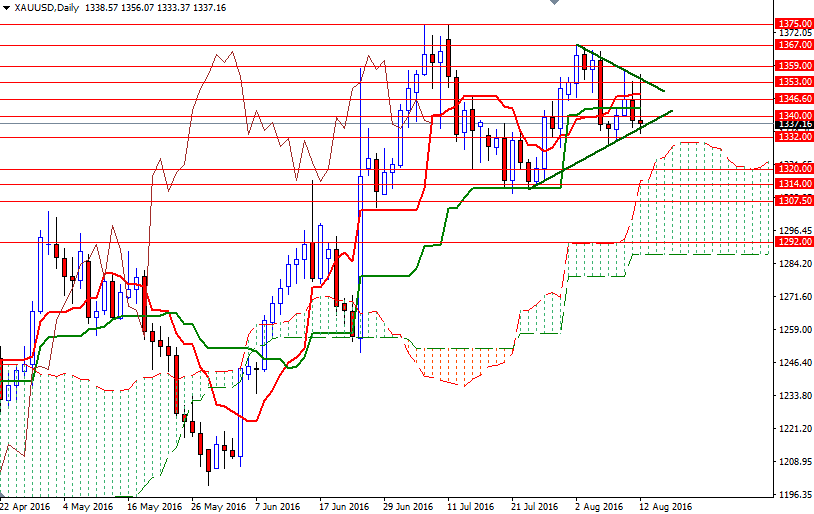

The precious metal ended the week virtually flat, settling at $1337.19 an ounce, as the impressive run in major equity markets around the globe eroded demand for the precious metal. The XAU/USD pair tried to break through the resistance at around the $1353 level three times but failed on each occasion. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 286447 contracts, from 294183 a week earlier.

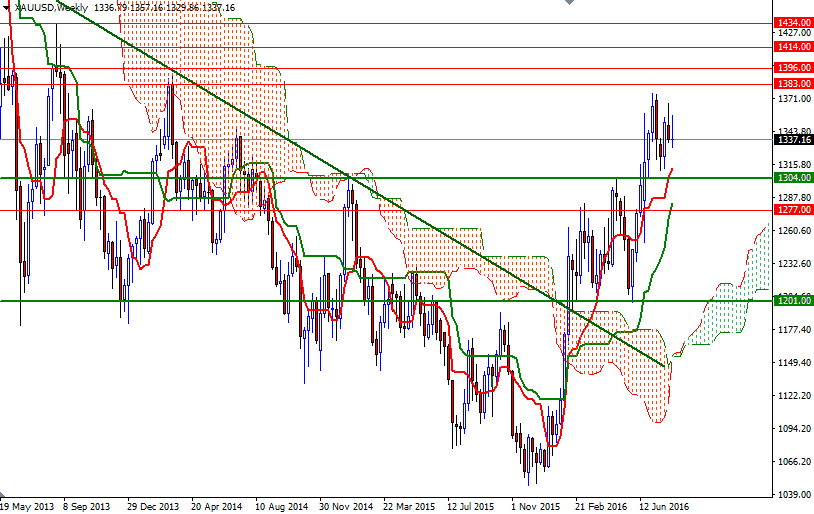

Gold is currently lacking a clear driver and as a result investors continue to seek better opportunities, especially in stocks. However, the perception that global monetary easing worldwide is going to continue persist for some more time limits the downside pressure. I still think that gold should stay rather range-bound at these higher levels, a case that I highlighted back in July.

In the short term, we can see some pressure towards 1300 if we break below the ascending trend line (the lower line of the triangle shown on the daily chart) and prices fail to hold above the 1332/0 area. In that case, I think the bears will have a change to challenge the 1326 and 1320 levels. Closing below 1320 on a daily basis would imply that the 1314/2 zone will be the next stop. This is the key support that the bears have to capture so that they can force XAU/USD to retreat to the 1307.50-1304 region. On the other hand, if the aforementioned support just below remains intact, a push up towards 1342/0 seems reasonable. In order to extend gains and test the 1348-1346.60 region, the bulls will have to push through 1342. The area between the 1353 and 1359 levels has been resistive in the past so it will play an important role going forward. A daily close beyond 1359 would be a bullish sign, suggesting a move up to 1367.