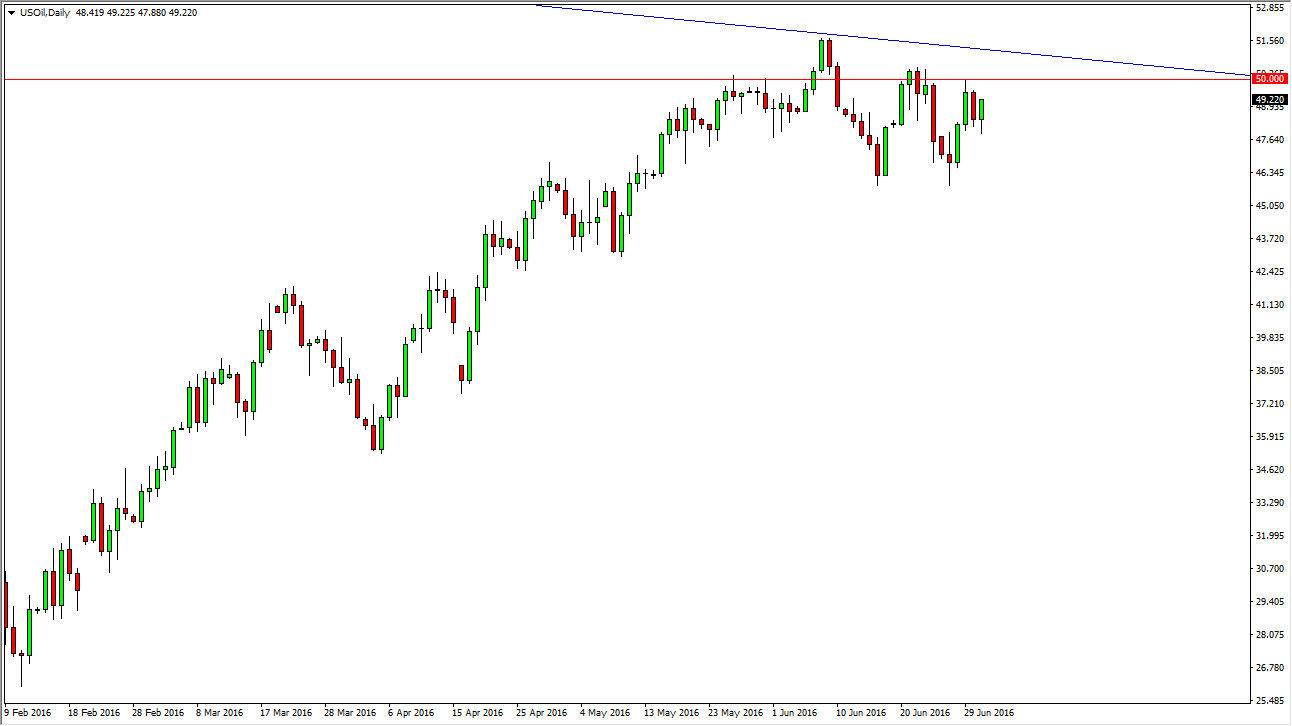

WTI Crude Oil

The WTI Crude Oil market rallied during the course of the day on Friday after initially falling. However, we are still well below the $50 level, an area that I believe is going to be rather resistive. I also have a downtrend line drawn on the chart that I believe is of significance, so at this point in time I don’t necessarily buy this contract although it would necessarily surprise me if we got a little bit higher during the day. Remember, we will only have limited electronic trading during the day as the Americans will be celebrating Independence Day. Because of this, liquidity might be an issue so we could get sudden moves, but my experience has been that more often than not, we get nothing. With this, I am looking for some type of candle that I can trade on the daily chart but it probably won’t occur until Tuesday.

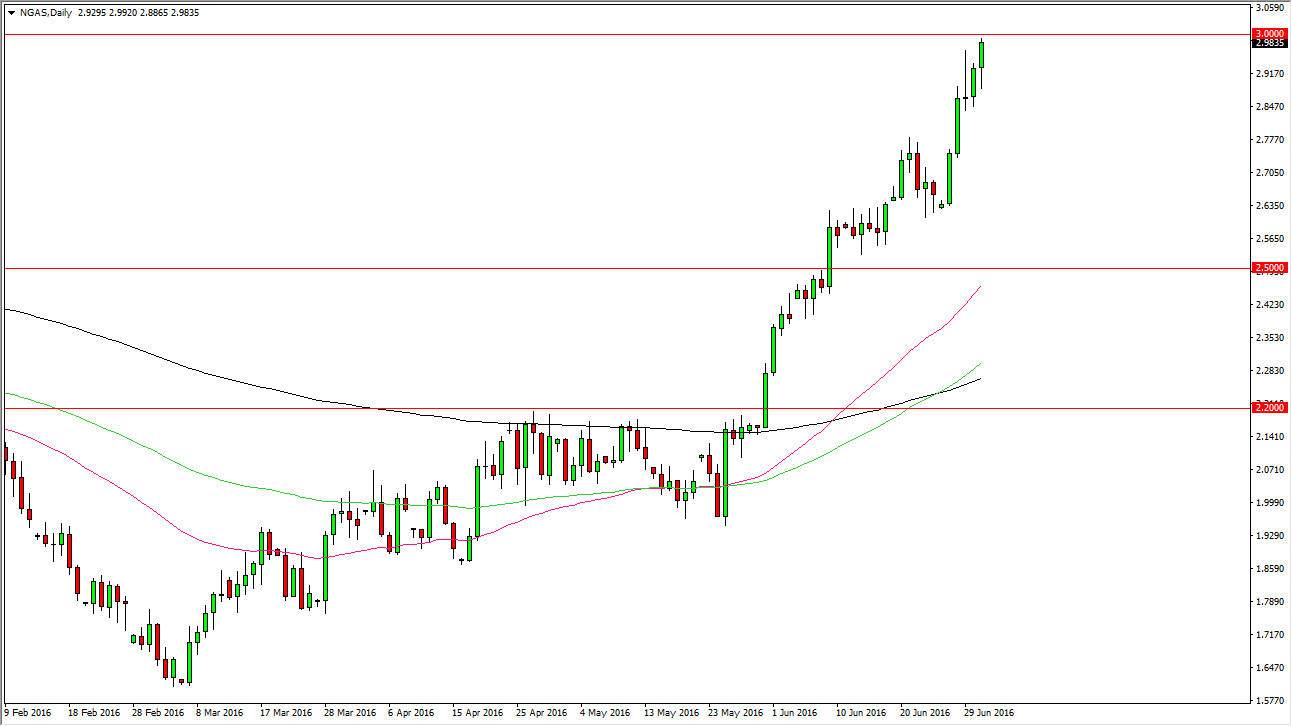

Natural Gas

Natural gas markets continue to defy gravity, as we initially fell during the day on Friday, and then shot straight up in the air towards the $3.00 level. It appears to me that the market is hell-bent on testing the $3 handle, and even trying to break above it. Because of this, I believe that it’s only a matter of time before that happens but certainly you cannot buy the natural gas contract until we clear that significant psychological barrier. Pullbacks at this point in time should end up being thought of as “value”, because there is a massive amount of upward pressure underneath. In fact, I don’t even have a scenario in which a willing to sell this contract until we get some type of longer-term sell signal.

I believe that there are massive amounts of support at the $2.75 level, the $2.60 level, and of course out the $2.50 level. With that type of upward pressure, I believe that buying is the only thing that you can do.