USD/JPY Signal Update

Yesterday’s signals produced a losing short trade following the bearish outside candle rejecting the resistance level at 104.81.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time to 5pm Tokyo time over the next 24 hours.

Protect any open trade by 6:30pm London time.

Short Trades

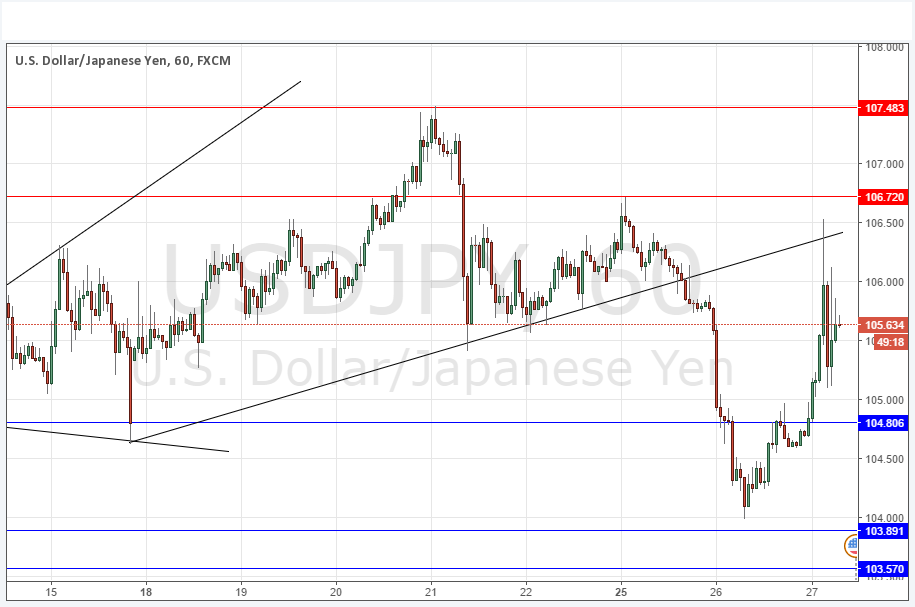

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.72 or 107.48.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 104.81, 103.89 or 103.57.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The Asian session saw rumours, counter-rumours, and then finally a confirmation from the Japanese Prime Minister regarding the size of the Japanese stimulus package. This sent the pair shooting upwards before falling and then rising quite strongly again, with so much volatility it has become very difficult to trade. The price is quite likely to settle down for the rest of the London session, but the FOMC releases due later should be the trigger for the true forthcoming price movements to begin. A spike up to key resistance could provide a good shorting opportunity

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm, ending with the FOMC Statement and Federal Funds Rate at 7pm.