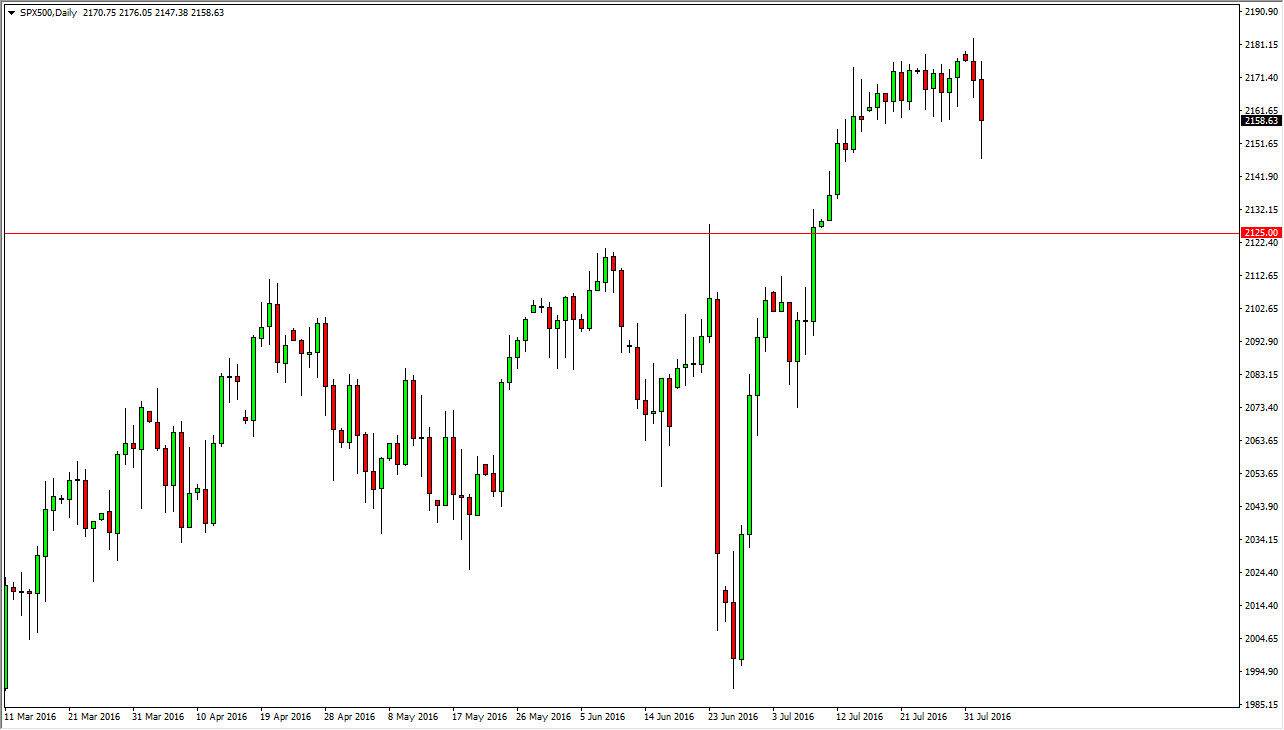

S&P 500

The S&P 500 initially tried to rally during the day on Tuesday, but then broke down rather significantly. This is a pretty negative candle, but having said that I believe that there is more than enough support below to keep this market afloat. The 2125 level is the absolute “floor” in this market as far as I can see, so therefore I have no interest whatsoever in selling. This is a market that sooner or later should form some type of supportive candle that we can serve buying, as I believe that the recent breakout was of course a very significant. Because of this, I am a buyer of supportive candles and of course bounces below. The S&P 500 is not a market that have any interest whatsoever in selling, low interest rates continue to be the environment that we find yourselves in, which generally helps stocks.

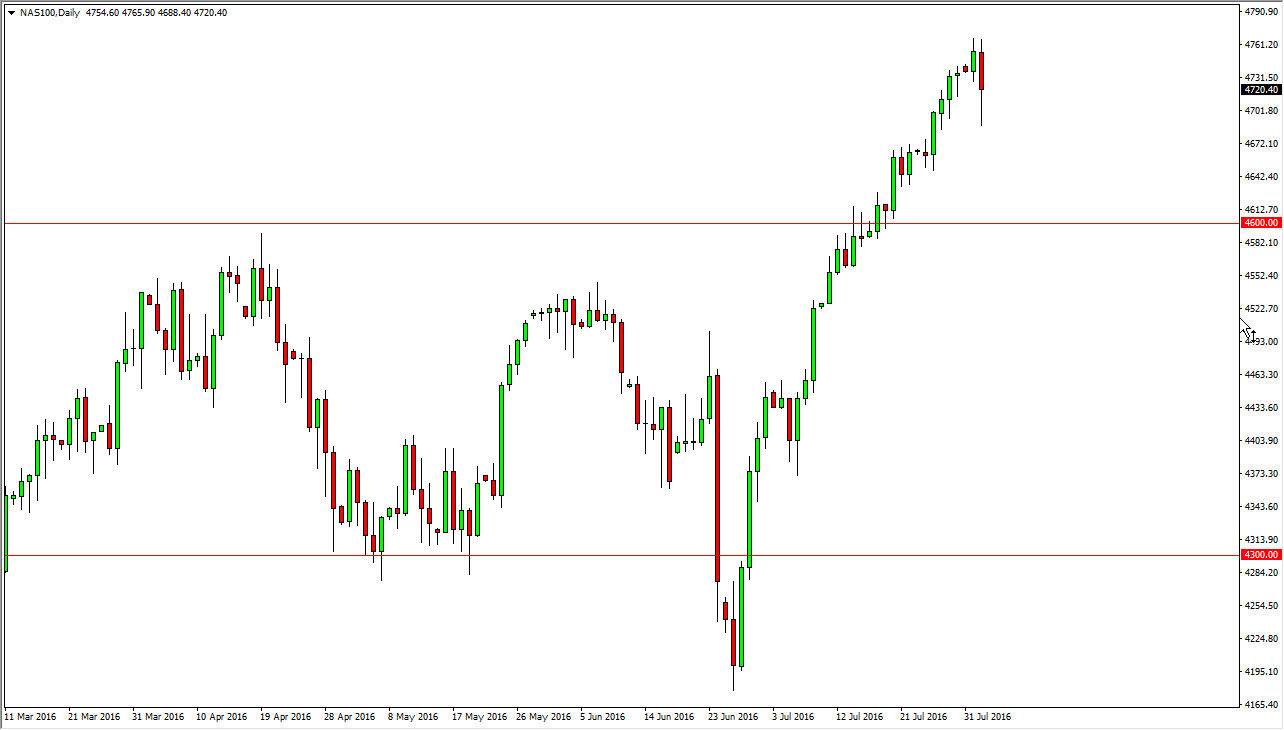

NASDAQ 100

The NASDAQ 100 fell significantly during the day but did bounce to recapture about half of the losses. Because of this, I believe it is only a matter time before we go higher, and the 4500 level below is probably the “floor” in this market. I have no interest whatsoever in shorting this market as I believe the buyers are going to continue to get involved in this market. I believe that the market should continue to find buyers again and again, but sooner or later we will find quite a bit of a reason to go long.

The low in trading firm it should help the NASDAQ 100 as well, so I believe that this market continues to go higher. Ultimately, I believe that the market will find buyers below, but we are a bit of an overextended market at this point in time, so a pullback is an excellent way to find value in this market that you can get involved in.