The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 21st August 2016

Last week I predicted that the best trades for this week were likely to be short GBP against long USD and also long JPY. The results of these trades was an average loss of 0.62% thanks to the relatively strong performance by the British Pound.

The market is likely to continue to be bearish on the U.S. Dollar due to the poorer than expected consumer data released over recent weeks.

The British Pound is still relatively weak but has shown some signs of recovery.

As the dominant theme in the market is likely to be a weak USD, I forecast that the best trade for this week will be short USD/JPY and also probably short USD/CHF.

Fundamental Analysis & Market Sentiment

Fundamental analysis is likely to be of little use this week with the exception of any poor data boosting the bearish trend in the U.S. Dollar.

Gold and Silver seem to have run out of momentum, at least for the time being.

The Swiss Franc has strengthened at a greater pace than its sister currency, the Euro has, although it may have struck support as it approached 0.9500.

Technical Analysis

USDX

The U.S. Dollar has seen a significant change, making another downwards movement. The price is now below its levels of both 13 and 26 weeks ago, suggesting that that the currency is in a downwards trend again. However, the price is still within an area of relative congestion, leading to choppy action. A strong break down below support from 11800 to 11650 or so could see a stronger fall. It can be seen in the chart below how this currency has been topping out for many months following its very strong rise during 2013 and 2014.

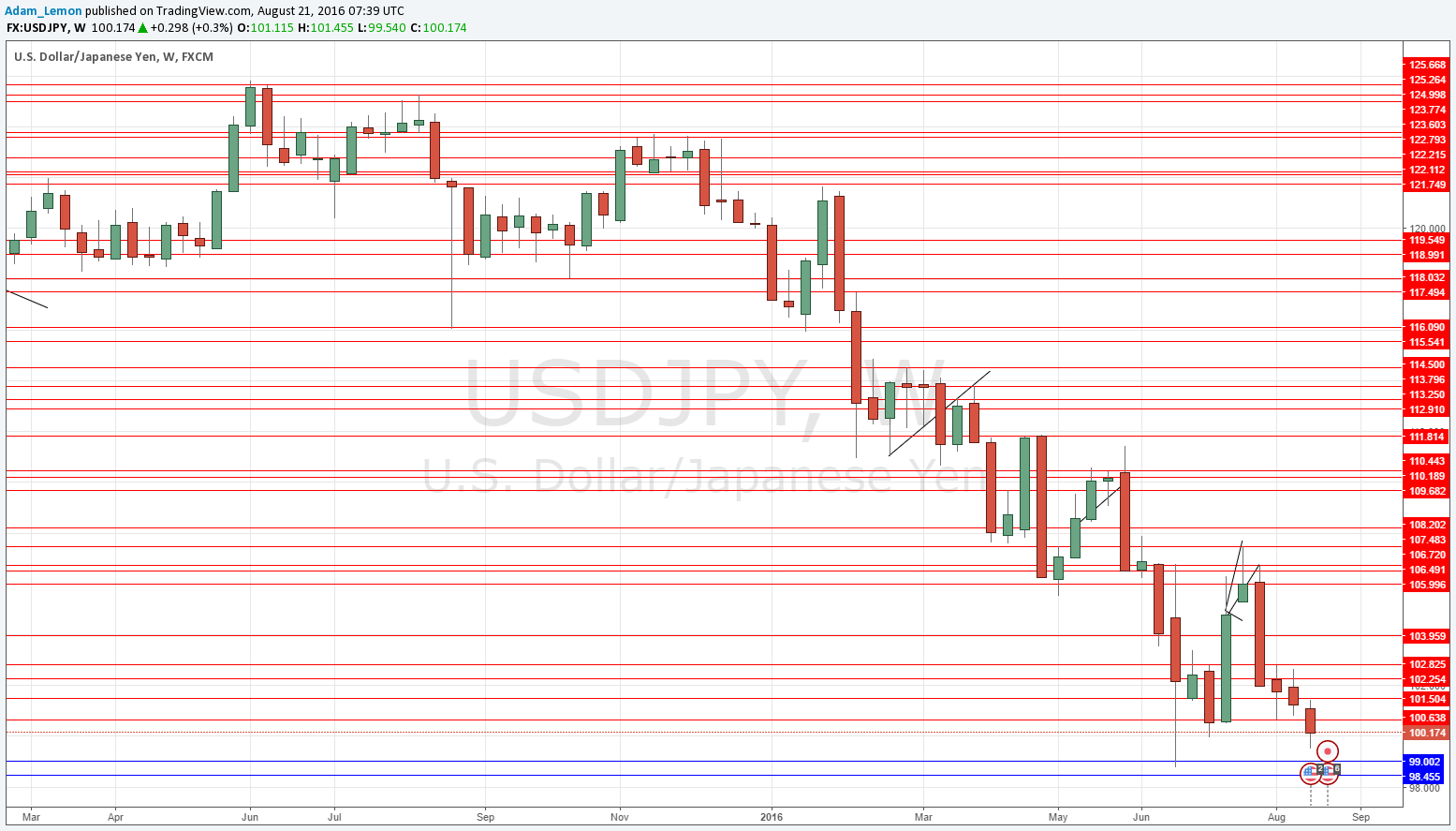

USD/JPY

The chart below shows that this pair fell again last week, printing a bearish candle with a weekly low that has been surpassed only by the low of a single week last June. There is some supportive buying below 100.00, but the chart does indicate a continuing downwards move is most probable.

USD/CHF

The chart below shows that this pair fell very strongly last week, printing a large bearish candle albeit with some wick on the supportive side. There is clearly strong selling pressure, and fairly respectable movements, but a key thing to note is how supportive this area around 0.9500 not far below the current price has been for about one year now. This means it would be prudent to watch out for sharp buying around this level. However, a strong break below0.9500 could see a sharp move down all the way to 0.9250 eventually.

Conclusion

Bearish on the USD, bullish on the JPY and CHF.