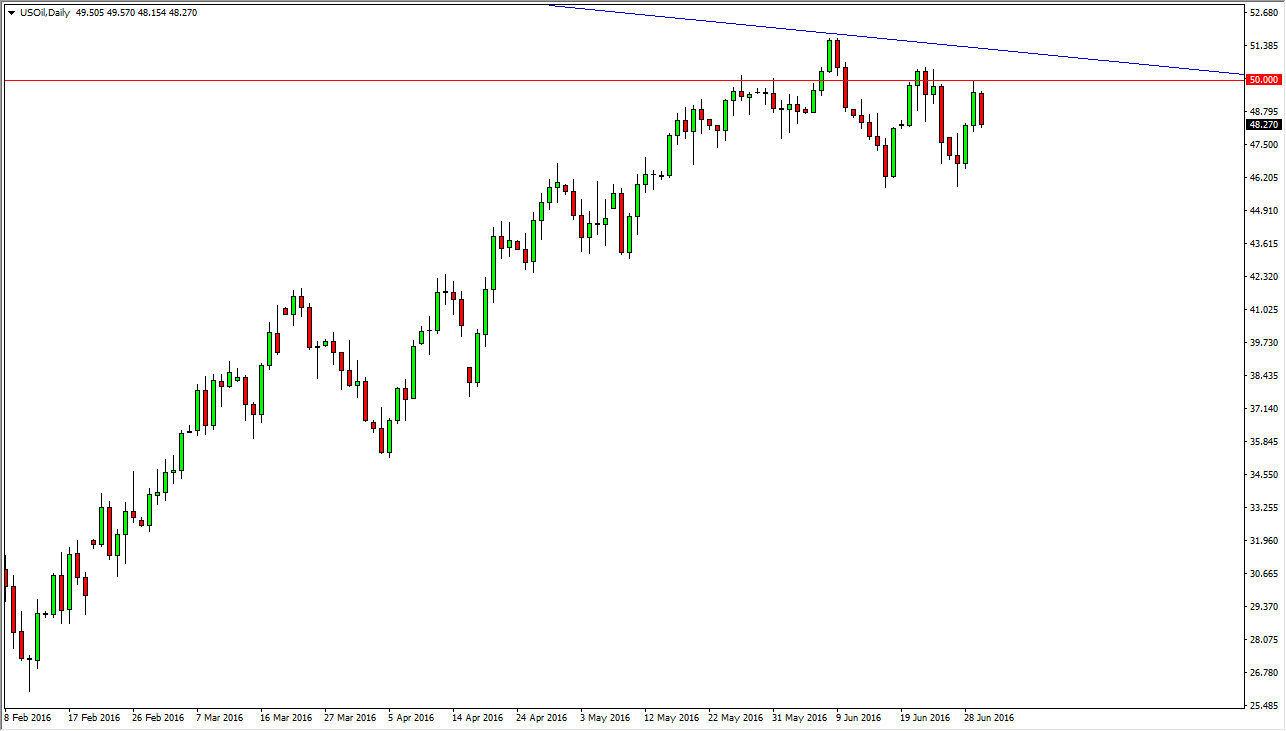

WTI Crude Oil

The WTI Crude Oil markets fell a bit during the day on Thursday, as the $50 level continues to be fairly resistive. On top of that, I have a downtrend line that is just above and it is possible that the market will continue to struggle in this general vicinity. I think that there is a lot of noise in this area, as we are trying to figure out where were going next. This could be the beginning of a significant move in either direction, but right now it does look like the sellers are starting to pick up a little bit of momentum. A break down below the $46 level since this market into a downtrend in my estimation, as we would continue to see bearish pressure. Pay attention to the US dollar, it often will have an effect on this market.

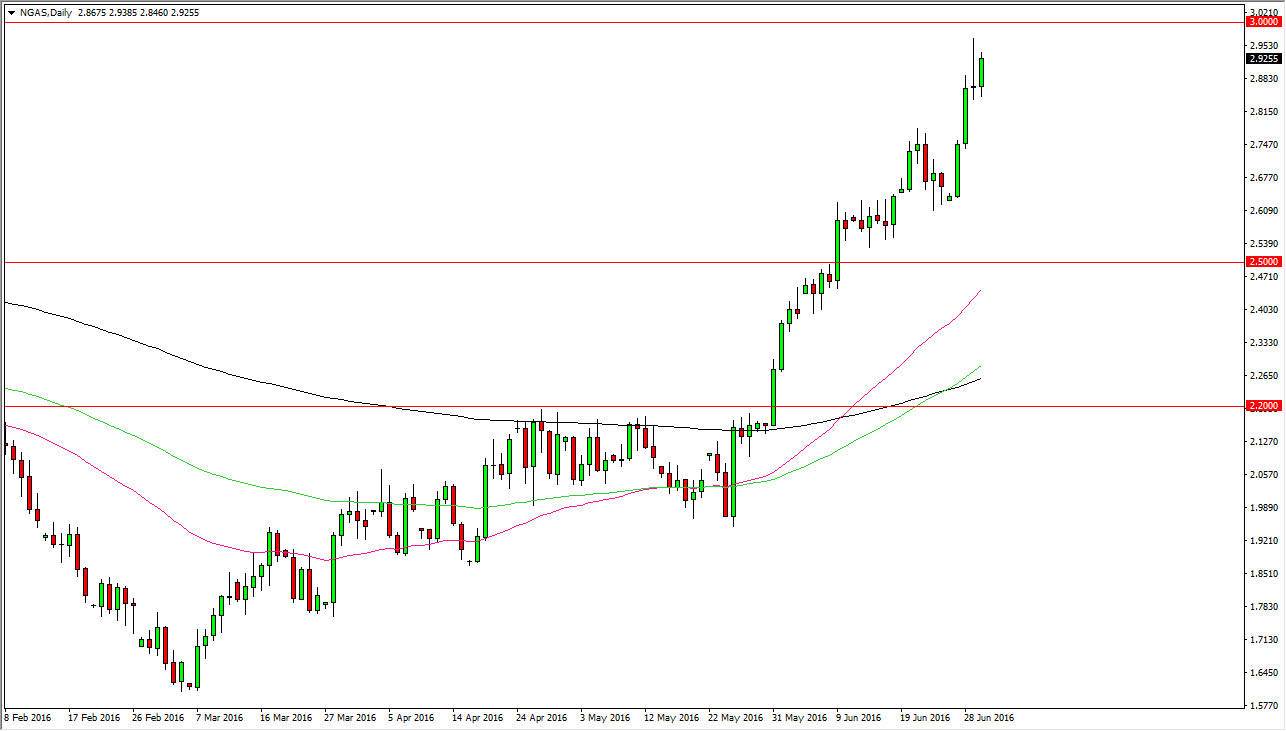

Natural Gas

The natural gas markets rose during the day despite the fact that there was a massive shooting star during the Wednesday session. With this, I believe that the market is trying to build up enough momentum to finally break above the $3 level, so I think there could be quite a bit of volatility in this area. I still believe that we could very well pullback, but a pullback should just end up being a buying opportunity, as it should represent “value” in this market. The market breaking above the $3 level would be momentous, and send us into a much higher leg up.

I believe that the $2.60 level and of course the $2.50 level below should be massively supportive, and as a result I really don’t have a scenario in which I’m willing to sell natural gas at this point in time, although I do believe that we have longer-term structural issues when it comes to the pricing of natural gas, and that the downtrend will continue sooner or later. In the meantime, the buyers most certainly have control.