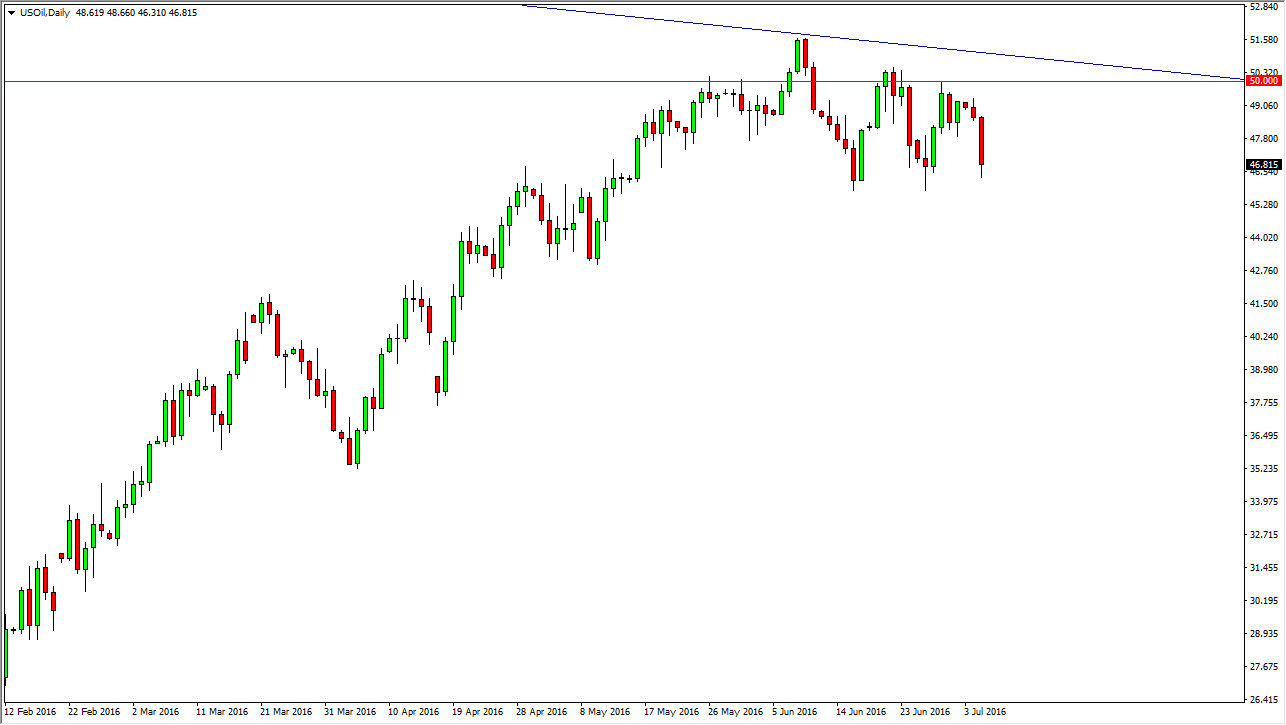

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Tuesday, as we reach down towards the $46 handle. We are starting to see “lower highs”, and as a result it makes quite a bit of sense that the market eventually tries to break down and through the aforementioned $46 level. I believe that if we break down below there we will reach towards the $43 level, and then possibly even lower than that. In fact, I believe that would be a complete breakdown as we have recently formed a shooting star on the weekly chart. That of course is a very negative sign, and the fact that it shows itself near the $50 level tells me that there is quite a bit of exhaustion in this market.

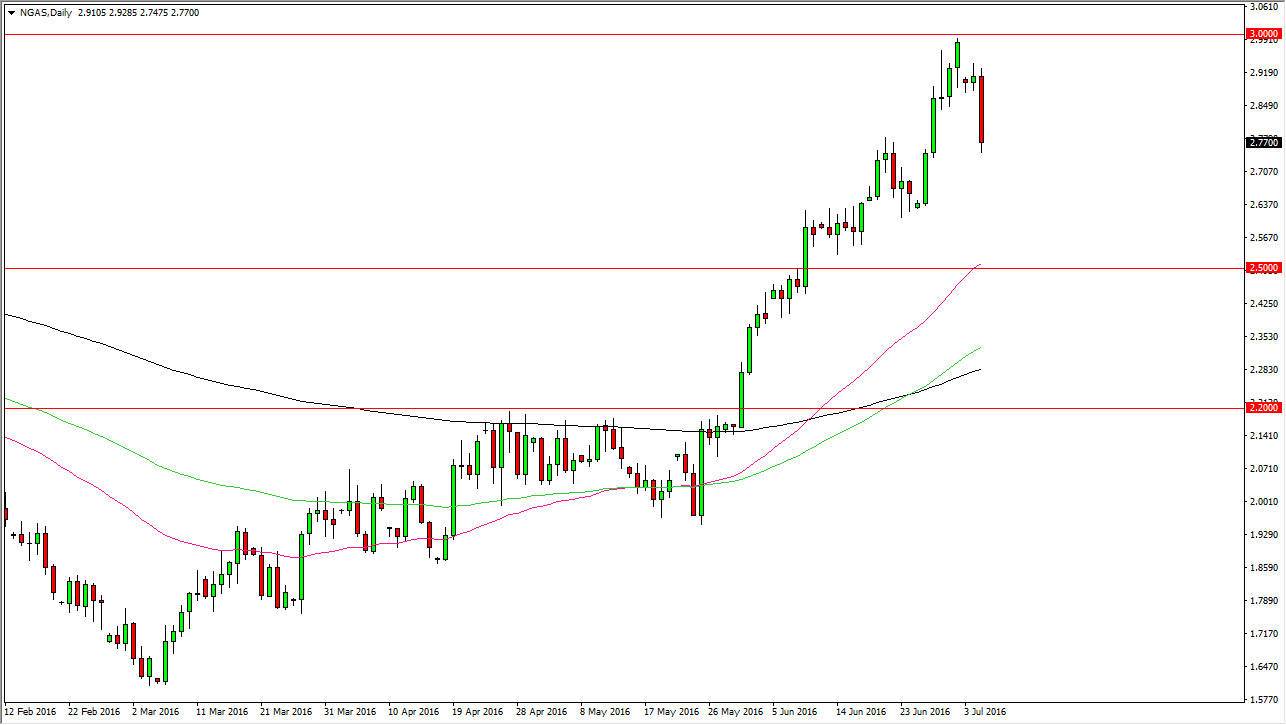

Natural Gas

Natural gas markets fell rather significantly during the course of the day on Tuesday, testing the $2.75 level. This was an area that I originally said could be support below, and the fact that we are closing near it tells me that the buyers could return, but I have to see some type of supportive candle in order to start going long. Quite frankly, we have been so overextended it would not surprise me at all that we continue to go little bit lower. Nonetheless, I have no interest in shorting this market, because it shows so much underlying strength. The $2.50 level below is of course a large, round, psychologically significant number, and I believe that a supportive candle in that area should be a nice buying opportunity. In fact, I don’t really have any interest in selling this market until we get below the $2.50 level, which is quite a bit lower than current trading levels. In the end, I believe that this market will simply overbought and now we are trying to build up enough momentum to break above the $3 handle.