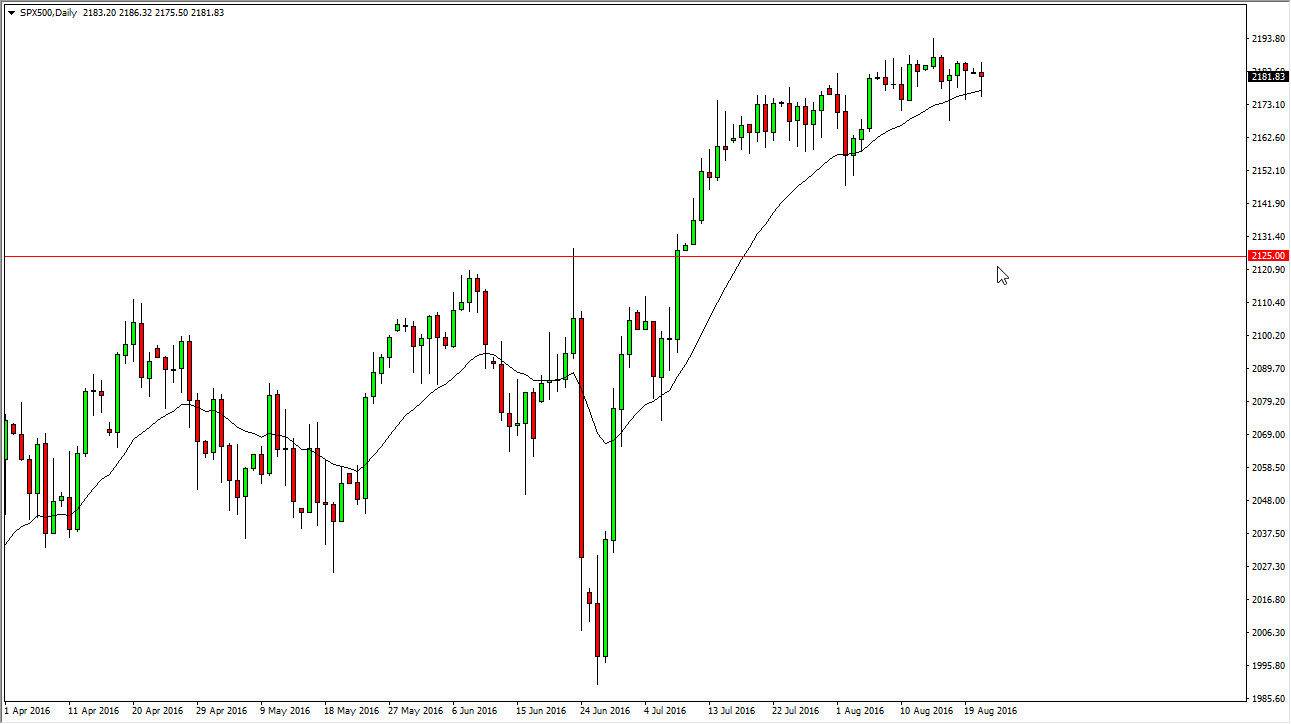

S&P 500

The S&P 500 initially dropped during the course of the day on Monday, but as you can see we turned right back around to form a bit of a hammer. The 20-day exponential moving average is just below, and it has offer dynamic support for some time. Because of this, I believe that the market should reach towards the 2250 handle, and as a result I believe that the markets will eventually go higher but I think at this point in time it is holiday season so therefore we may struggle to find enough momentum to continue going higher in the short-term, but I certainly think that given enough time the buyers will overwhelm this particular stock index.

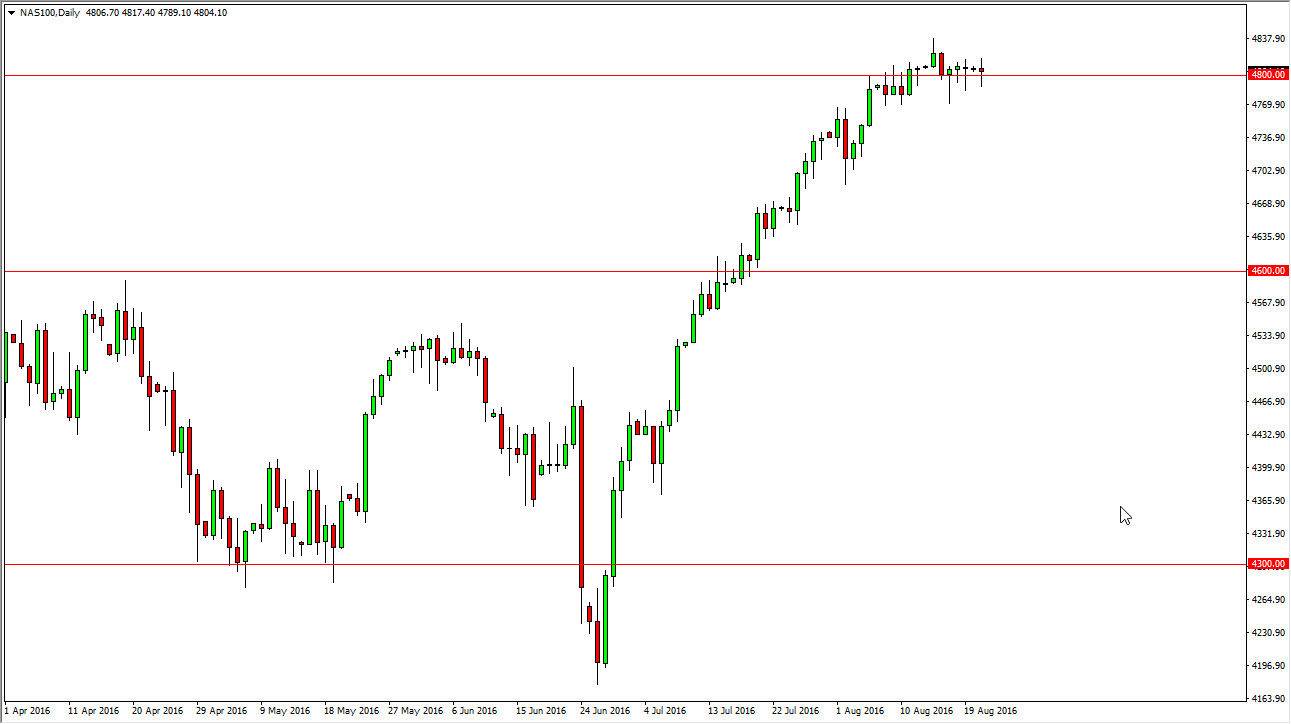

NASDAQ 100

The NASDAQ 100 is acting very much the same as the S&P 500 but I also recognize that the 4800 level is not only supportive, but is probably more important than the 20-day exponential moving average that we see in the other market. As we continue to form a hammer after hammer, I believe that it is only a matter of time before the support the forces the buyers to get aggressive. I think that we will then reach towards the 5000 level above, which of course is a large, round, psychologically significant number.

At this point though, with the lack of volatility I believe that every time this market pulls back, you have to look at it as a potential buying opportunity. Perhaps you can also think of it as value, and therefore we are more than likely going to continue to see bullish pressure going forward. Even if we did break down, I think that the 4700 level below should very well be supportive as well. At this point, I have absolutely no interest whatsoever in selling this market, as all US indices look very healthy.