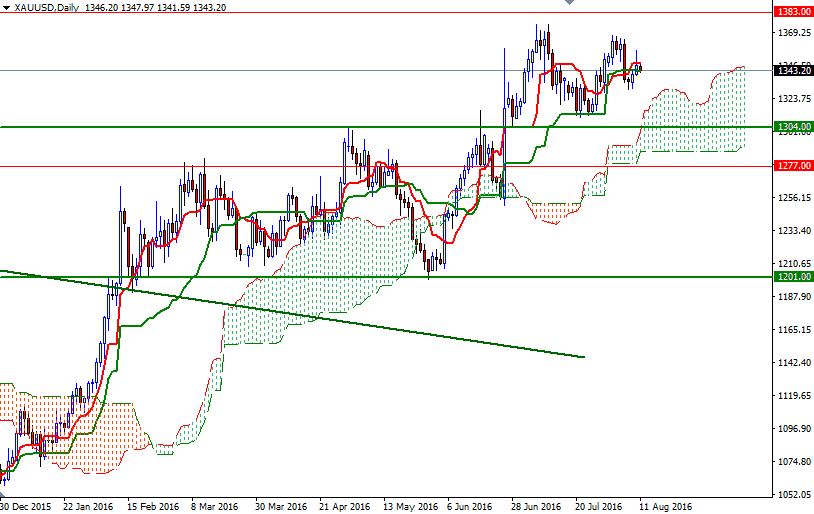

Gold prices advanced on Wednesday as the dollar weakened and a pullback in equity markets lent some support to the precious metal. The XAU/USD pair traded as high as $1357.16 an ounce but failed to hold above the $1354.50-1353 area. As a result, prices fell back below the $1348-1346.60 support, leaving a tall upper shadow on the daily candle. This shadow suggest that higher prices are rejected at the moment - the market's inability to climb above $1348-1346.60 during the Asian session also supports this theory.

However, also note that trading within the boundaries of the Ichimoku cloud on the H4 chart suggests that XAU/USD will be range bound over the short-term. Flat Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the daily time frame indicate lack of a strong momentum. It appears that the market is going to test the anticipated support zone that stretches from 1339.90 to 1337.

If this support is broken, we will probably see a fall back to the 1332/0 region which caused prices to reverse earlier in the week. The bears will have to drag prices below 1330 so that they can force the market to retest the 1326 and 1320 levels. A break below 1320 could put us back on track with such a scenario eying subsequent targets at 1314 and 1307.-1304. The first hurdle gold needs to jump is located in the 1348-1346.60 area. If this barrier is eliminated, we could see a push up towards the 1354.50-1353 region. A daily close above the 1359 make me think that the bulls are ready to march towards the 1367/4 area.