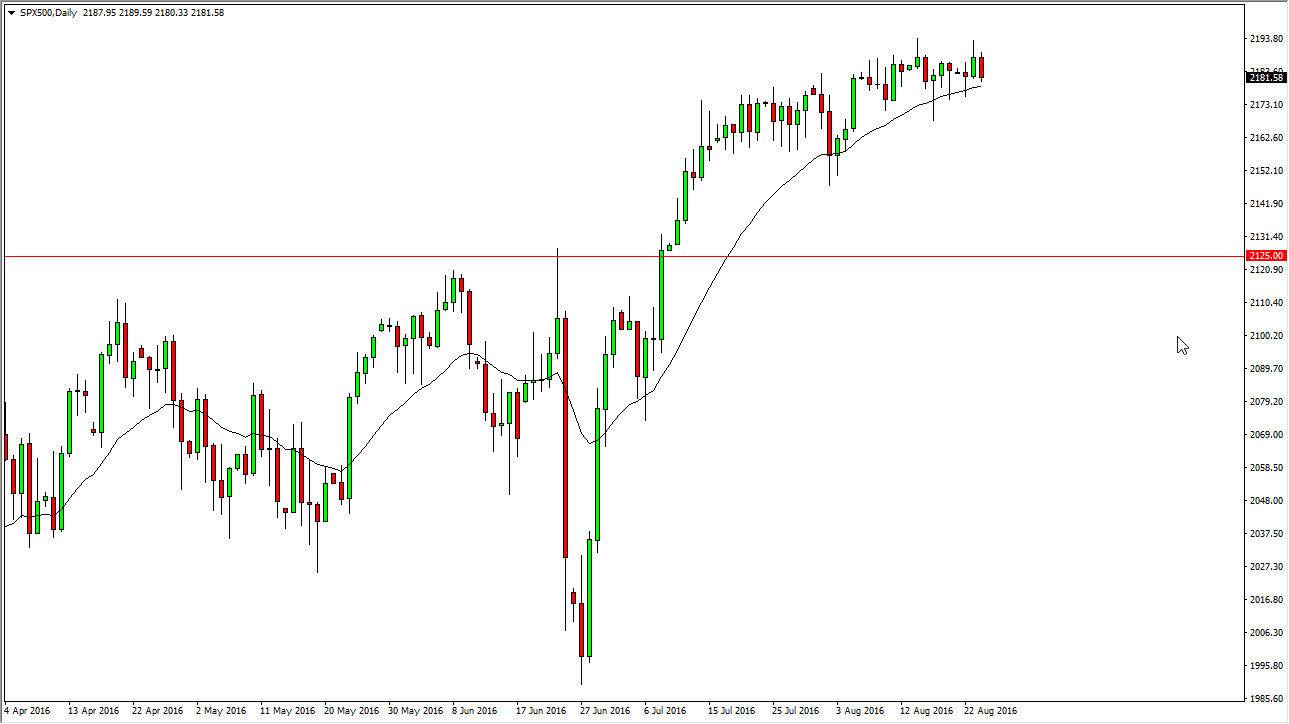

S&P 500

The S&P 500 fell during the day on Wednesday, as we continue to grind back and forth in this general vicinity. However, this was a fairly negative candle, so we could get a little bit of follow-through to the downside. Ultimately, I do think that given enough time we could find a supportive candle below that turned the market back around. The 20-day exponential moving average is sitting right where the market is now, and as a result I feel that the market will perhaps attract some longer-term traders. Ultimately though, I believe this is a market that will eventually find buyers as there is such a low interest-rate environment right now, and of course the United States is the strongest market that people typically trade.

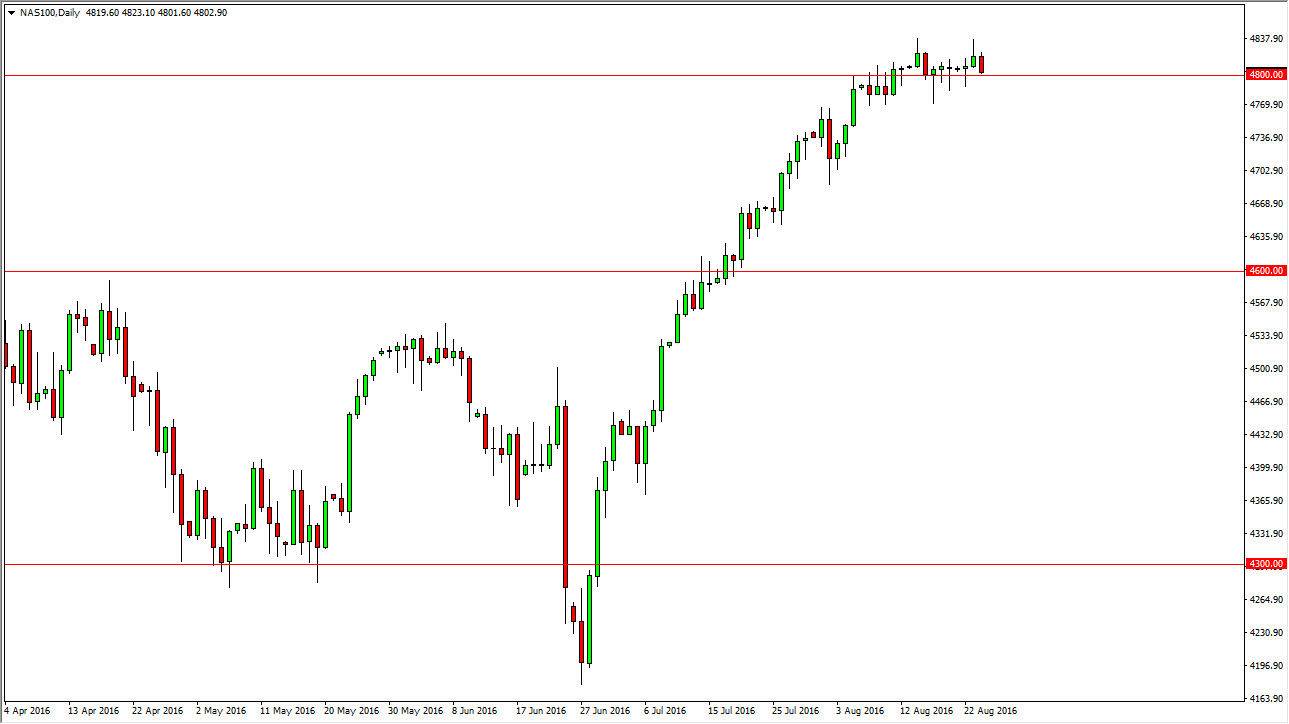

NASDAQ 100

The NASDAQ 100 fell significantly during the course of the session on Wednesday, slicing through the 4800 level. However, there is a significant amount of support just below there in order to turn the market back around and as a result I feel that sooner or later we will get a supportive candle that we can serve buying but at this point in time I’m not interested in doing so. I think given enough time we should reach towards the 5000 level, which is my longer-term target. I don’t think it’s going to be easy to get there, but I do think that the market gets there given enough time. It will probably be a series of “buy on the dips”, and continue to be for the foreseeable future.

The 4700 level below is massively supportive as well, so even if we break down a little bit from here I would still be looking for signs of support or a bounce in order to take advantage of what I would consider to be value at the moment in this particular market.