higher, and therefore I have no interest whatsoever in selling. Ultimately, even a break down from here should see plenty of support near the 4600 level, which was so massively resistive in the past. With this being the case, I think that the market will eventually go higher but we may have a bit of volatility as we have seen massive overreach buying the bullish traders lately, and as a result it’s likely that the markets will continue to grind away or even pullback in order to find enough momentum to continue to go much higher. Given enough time, I still believe that the NASDAQ 100 reaches towards the 5000 level, but that of course is a longer-term estimation on my part, and not something I expect to see anytime soon.