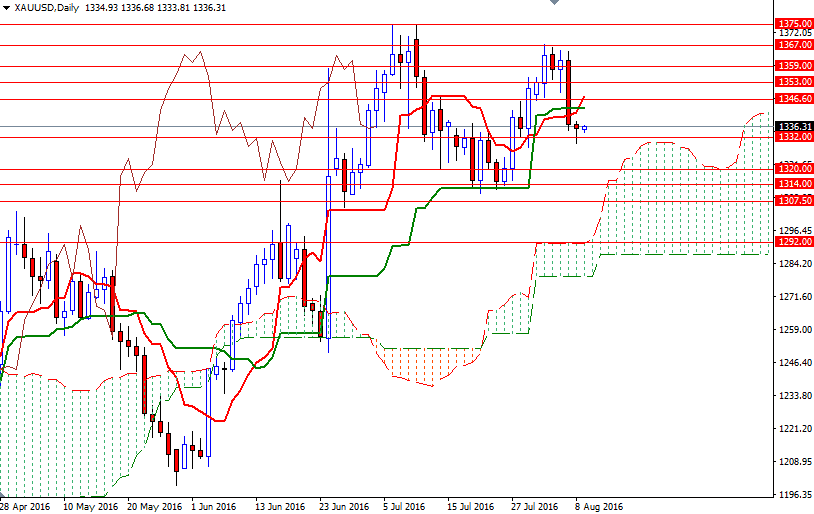

Gold prices fell for the second session in a row Monday, weighed down by robust U.S. employment figures released Friday. The XAU/USD pair tested the support at around 1332 before recovering slightly to 1235. Although accommodative monetary policies in major economies is expected to provide support for gold, the remarkable rally in equity markets around the globe leads investors to reduce their heavy long positions.

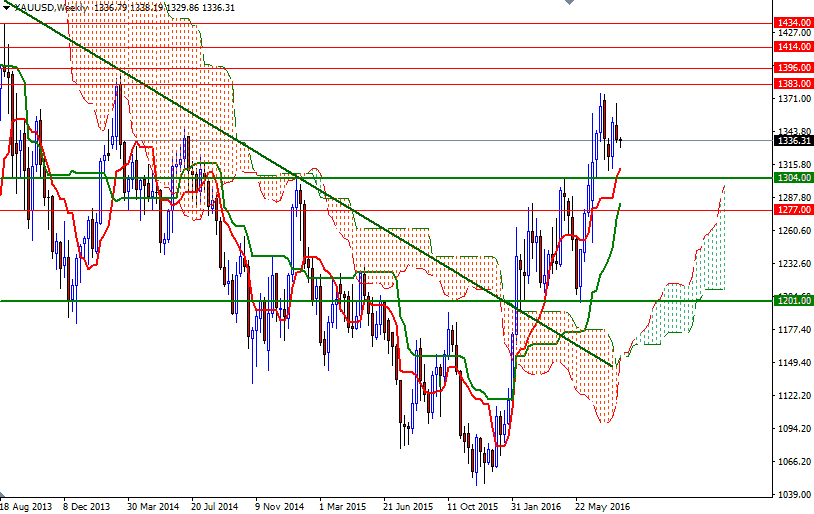

Trading above the Ichimoku clouds on the weekly and daily charts shows that the medium-term outlook still points to an upwards bias. However, the market pierced below the 4-hourly cloud and this suggests we could see further liquidations. In other words, as long as prices remain below the 4-hourly cloud, the risk of the break below 1332/0 remains high. If that is the case, look for further downside with 1326 and 1320 as targets. The bears will need to drag prices below 1320 so that they can make an assault on 1314.

To the upside, the initial resistance sits at around 1339.90 (the bottom of the cloud on the H4 chart), followed by 1348-1346.60. If the market breaks through 1348, the bulls will probably have another chance to tackle the 1354.50-1353 resistance. Closing beyond 1354 on a daily basis would shift my attention back to the long-side of the trade as it paves the way towards 1359.