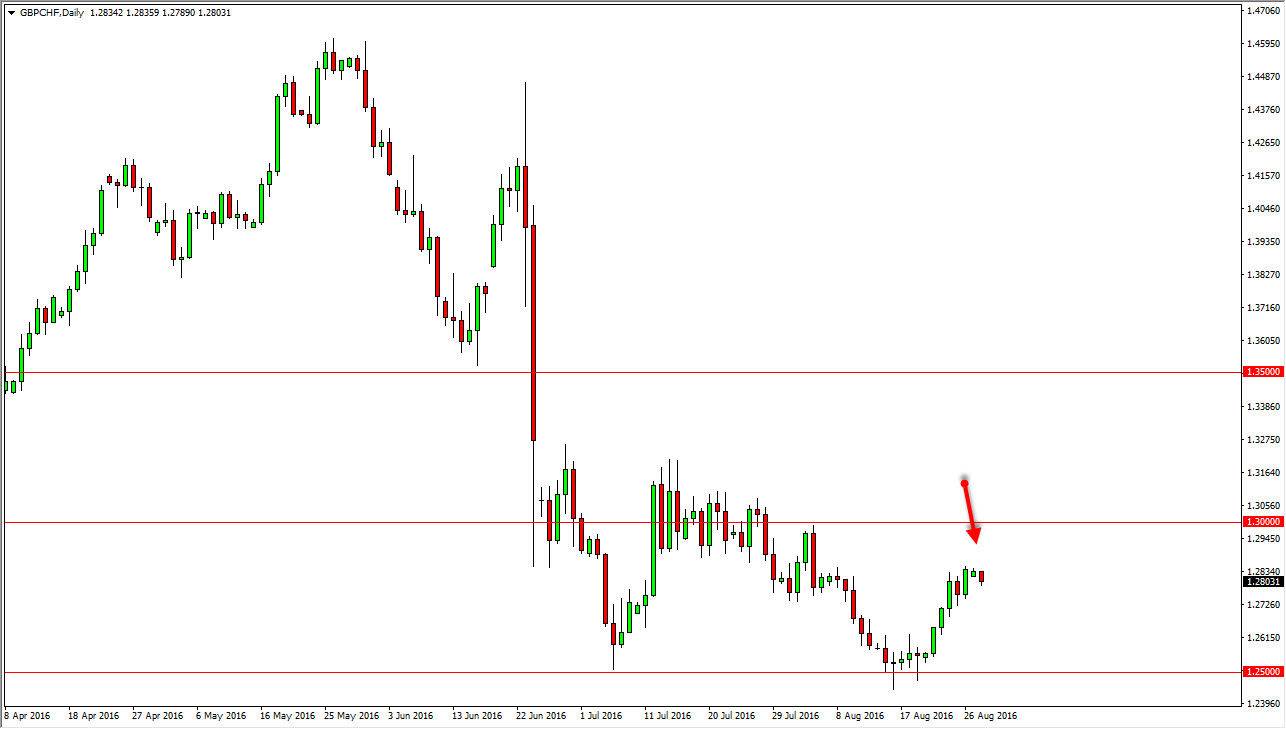

The British pound fell again during the course of the session on Monday overall, including the Swiss franc. I believe that this market is going to continue to go lower, and the fact that we are starting to roll over again is not much of a surprise. You can notice that the highs are gradually getting lower, and that of course is a very negative sign. With this being the case, it’s likely that we will try to reach back towards the 1.25 level below, as it is the “floor” in this market at this point in time.

Risk appetite

The GBP/CHF pair tends to be very influenced by risk appetite, and as a result you will have to pay attention to how the commodities markets as well as the indices around the world are behaving. In general, as they go up, so does this pair. This is because the Swiss franc is considered to be a “safety currency”, and as a result money flows into Switzerland in order to hide from risky asset. On the other hand, we have the British pound which of course continues to be plagued by the vote to leave in the European Union.

I continue to believe that short-term rallies will be selling opportunities, and I also recognize the 1.30 level above as the “ceiling” in this market. In other words, I’m waiting to see whether or not we can get some type of exhaustive candle to sell, or just simply an impulsive red candle to continue the downward momentum. In fact, I can make a real argument for a longer-term descending triangle at this point in time. With that being the case, I have no interest in buying and believe that once we do break below the 1.25 level, this is a market that can really start to pick up negative pressure.