Gold edged higher on Monday as the dollar pared its recent gains on doubts the Federal Reserve would hike rates at its next meeting. Despite comments by Fed officials in recent days that suggested they leave the door open to a September interest rate hike, there is still a perception that it is unlikely the Fed will act before the U.S. presidential election in November. A hike later in the year remains a strong possibility (depending on the data flow in coming weeks, of course).

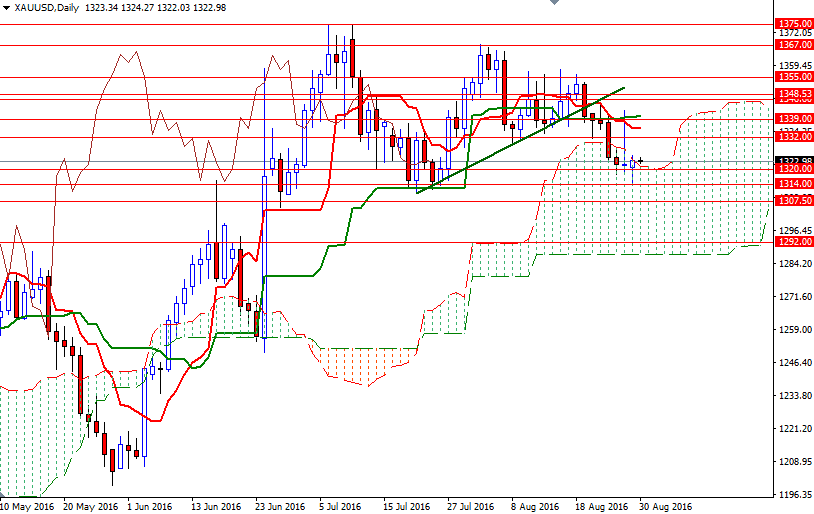

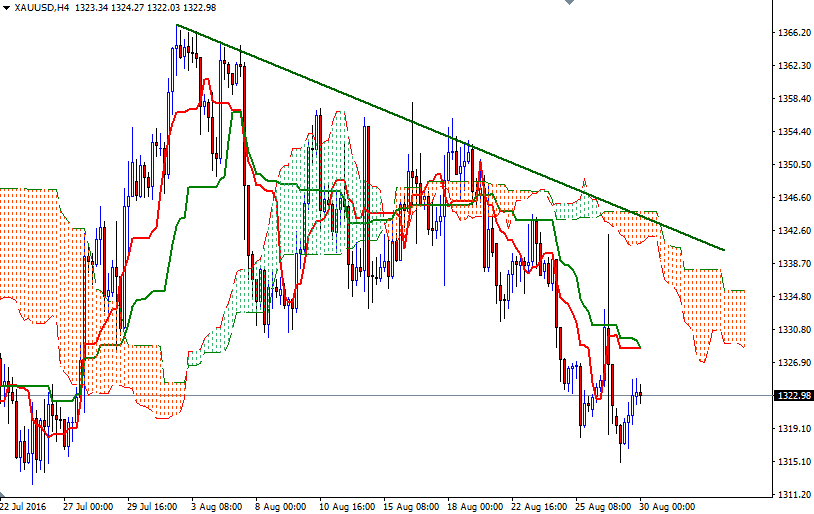

The week offers a big batch of news on the U.S. economy, headlined by the August non-farm payrolls report. Other highlights include consumer confidence, manufacturing PMI, factory orders and housing data. On the weekly chart, XAU/USD remains above the Ichimoku cloud, suggesting that prices have a tendency to rise over the medium-term. However, the market is trading below the 4-hourly cloud and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on both the daily and H4 charts. I think the area between 1314 and 1304 (a support that held the market up back in July, and now it is fortified by the daily cloud) will play an important role going forward.

If XAU/USD breaks up above 1327/6, then the market may have a chance to tackle the 1332 level. Beyond that, the 1340/39 zone stands out and the bulls will have to clear this strategic resistance so that they can test the 1348.53-1346.60 zone. To the downside, keep an eye on the 1320/19 region. If prices fall through, the bears will be aiming for 1314. A break down below 1314 implies that the market will proceed to the 1307.50-1304 support.