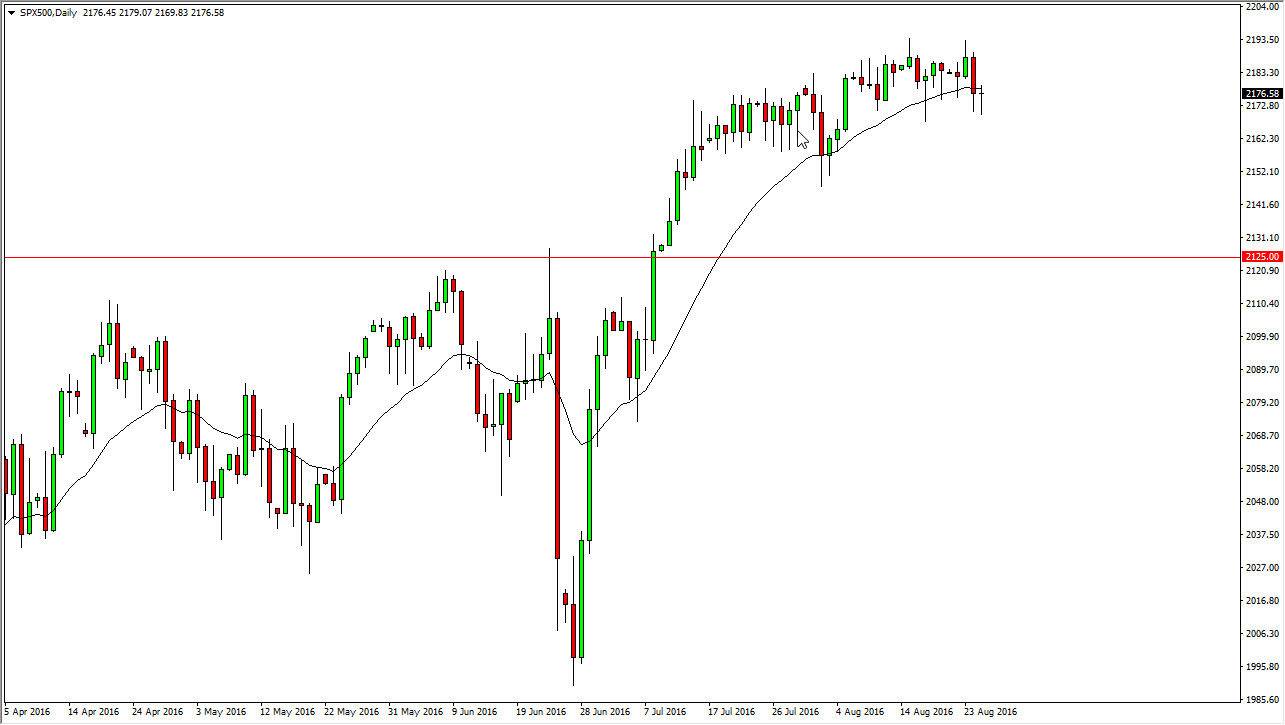

S&P 500

The S&P 500 initially fell during the day on Thursday, but found support yet again as we bounced and formed a bit of a hammer. This shows just how resilient the market is and as a result I believe that it’s only a matter of time before we rally and continue to go higher. Because of this, I am a buyer above the top of the top of the candle, but I recognize that there is a significant amount of resistance above as well. Because of this, I think it is a short-term buying opportunity only, and that makes quite a bit of sense considering that the summertime trading has very little in the way of volume. I think we simply continue to consolidate overall with an upward bias at this point in time.

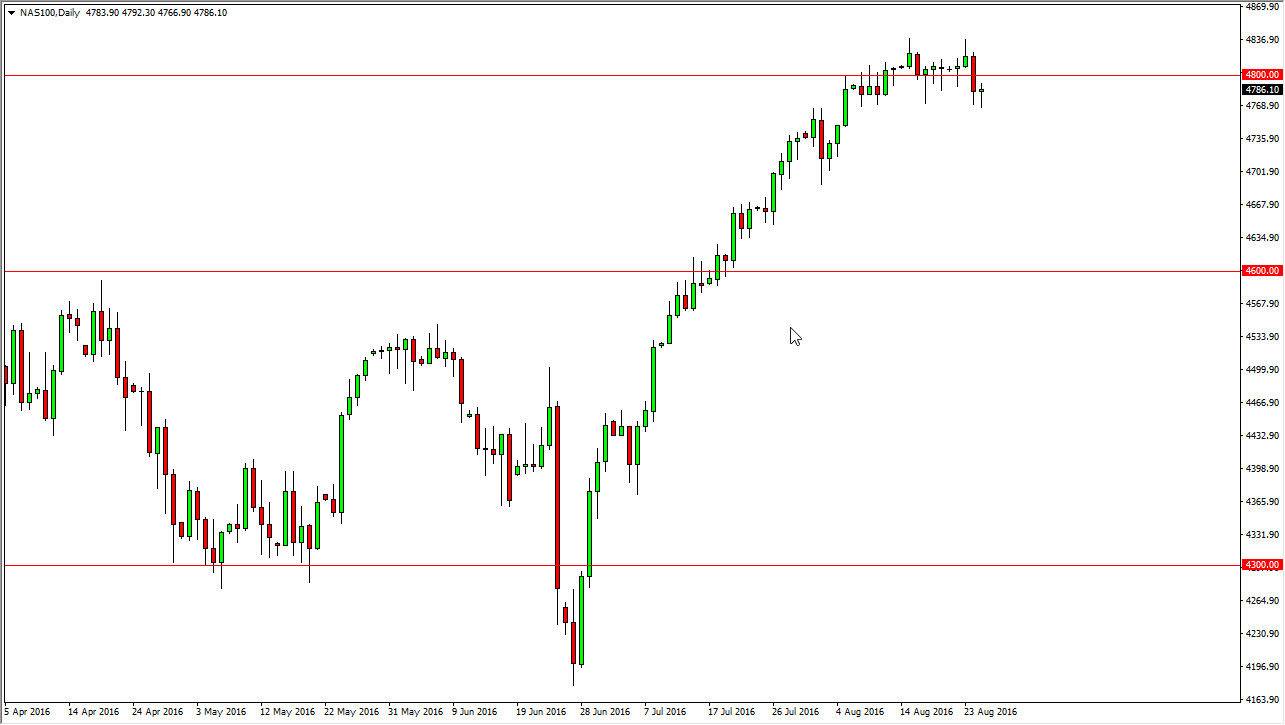

NASDAQ 100

The NASDAQ 100 did very much same thing during the day, initially falling the turning around to form a positive hammer. Because of this, looks like we’re going to continue to consolidate around the 4800 level, which could send this market sideways for the next couple of weeks. I think that there’s plenty of buying to be done underneath, and as a result I think every time we drop you have to be thinking about picking up a small value play for short-term gains. I think once the volume returns the markets though, we will reach towards 5000 which is my intermediate target.

With this, I have no interest in selling, and recognize that even if we break down from here there should be plenty of support near the 4700 level, and with that I simply look at it as offering even more value in an index that has been a great performer as over the last several months. I believe that we will not only reach 5000, but we will probably break above there towards the beginning of next year.