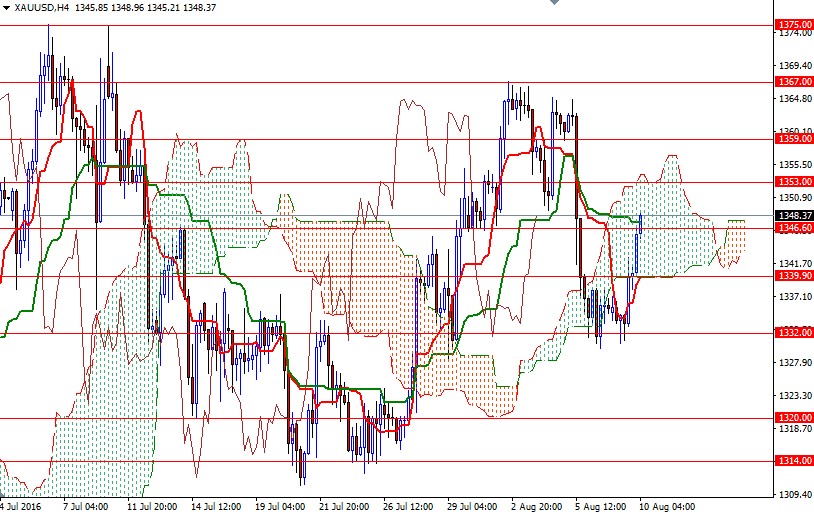

Gold prices ended Tuesday's session up $5.44, as a softer dollar bolstered demand for the precious metal. The XAU/USD pair turned higher after making a short-term double bottom in the $1332/0 area and consequently closed above the $1339.90 level which I had identified as a key for a push up towards the $1348-1346.60 area. In early Asian session, the market reached this area as anticipated.

Climbing above the 1348-1346.60 zone altered the short-term technical picture. The short-term charts are bullish at the moment, with the market trading above the Ichimoku clouds on the M30 and H1 time frames, plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. All these suggest that a retest of 1354.50,1353 likely. However, the market is still within the borders of the 4-hourly cloud so therefore the outcome of the test of this barrier is probably going to confirm what will happen next. Penetrating this barrier would suggest an extension towards the 1359 level. Once beyond that, I think the 1367/4 area will be the next stop.

On the other hand, if the bulls fail to break through, then the market will have a tendency to return to the bottom of the cloud (H4 chart), sitting at 1339.90. The bears have to eliminate this support in order to increase the downward pressure and march towards 1332/0. Breaking down below 1330 could increase speculative selling and drag the market towards the 1326 level. If this support is broken, the market will be aiming for 1320.