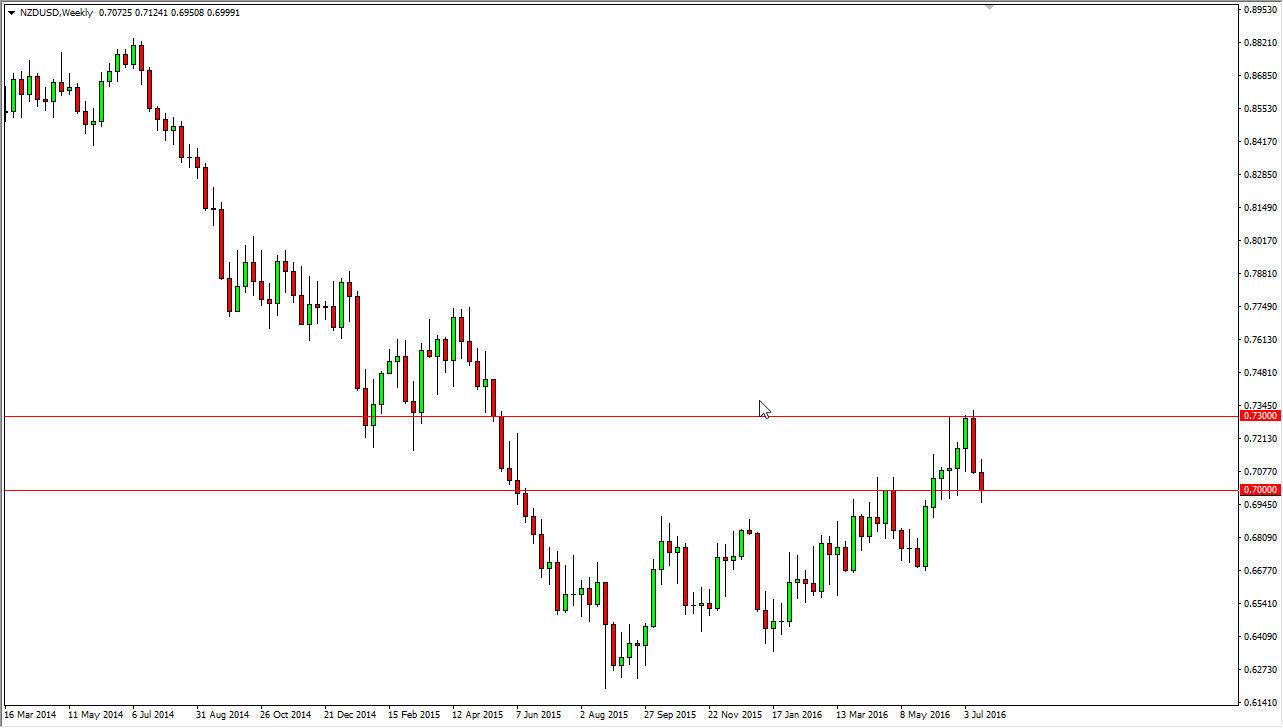

NZD/USD

The New Zealand dollar fell a bit during the course of the week, but it did find enough support at the 0.70 level to bounce. Also, you have to keep in mind that the Friday candle was a hammer, and that of course is a bullish sign as well. As we bounce from here, I believe that short-term buying will continue to be the way going forward, reaching towards the 0.73 level. As far selling is concerned, there’s far too much in the way of noise below for me to be interested in doing so.

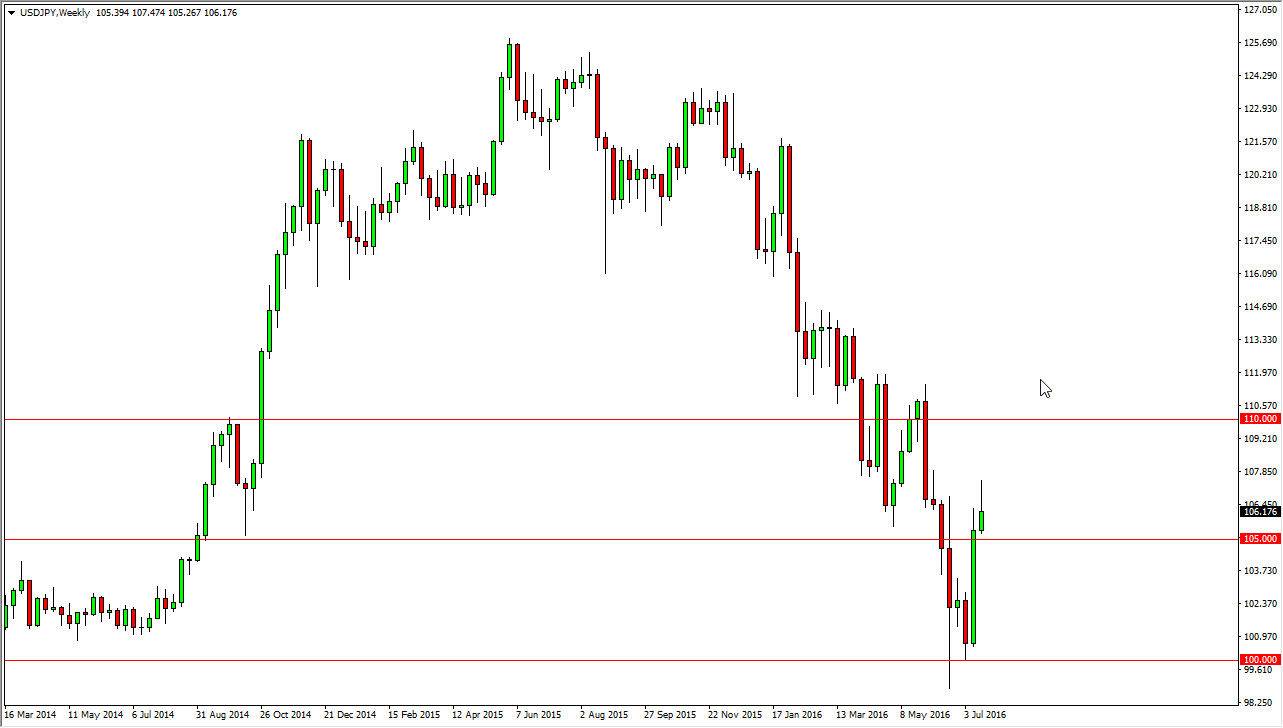

USD/JPY

The USD/JPY pair initially rallied during the course of the week, but turned back around to form a bit of a shooting star. The shooting star of course is a negative sign but I don’t think that the sellers will really pick up any momentum until we break down below the large figure out 105. With this, I’m a bit hesitant to sell anyway, even though this is a very negative candle, the reality is that the previous week was extraordinarily strong.

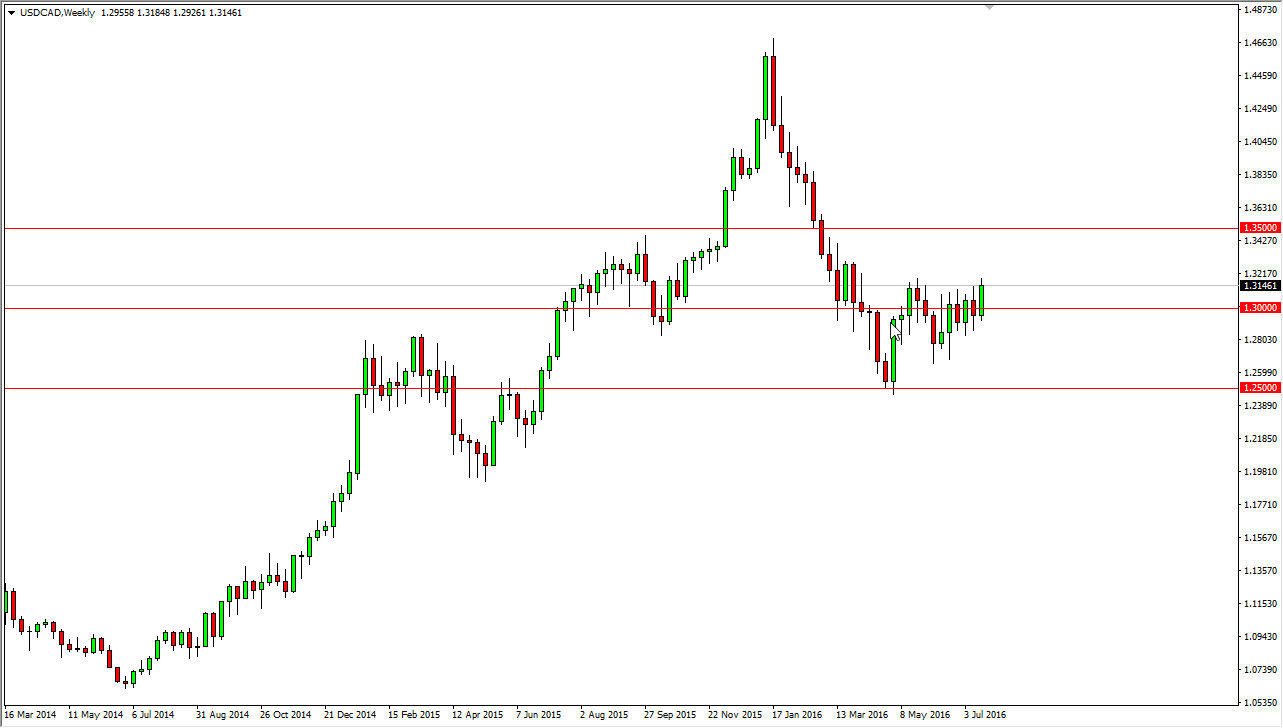

USD/CAD

The USD/CAD pair continues to grind its way higher, and what looks to be an ascending triangle. Because of this, I am a buyer above the 1.32 level, in anticipation of a move to the 1.35 handle next. The pullbacks will more than likely offer buying opportunities as well, as this is a market that of course tracks oil which looks extraordinarily soft, which works against the value of the Canadian dollar.

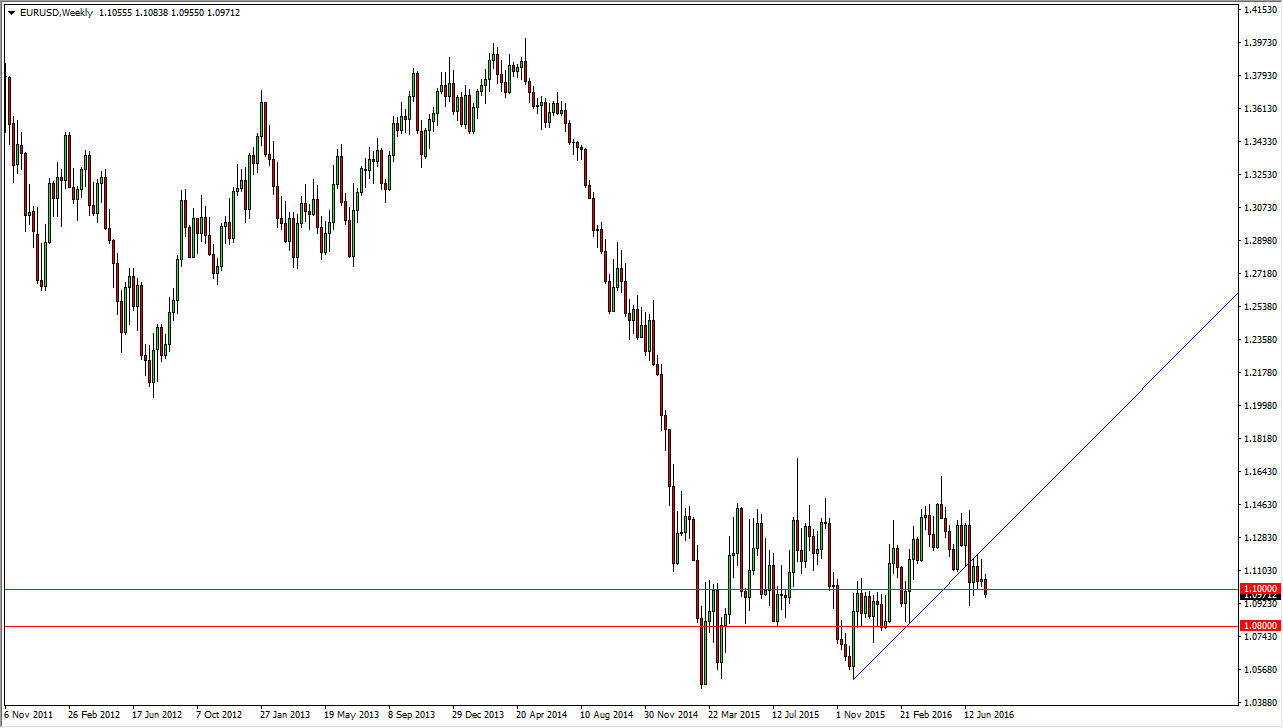

EUR/USD

The Euro broke down and below the 1.10 level during the course of the week. With this being the case, I feel that the market is probably going to continue to go lower, and perhaps reach down to the 1.08 level. After that, I think we go down to the 1.205 level, as we continue the longer-term consolidation that is clearly shown on this chart. With this being the case, the market will continue to drift lower not only because of the technical aspects, but the fact that the US dollar offers a bit of a safety.