AUD/USD Signal Update

Yesterday’s signals were not triggered as the price action was off key at both of the key levels which were hit.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hours period.

Short Trades

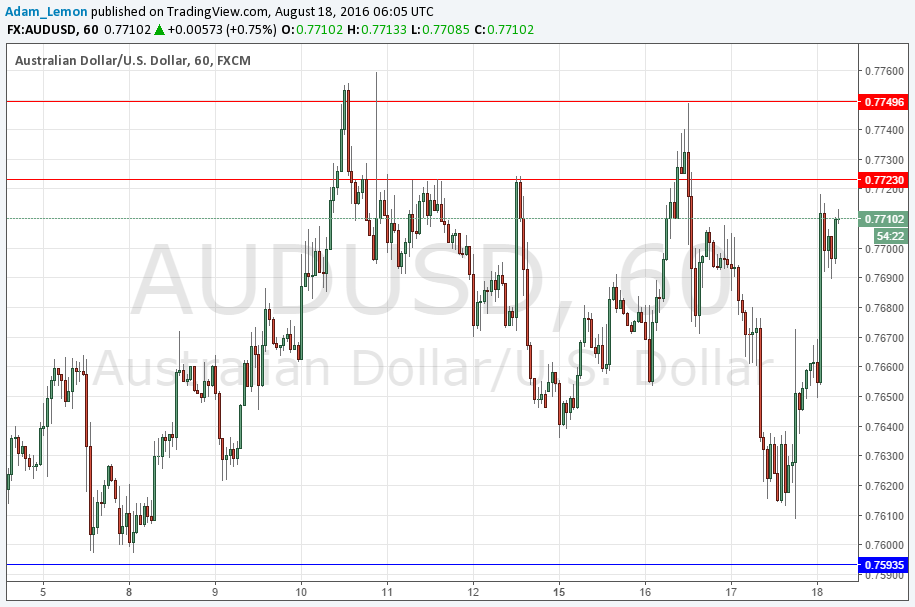

* Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7723 or 0.7750.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

* Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7594.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

I wrote yesterday that the price may well bottom out somewhere above the round number at 0.7600. This is what happened, although unfortunately it occurred a little below the anticipated support level. There was then a strongly bullish move and it now looks as if the price is set to challenge the area of resistance between 0.7723 and 0.7750.

There is a long-term bearish trend, but it tends to “stutter”, so there are a few shorting opportunities along the way.

There is nothing due today concerning the AUD. Regarding the USD, there will be releases of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time.