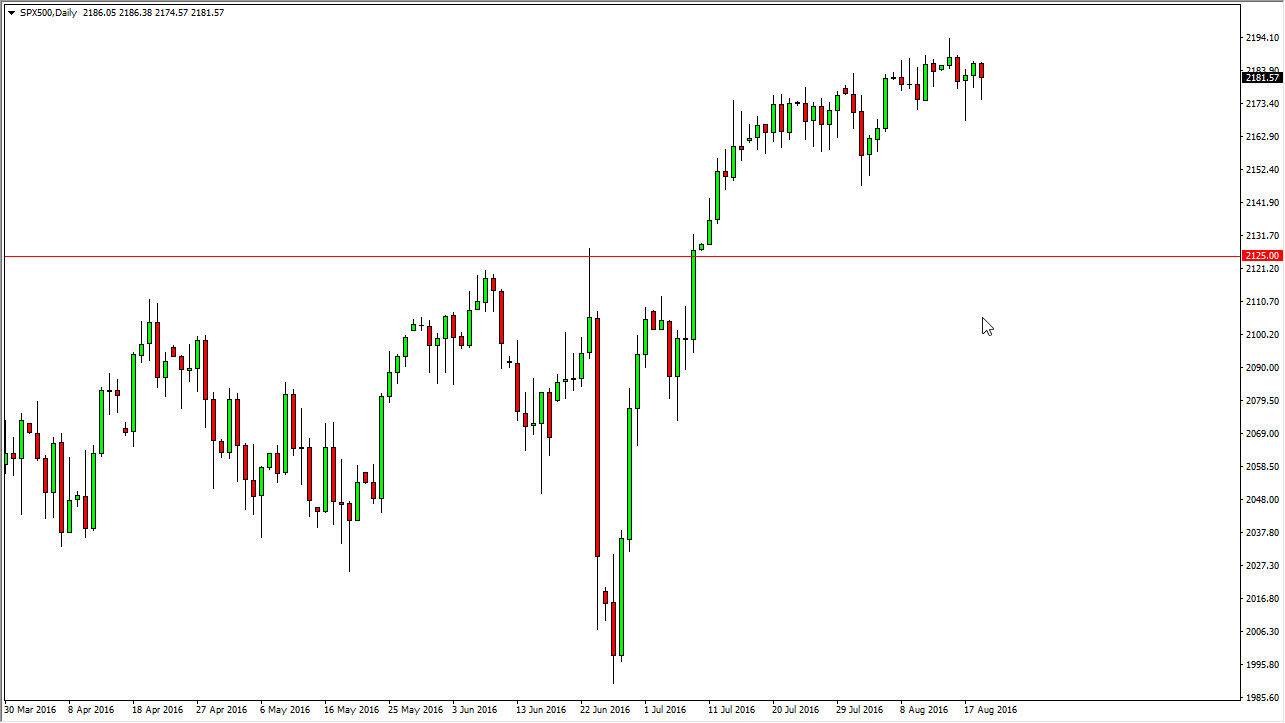

S&P 500

The S&P 500 initially fell during the day on Friday, but just as we have seen time and time again, the buyers returned to turn the market around and form a somewhat supportive looking candle. I believe that this market will grind its way higher given enough time, but we are in the least liquid time of the year as most traders are away at holiday. I believe that pullbacks should continue to offer buying opportunities, and then send this market looking for my target at the 2250 handle. I have no interest in selling, I believe that the low interest-rate environment that we are currently stuck in will continue to provide a bit of a lift for equity markets. Because of this it’s almost the “de facto” position of traders to be long of stocks.

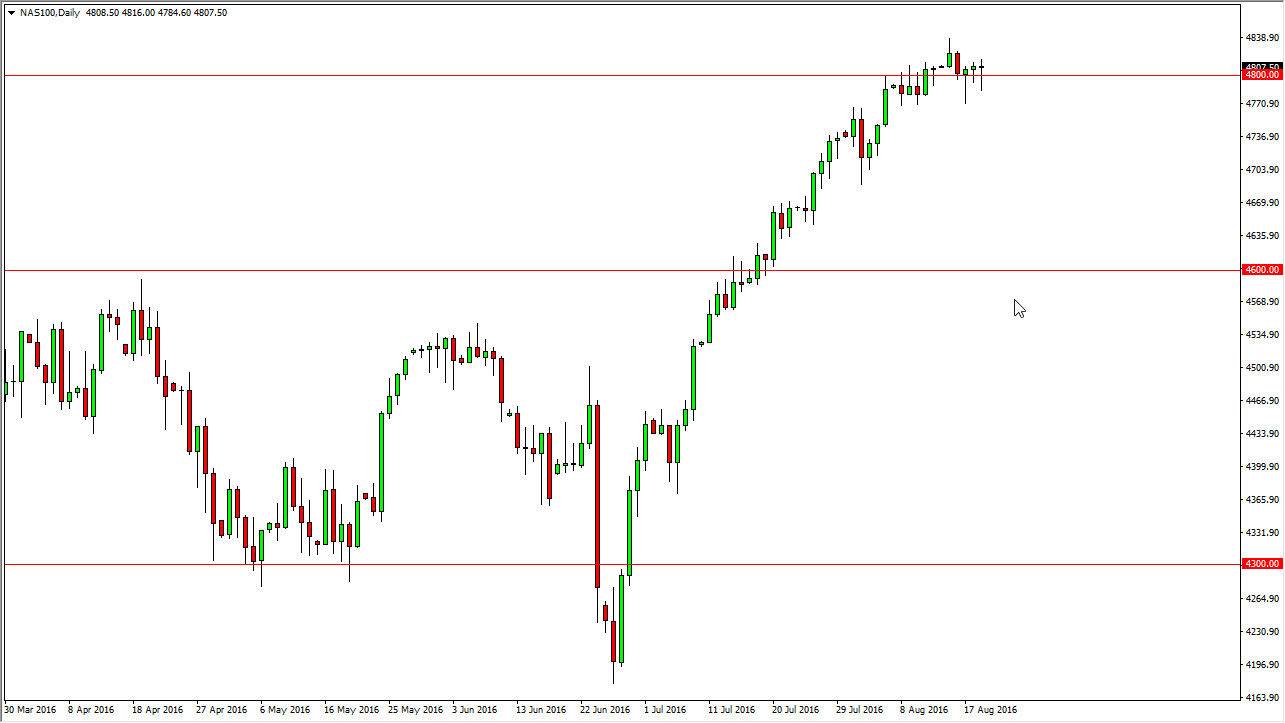

NASDAQ 100

The NASDAQ 100 initially broke down as well, but turned around to form a hammer. The 4800 level offered enough support to turn things around and show opportunities to go long. A break above the top the hammer should send this market looking towards the longer-term target of 5000 that I have had for some time, and with this being the case I’m a buyer again and again. I believe that the sellers will continue to be bashed given enough time, and even if we broke down below here, I think there are plenty of areas that offers support in the form of 4700, and most certainly 4600. The US markets are doing better than most of the other European markets, and I think that will continue to be the case going forward because not only do have low interest rates in America, but you also have the stability of one of the few somewhat stable economies in the world, the economy of the United States behind the stock market itself.