By: DailyForex.com

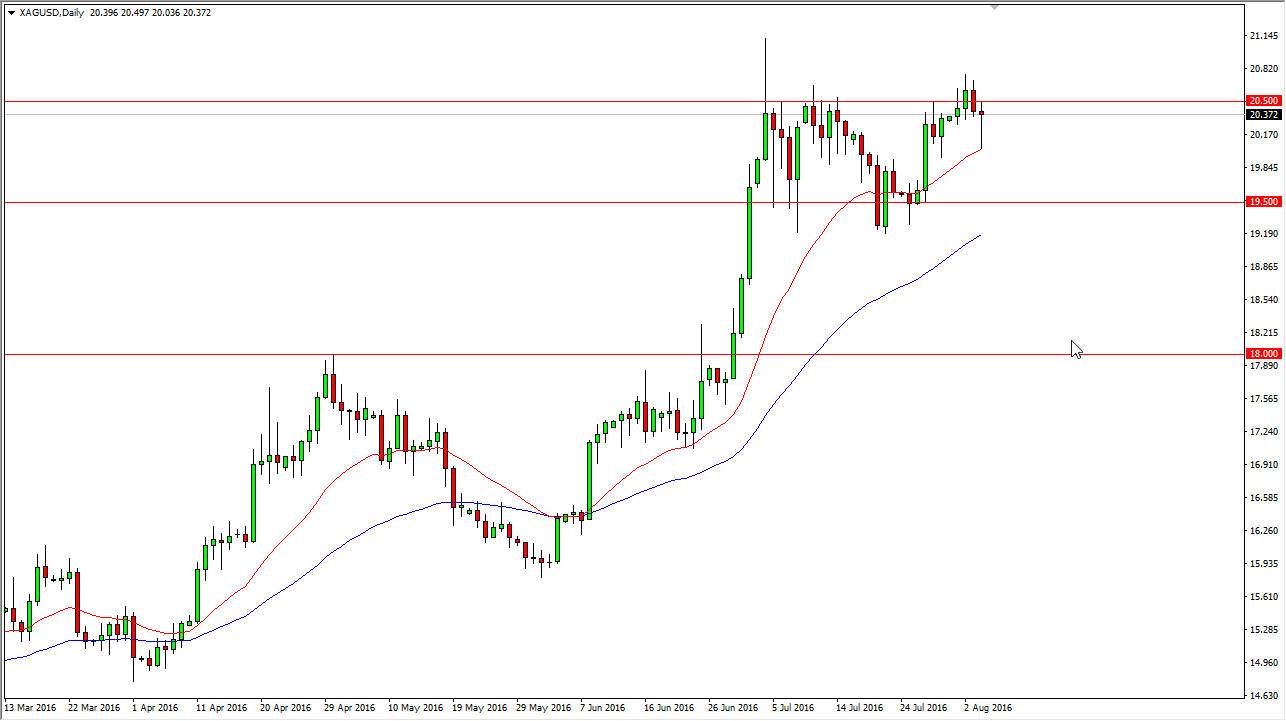

Silver markets initially fell during the course of the day on Thursday, finding support near the $20 level. What I find interesting is that we also have the 20-day exponential moving average right there as well, pictured and rent on the accompanying chart, and we stopped range there. The fact that we bounced and formed a hammer is also a very bullish sign, and I believe that we are winding up in order to finally break above the $20.50 handle.

With that being said, I believe that the market is going to grind its way to the upside given enough time, but I recognize that there is a significant amount of noise near the $21 handle. Once we break above there, silver becomes more of a buy-and-hold type of situation.

Pullbacks

I will pullbacks and silver, and have been buying physical silver every time we do it. I think that there is a massive amount of support near the $19.50 level, so even if we drop from here it’s likely that we will find buyers. Beyond that I believe that the market will continue to go higher based upon a lot of different things, not the least of which are currency concerns around the world. We are in a low interest rate environment, so of course currencies in general look very soft so it makes sense that people would want “hard money.”

Silver is highly undersupplied anyway, so under the best of circumstances there is going to be steady demand. Under normal circumstances demand is through the roof so I believe that it’s only a matter of time before the buyers enter any time we pullback. It might be volatile, and with the Nonfarm Payroll Numbers coming out today make a lot of noise with the US dollar, it’s likely that we will see volatility but we should continue to see bullish pressure.