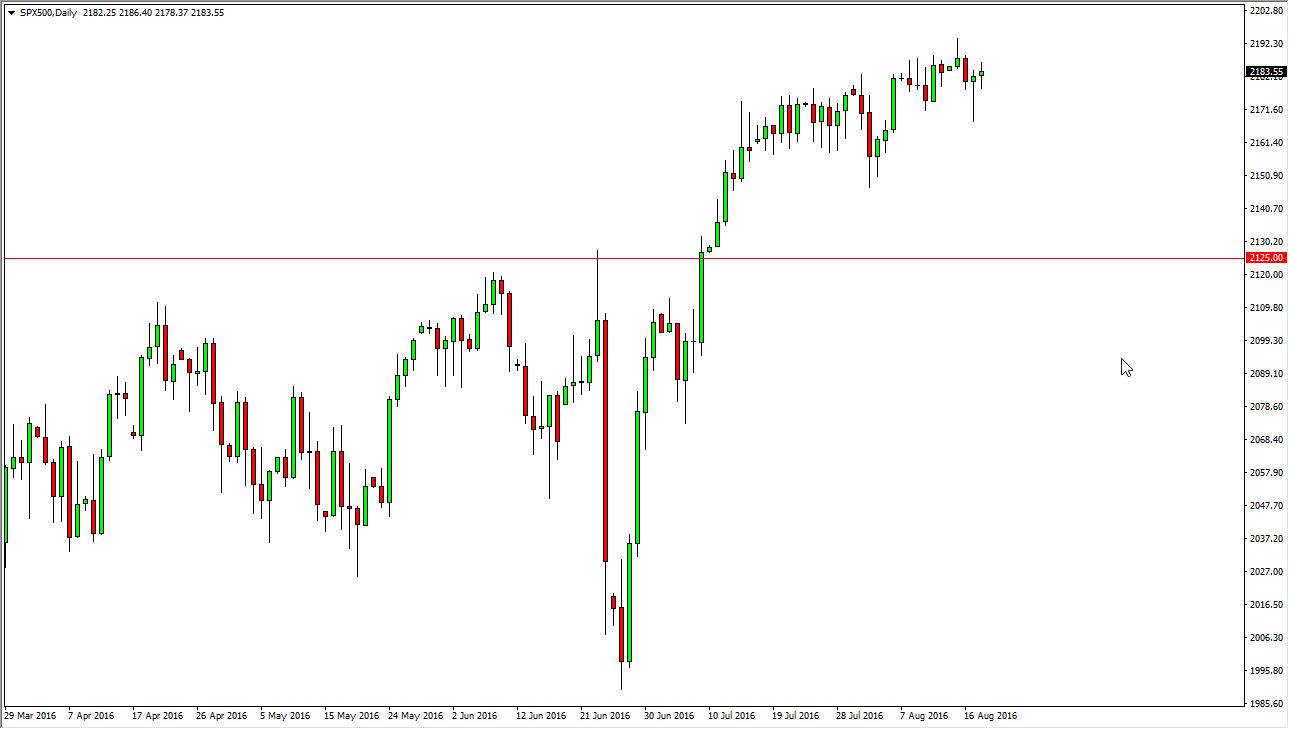

S&P 500

The S&P 500 fell initially during the course of the day on Thursday, but turned right back around to form a bit of a hammer for the session on Thursday. The Wednesday session formed a massive hammer as well, so having said that it looks as if the market is ready to go higher over the longer term. This makes sense, because the interest-rate environment in the United States is very poor, and that of course will more than likely facilitate people going into stocks overall anyway. There has been a significant move higher recently, and all the noise just below should continue to be very supportive.

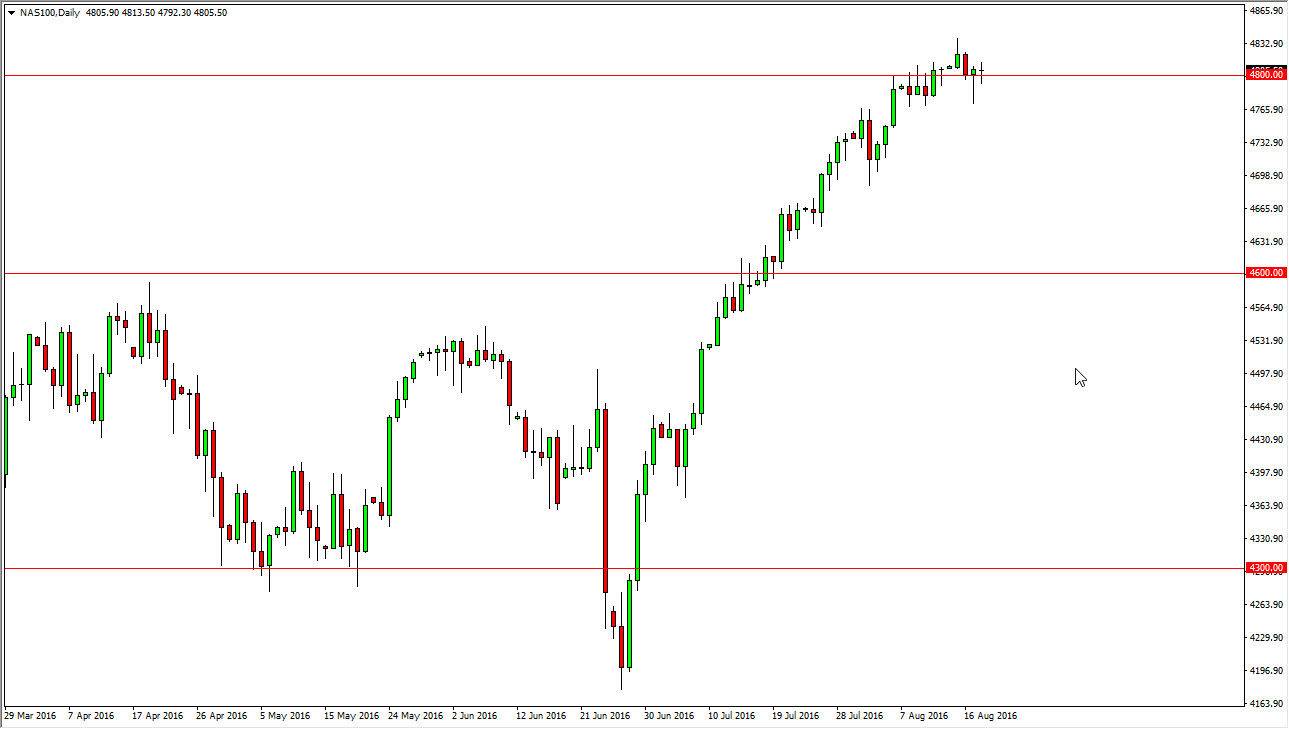

NASDAQ 100

In the NASDAQ 100, we fell again and ended up forming a hammer just as we did in the S&P 500. Just as we did on Wednesday, we have a hammer in this market as well. What I find particularly interesting in this particular market is that the 4800 level is offering support and it is a large, round, psychologically significant number. That of course means that we should have plenty of support just below. Not only do we have order flow in various areas below, but we also have the 4800 level which has been significant resistance in the past.

With low interest rates being the norm now, it makes sense that S&P 500 and NASDAQ 100 traders continue to go long, simply because there is no way to make any money off the bond market as far as interest rates are concerned. Ultimately, I believe that there is a bit of a safety trade involved as well, because quite frankly the US markets are going to be a lot safer than the European Union, Asia, and of course the United Kingdom. With this, I think long only is the thing you should be paying attention to the most, and pullbacks should of course offer value in a market that is obviously well liked.