WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the course of the session on Thursday, and then fell rather significantly towards the $41 level. Ultimately, this is a market that shows quite a bit of negativity. With this being the case, I believe that every time we rally you should be thinking about selling, especially as the $43 level and the $45 level above should offer quite a bit of trouble. An exhaustive candle should be reason enough to start selling as well, and I do believe that the market should continue to go down towards the $40 handle, and then eventually below there. I have no interest whatsoever in buying this market, and believe that it is a “sell only” type of situation, as the demand for crude oil continues to fall, and the US dollar continues to strengthen overall.

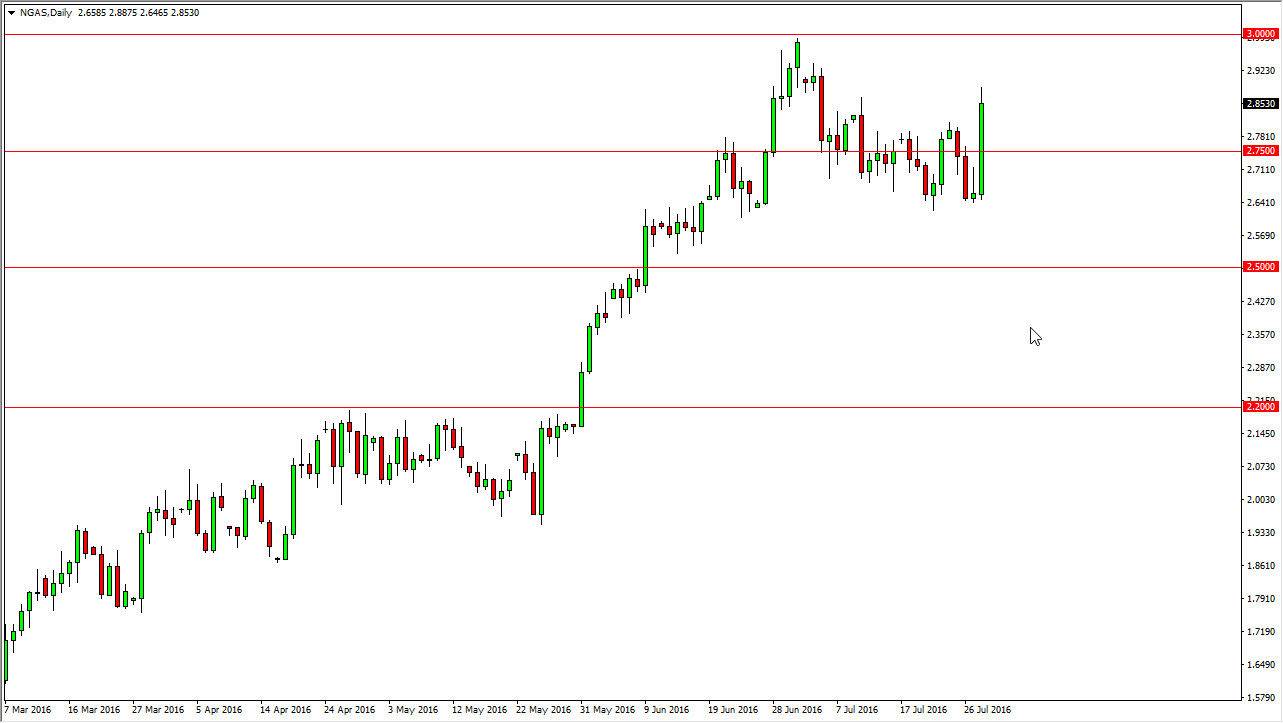

Natural Gas

The natural gas markets exploded to the upside during the course of the day on Thursday, breaking well above the $2.75 handle. In fact, we clear the $2.80 level and beyond. I believe that if a market pulls back after an explosion like this, buyers will return to this market, and grind higher. I hate fully anticipate that this market will offer buying opportunities on pullbacks that should continue to push this market towards the $3 handle. In fact, that’s an area that has been tested once before, and I believe that most the time these major levels need to tested a couple of times. With this, I believe that it’s only a matter of time before we go higher and continue to test that area yet again. I have no interest in selling at this point, I believe short-term buying opportunities will present themselves on short-term charts. Nonetheless, I still have concerns about the longer-term strength of the natural gas markets, but at this point in time we obviously have a bullish market.