WTI Crude Oil

The WTI Crude market fell during the day, breaking significantly below the $43 level at one point. However, we turned around and formed enough support to end up printing a hammer. This of course is a bullish sign and it makes sense considering that we have the Crude Oil Inventories number coming out during the day, and that of course will have a massive effect on what happens with the oil market. With this, it makes sense that perhaps sellers decided to take profits. I believe that any bounce at this point in time will eventually offer a selling opportunity though, and with that signs of exhaustion would be a nice opportunity to sell. If we break down below the bottom of the hammer, that is also a very negative sign and would have me selling just as quickly.

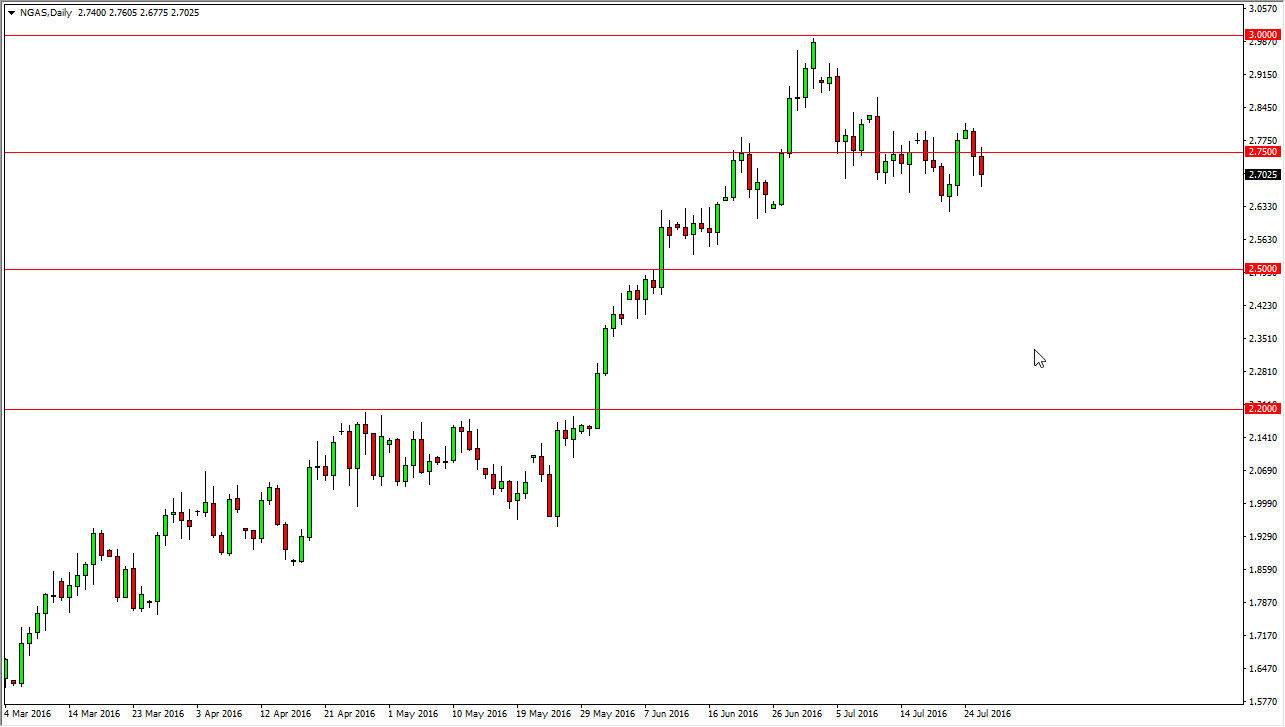

Natural Gas

Natural gas markets went back and forth during the day with a slightly negative twist. I still believe that the 2.75 level above is pretty significant at this point in time, and a move above there should send this market higher. We still have to test the 3.00 level given enough time, as typically the larger numbers like that get tested more than once. I have no interest in selling this market, it has been far too bullish and I believe that there is significant support at the 2.60 handle, and of course the 2.50 level which I see as the “floor.”

At this point in time, I still think that we will more or less a grind sideways as we try to figure out where were going next. I think that the longer-term trend for natural gas will be negative regardless, but it is going to take some time to get there. It’s been a rather hot summer in the United States, so the use of natural gas has exploded. At the end of the day though, there’s still far too much supply to justify extraordinarily high prices.