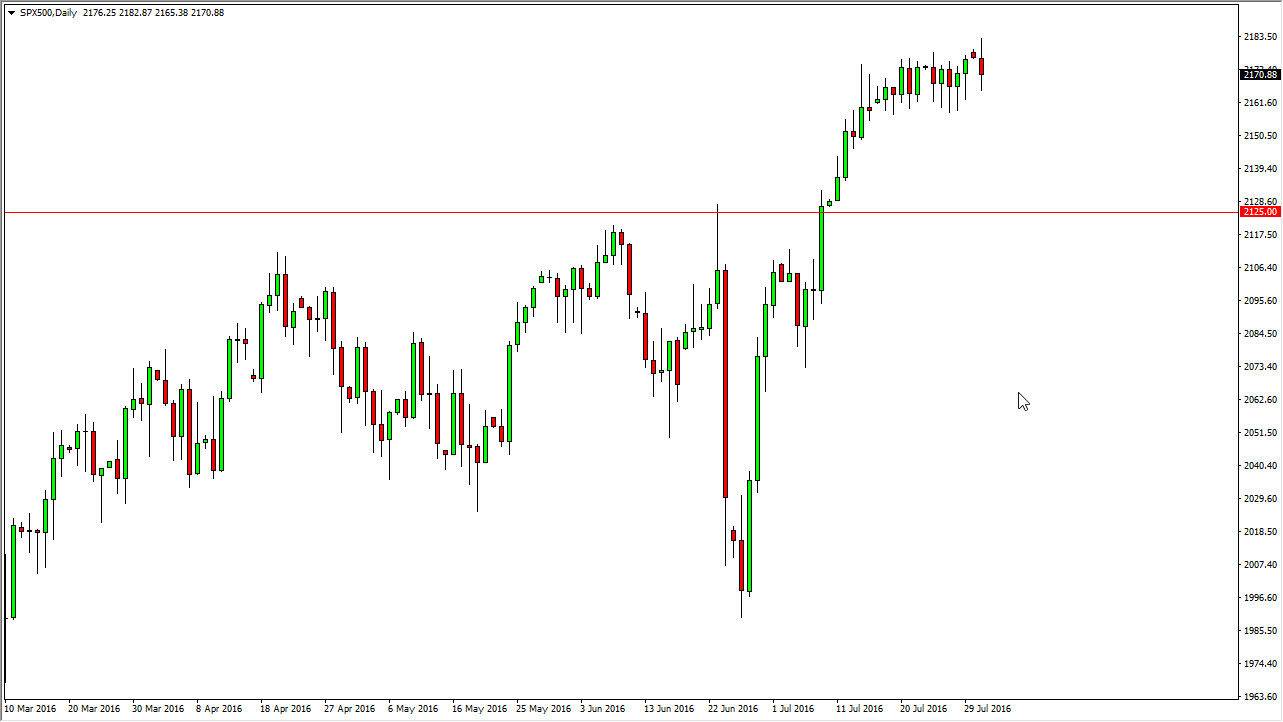

S&P 500

The S&P 500 went back and forth during the course of the session, as we are going to continue to see quite a bit of back and forth type of trading. The market has been trying to grind its way through the upside, but as you can see the 2160 level has been supportive over the last several sessions. With this, I believe that the market should continue to go higher but we of course are going to have to try to pick up enough bullish pressure in order to go higher. We need more buyers, and quite honestly, it’s common for markets to consolidate right before continuation. We’ve seen a nice bullish move to the upside, and as a result it’s likely that the markets will eventually continue that move so I am bullish.

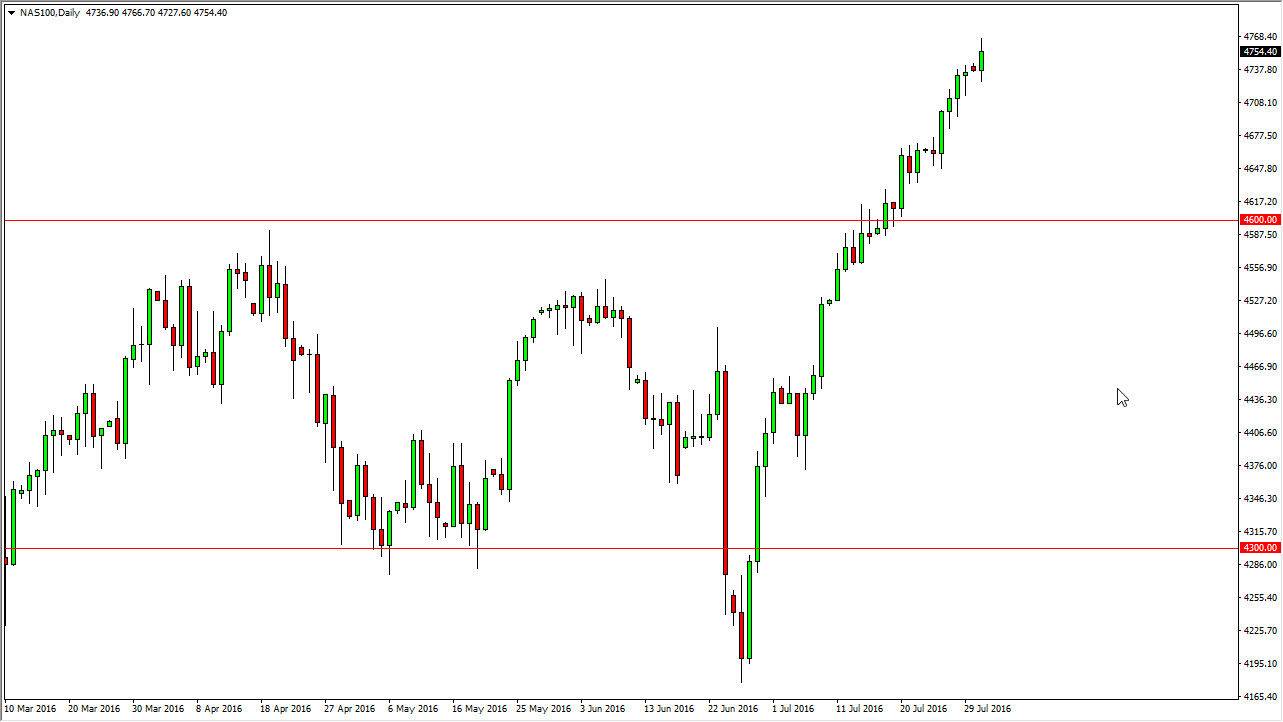

NASDAQ 100

The NASDAQ 100 rose during the course of the session on Monday, but initially found a bit of negative pressure. That being the case, I believe that we are going to continue to go to the upside and I have no interest in selling. However, there is a bit of concern because we are overextended, so I would like to see some type of pullback it would offer “value” in this market that is obviously bullish. With this, I am actually waiting for those pullbacks in order to get involved and on the sidelines. I have no interest in selling, and would completely ignore selling signals at this point in time.

Ultimately, I believe that this market is going to continue to reach towards the 5000 level, but it is going to take a certain amount of time to get there, so I believe that every time we pullback that is when you should be looking to go long. I don’t have any interest in selling until we get well below the 4500 level, which is unlikely to get broken to the downside.