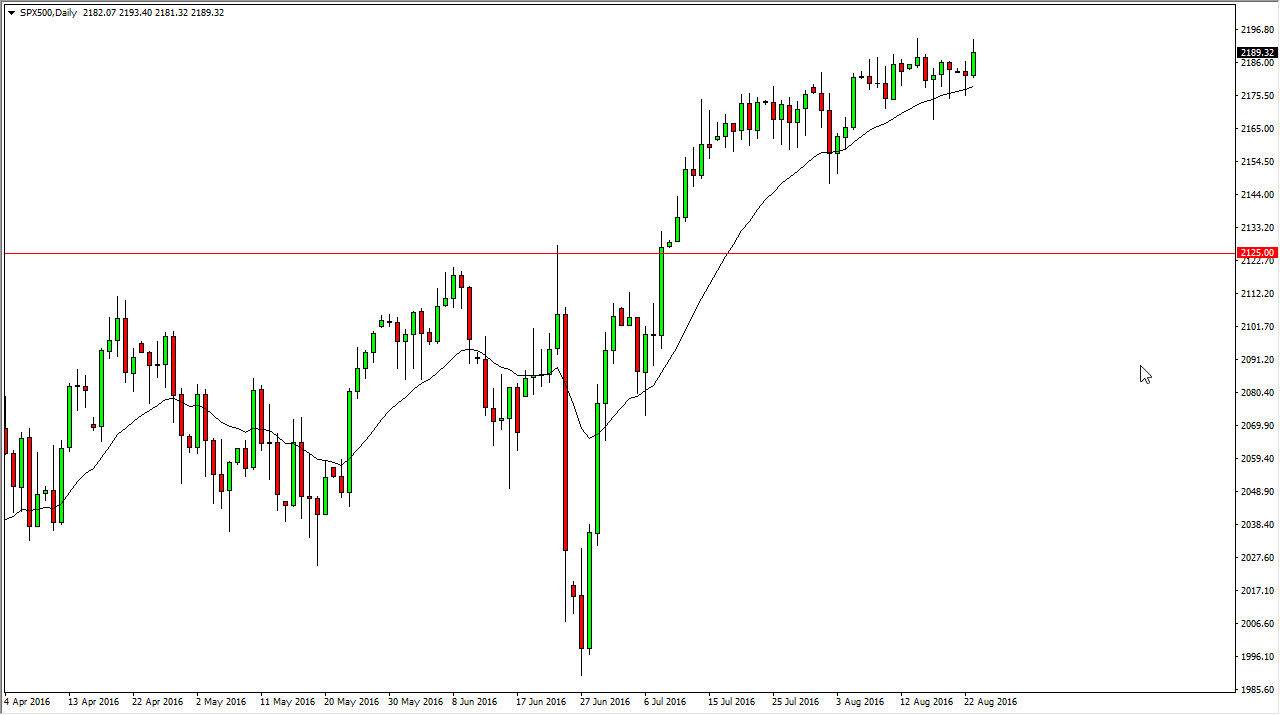

S&P 500

The S&P 500 rallied during the day on Tuesday, as we continue to see strength in this market. The market is trying to grind its way to the upside, and given enough time I think that we will probably reach towards the 2250 handle. It might take a while to get there, but I believe that every time we pullback you have to start thinking about value in a market that continues to see people jumping in every time we sell off. Would be extraordinarily low interest-rate environment, it makes sense that the continuation of the uptrend is what we see. Once we get the volumes back in the market after the holiday season, I expect that we will accelerate to the upside. I have no interest whatsoever in selling this market.

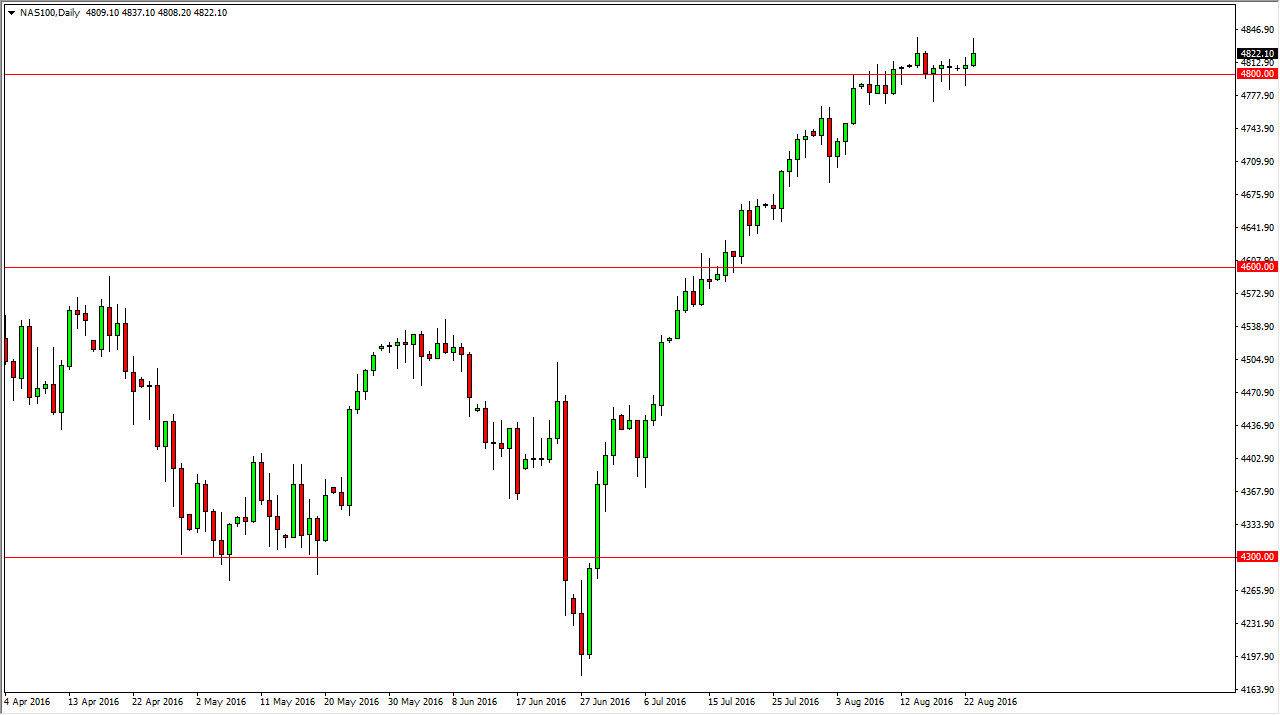

NASDAQ 100

The NASDAQ 100 as you can see rally during the day initially on Tuesday, but gave back about half of the gains. With this being the case, the market should continue to be positive overall, but it won’t necessarily be a straight shot higher. I believe the 4800 level below is supportive, and I believe that we will eventually reach towards the 5000 level. Given enough time, every pullback should offer a buying opportunity, as there is more than enough reason to think that the NASDAQ 100 will follow the rest of the American indices.

The 4700 level below is also supportive, and most certainly the 4600 level is. In other words, I see far too many reasons for this market to bounce going forward, so having said that I have no interest in selling this market and I do believe that the market will pick up volume and more importantly momentum after the summer holiday season is over, which should be in just a couple of weeks. I believe that the smart money is already getting involved.