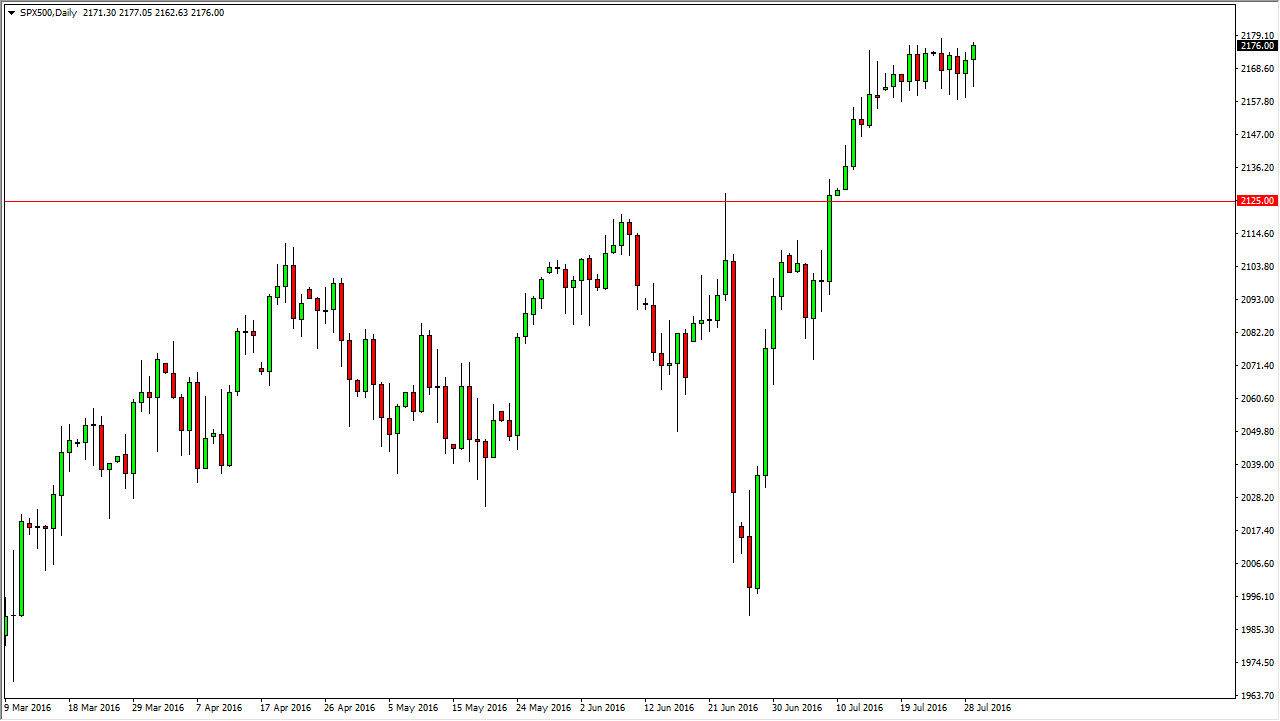

S&P 500

The S&P 500 initially fell during the day on Friday, but just as we have seen all week, market turned right back around and gained enough to form a nice-looking hammer. Anytime you get five hammers in a row, you should be paying attention. With this, I believe that it’s only a matter of time before we break out and a move above the 2180 level is the sign that it has happened to. At that point in time, I would not hesitate to get involved in this market to the upside, and also believe that short-term pullbacks should continue to offer buying opportunities. Because of this, I am very bullish of the S&P 500 and have no interest whatsoever in selling this market because I believe that even if we break down below here, we have a massive amount of support at the 2125 level.

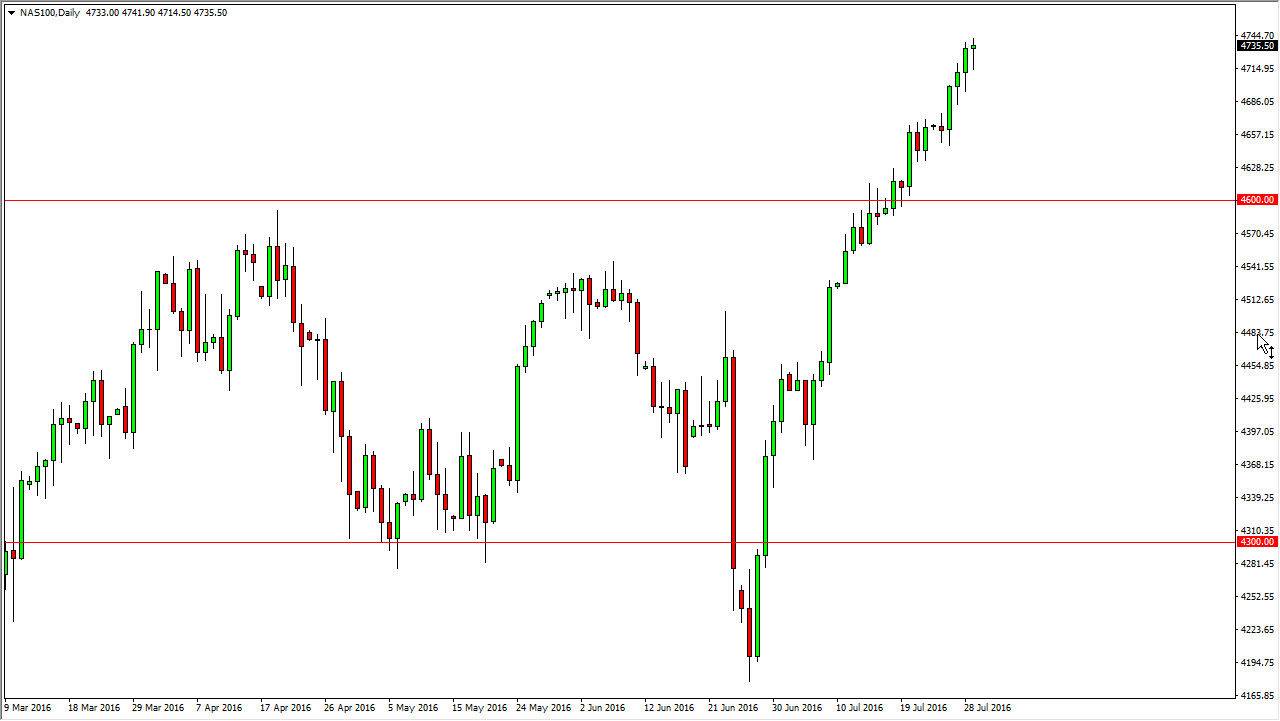

NASDAQ 100

The NASDAQ 100 initially fell during the course of the day on Friday as well, but just like we did in the S&P 500, the NASDAQ 100 rallied enough to form a nice-looking hammer. That hammer of course is a bullish sign but we are bit overextended in this market in my estimation. Because of this, I am not as interested in going long of the NASDAQ 100 as I am the S&P 500 at the moment, but I do believe that the both will eventually reach the higher levels. I believe that there is a floor in this market somewhere closer to the 4600 level, and most certainly the 4500 level, as psychological support would be expected there. Ultimately, I believe that this market reaches towards the 5000 level, but that obviously a long-term call. In the meantime, I believe that anytime this market pulls back you have to be looking at it as potential value. That being the case, I have no interest in selling, and I believe that eventually the buyers will return the matter what happens.