WTI Crude Oil

The WTI Crude Oil markets fell a bit during the session on Friday, but by the end of the day we bounced enough to close above the 200-day exponential moving average. I do not think it will cause a permanent bounce, and quite frankly it’s only a matter time before the sellers return in my estimation. I recognize that the fundamentals for oil are starting to slip a bit, and of course we have a strengthening US dollar. That almost always is bad news for oil, especially when it is considered to be a flight to safety. With this, I am looking for short-term bounces in order to start selling again as I believe that now the $46 level is going to offer a little bit of a “ceiling” in this market.

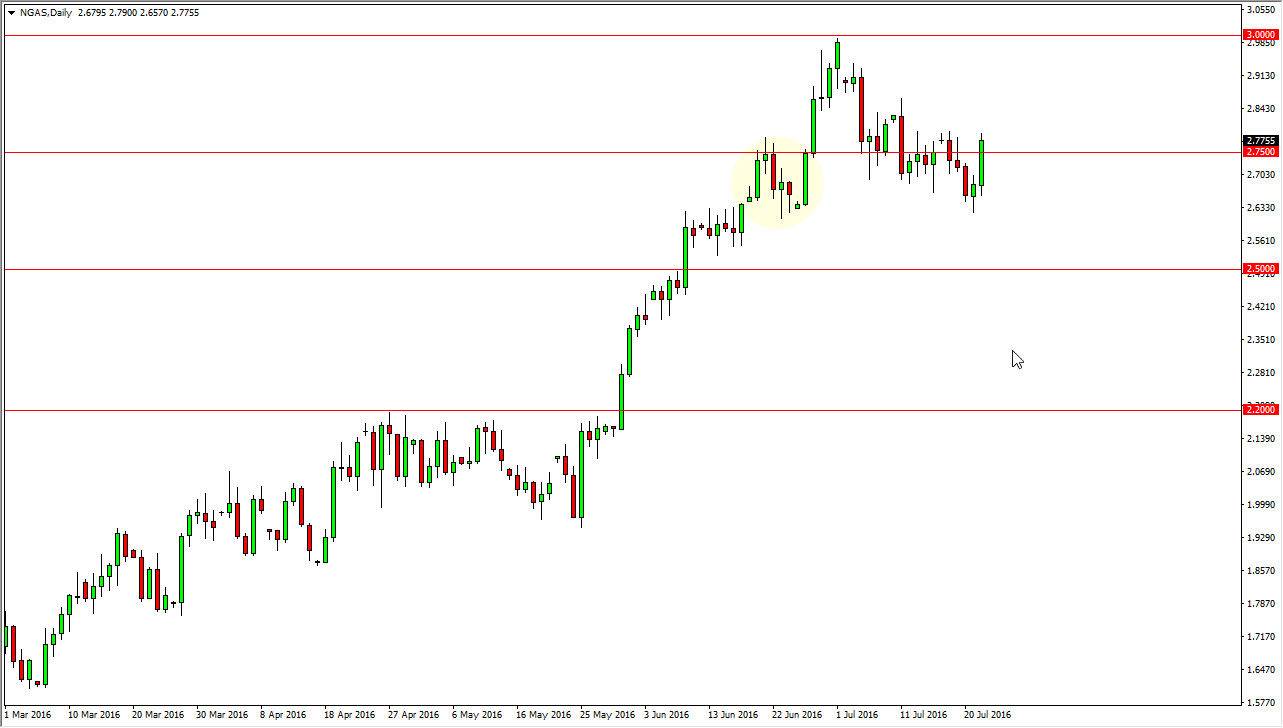

Natural Gas

Natural gas markets rose during the day on Friday, breaking above the $2.75 level by the end of the day. This was a very strong move, and should continue to see buyers jump into this market as we reach towards the $3.00 level. Pullbacks should offer buying opportunities, and as a result I think that we will continue to find buyers again and again, but will probably have to do it off of short-term charts as the “easy money” has already been made in this marketplace.

I don’t necessarily think that will be able to break above the $3 level anytime soon, it will probably take several attempts. With this though, it is going to be a difficult market to hang onto for any real length of time, so with that I think short-term trading continues to be the only way that you can handle this type of volatility. I feel that there is a “floor” at the $2.50 level below, and therefore will not sell until we either failing at the $3.00 level above, or break down below there.